At the New York Investment Summit, a statement from BlackRock, the world’s largest asset management company, sent shockwaves through the financial sector. This giant, which manages over $11 trillions in assets, has officially elevated bitcoin to a position as important as U.S. Treasuries and tech giant stocks.

At the investment summit held in New York on December 22, 2025, BlackRock announced that bitcoin, alongside U.S. Treasuries and the “Tech Seven” stocks, would be listed as the three pillars of a modern diversified investment portfolio.

The head of BlackRock’s iShares division proposed this strategy, marking BlackRock’s evolution from a tentative foray into digital assets to deeply integrating them into its core macroeconomic worldview.

I. Event Positioning: Bitcoin Joins the Ranks of Core Assets

● On December 22, 2025, at an investment summit in New York, BlackRock made a decisive statement: bitcoin was officially hailed as the most important investment theme of 2025. The head of the iShares division at the world’s largest asset management company proposed a groundbreaking strategy.

● This strategy places bitcoin alongside U.S. Treasuries and “Tech Seven” stocks as the three pillars of a modern diversified investment portfolio. This move solidifies the institutional narrative of the current market cycle and marks a fundamental shift in traditional finance’s attitude toward bitcoin.

● BlackRock’s core philosophy has shifted from “providing access” to speculative asset channels to recognizing bitcoin as a fundamental component of the global monetary system infrastructure. This upgrade in positioning reflects the evolving role of bitcoin in the eyes of institutional investors.

II. Strategic Evolution: From Allocation Advice to Core Pillar

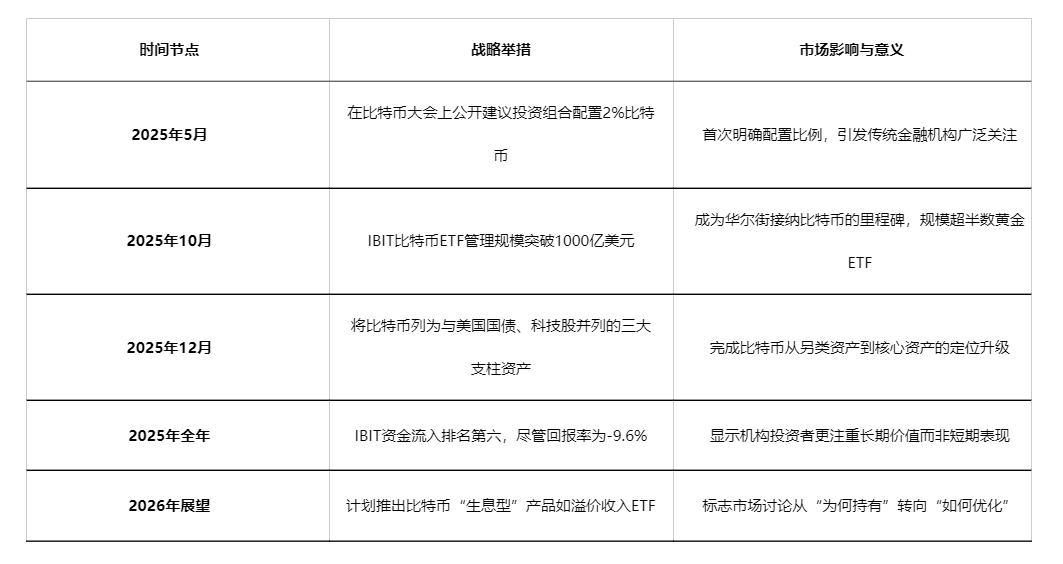

● As early as May 2025, BlackRock publicly recommended at the Bitcoin 2025 conference that 2% of investment portfolios be allocated to bitcoin. At the time, this suggestion attracted widespread market attention and was seen as an important signal of increased institutional recognition of crypto assets.

