Bitcoin broke through $120,000 in January, Zcash soared 241% in a single month in October, and a hacker attack wiped out $300 billions from the market in a single day. In 2025, the crypto market is witnessing a fierce battle of ice and fire on the same candlestick chart.

2025 is the year when the crypto world is officially “brought into the fold.” The heavy hand of regulation has landed, institutions are pouring in, and the market narrative is no longer just about Bitcoin.

From Capitol Hill in the US to the Hong Kong Securities and Futures Commission, from BlackRock’s boardroom to anonymous decentralized autonomous organizations, every decision is reshaping this digital jungle worth trillions of dollars.

I. New Macro Landscape: Three Forces Reshape Market DNA

The underlying logic of the crypto market in 2025 has been completely rewritten. The market, once driven by retail sentiment and Twitter narratives, is now dominated by three much stronger forces: national regulatory will, traditional capital pathways, and sustainable technological narratives.

● The Trump administration’s policy shift is the most critical macro variable of the year.

1. From swiftly pardoning key industry figures after taking office in January, to signing the milestone “GENIUS Act” in July, the US completed a sharp turn from vague resistance to proactively building a regulatory framework within a year.

2. This is not an isolated case. The full implementation of the EU’s MiCA regulation and Hong Kong’s “Stablecoin Ordinance” together outline a clear picture of major global economies incorporating crypto assets into mainstream financial regulatory systems.

● Meanwhile, the way capital enters the market has fundamentally changed.

1. Bitcoin and Ethereum spot ETFs are no longer novelties, but have become standard allocation tools like stocks and bonds.

2. BlackRock’s Bitcoin ETF alone saw weekly net inflows exceeding $1 billion several times in the fourth quarter.

3. The institutionalization of capital has made market volatility closely linked to macro indicators such as Federal Reserve interest rate decisions and Treasury yields, rather than being simply swayed by Musk’s tweets.

● The technological narrative has undergone a deflationary baptism.

1. The “zoo meme coin” craze that was rampant last year quickly faded, replaced by substantive integration of AI and blockchain, tokenization of real world assets (RWA), and serious discussions about privacy computing infrastructure.

2. Market funds are voting with their feet, shifting from pure speculation to seeking protocols that can generate real cash flow or solve real problems.

II. Regulatory Turning Point: From Grey Area to Rule Jungle

If in 2024 the market was still guessing when the regulatory axe would fall, in 2025, the axe has already fallen and carved out a whole new set of rules. The signing of the US “GENIUS Act” is a watershed moment in the history of global crypto regulation.

● The essence of this act lies in “bringing in” and “incorporating.” It establishes a federal-level issuance and regulatory framework for US dollar stablecoins, mandating 100% high-quality liquid asset reserves and transparent audits.

Its deeper intention is clear: in the digital currency era, to continue and consolidate the global dominance of the US dollar through fully regulated, privately issued dollar stablecoins. Overnight, compliant stablecoins like USDC have been upgraded from financial tools to extensions of national strategy.

● The “double-edged sword” effect of regulation is extremely evident. On one hand, it removes the greatest uncertainty from the market, clearing compliance barriers for