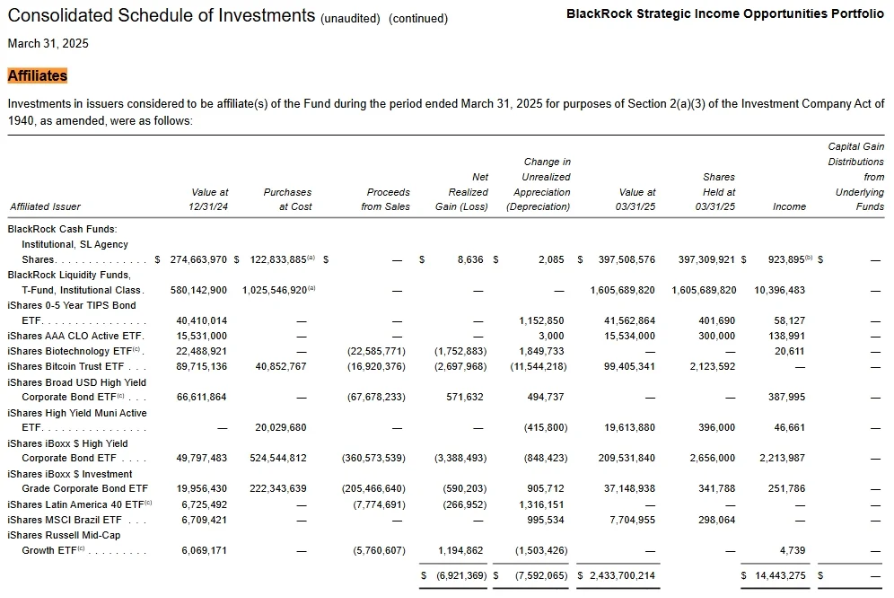

● In October 2025, BlackRock’s spot bitcoin ETF surpassed $100 billions in assets under management, equivalent to more than half the size of all global gold ETFs. This milestone marked Wall Street’s official embrace of bitcoin, integrating decentralized digital assets into the centralized financial system.

● By December 2025, BlackRock’s stance was further strengthened, elevating bitcoin to the same core asset status as U.S. Treasuries and tech stocks. This strategic evolution demonstrates BlackRock’s deepening understanding and positioning of bitcoin.

● According to institutional data, as of October 2025, institutions and ETFs collectively held 6%–8% of all bitcoin in circulation, and corporate treasuries increased their holdings by 245,000 bitcoins in the first half of the year. These figures indicate that the institutionalization of bitcoin is accelerating.

III. Theoretical Framework: “Macro Mirror” and Digital Gold Positioning

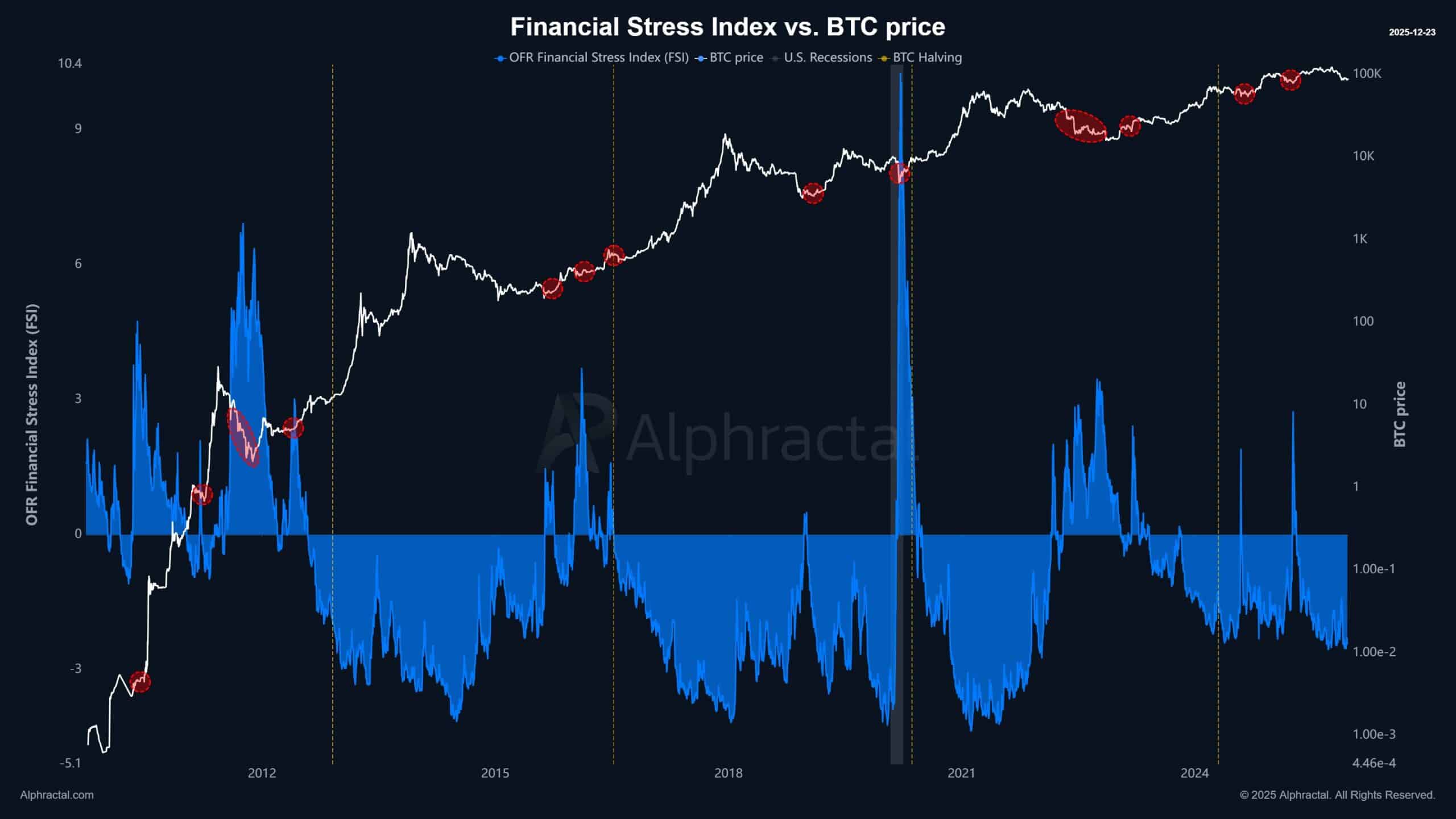

● BlackRock’s 2025 thesis is built on the argument of the “macro mirror.” This theory holds that bitcoin’s performance increasingly reflects global concerns about sovereign debt and currency devaluation. As the U.S. federal deficit continues to expand and global fiscal imbalances worsen, BlackRock analysts point out that institutional investors are seeking “uncorrelated” assets outside the traditional banking system.

● By positioning bitcoin as “digital gold,” BlackRock provides a necessary theoretical framework for conservative asset allocators to justify large positions. This framework redefines bitcoin from a speculative asset to a store of value.

● Jean Boivin, head of BlackRock Investment Institute, has pointed out that bitcoin is expected to become a tool for diversifying investment returns and a unique driver of risk and return. This view is gradually gaining acceptance in traditional finance, paving the way for bitcoin’s institutionalization.

IV. Market Reaction: Divergence Between Capital Inflows and Price Performance

● Although BlackRock’s bitcoin ETF (IBIT) had a return of -9.6% in 2025, it still ranked sixth in net ETF inflows for the year. This phenomenon is unique among the top 25 funds by inflows—other funds all had positive returns, with only IBIT posting a loss.

● Bloomberg analyst Eric Balchunas noted that this phenomenon of “inflows alongside negative returns” demonstrates investors’ determination to maintain bitcoin exposure. This seemingly contradictory market behavior actually reflects institutional investors’ confidence in bitcoin’s long-term value.

● From a trading perspective, IBIT’s net subscriptions result in the trust buying bitcoin on the market with cash, turning capital inflows into spot demand. Traders can assess the strength of spot demand by monitoring subscription and net creation data during U.S. trading hours.

● Such institutional capital inflows may stabilize bitcoin prices. Traders can watch for support levels around $50,000 to $60,000 for potential buying opportunities. Meanwhile, cross-market dynamics are also worth noting, as bitcoin is often correlated with stock indices as a risk asset.

V. Institutionalization Process: Wall Street’s “Relocation” Movement

● The real reason behind bitcoin’s surge is the quiet “relocation” movement underway among Wall Street giants. The success of BlackRock’s $100 billions ETF has not only opened the door to mainstream finance for bitcoin but also reveals the deeper logic of how Web3 technology is reshaping the global monetary system.

● As the largest bitcoin ETF in the U.S., IBIT currently manages $72 billions in assets, with daily net inflows exceeding $500 millions multiple times since May 2025. Bitwise predicts that total bitcoin ETF inflows could reach $120 billions in 2025 and may surpass $300 billions in 2026.

● Bitwise CEO Hunter Horsley pointed out that if wealth management institutions allocate 1% of their portfolios to bitcoin, it would bring “hundreds of billions of dollars” in capital inflows to the bitcoin market. This forecast highlights the potential impact of institutional capital on the bitcoin market.

● BlackRock’s mechanism innovation also solves the problem faced by bitcoin “whales.” Early large holders can now “transfer bitcoin into the ETF” without it being counted as a “sale,” meaning they don’t have to pay taxes and can use the asset as collateral for loans, while still being able to prove on-chain that the bitcoin belongs to them.

VI. From “Why Hold” to “How to Optimize”

This shift is expected to reach its climax in 2026 with the launch of complex “yield-generating” products. BlackRock plans to introduce bitcoin premium income ETFs and other products designed to generate returns through covered call option strategies.

● Through these tools, BlackRock is shifting the market discussion from “why hold bitcoin” to “how to optimize bitcoin positions,” thereby cementing its role as the primary gatekeeper of next-generation digital capital.

● Nasdaq is promoting an increase in the futures position limit for BlackRock’s bitcoin fund, indicating that the bitcoin market is “shedding its training wheels” and moving toward more mature financial products. This product innovation will further drive the institutionalization of bitcoin.

● At the same time, BlackRock is also exploring the application of tokenization and blockchain technology, launching a blockchain version of its fund recorded on Ethereum. This hybrid launch allows investors to choose between the traditional fund and the blockchain version.

VII. Restructuring the Trust Anchor of the Global Financial System

● BlackRock’s $100 billions bitcoin ETF is not simply a bet on bitcoin’s price appreciation, but is paving the way for a future reset of the debt system. What they are doing is “collateral substitution”—shifting trust from “government credit” to “mathematically proven scarcity.”

● Robbie Mitchnick, head of digital assets at BlackRock, noted that bitcoin’s widespread use for daily payments in the future is merely “out-of-the-money option value upside.” This means that bitcoin’s potential use cases far exceed its current role as an investment tool.

● This change is not just a financial experiment. Its impact may be greater than imagined: El Salvador has adopted bitcoin as legal tender; some sanctioned countries are using cryptocurrencies to bypass the U.S. dollar payment system; and some central banks are researching “digital reserves.”

● In the future, reserve assets may no longer be limited to the U.S. dollar but could include bitcoin. This means that the foundation of the monetary system is being gradually rewritten, shifting from government credit to mathematical scarcity as its core.

The table below summarizes the key milestones of BlackRock’s 2025 bitcoin strategy and its market impact:

Bitcoin is undergoing a critical stage in its development: with the push from institutions like BlackRock, it is accelerating its entry into the mainstream market, gradually gaining legal status, while inevitably facing the challenge of its decentralized spirit being diluted.

Regardless of the future—whether bitcoin is smoothly integrated into the traditional financial system or faces regulatory backlash—it is no longer just a simple digital currency. It is becoming Wall Street’s underlying “hard currency,” leading global finance into a new era supported by mathematical scarcity rather than government credit.

This financial transformation led by BlackRock answers not only the question of how to allocate assets, but also a century-defining question: can mathematically proven scarcity coexist and thrive with the existing financial system, reconstructing the foundation of global value storage and exchange.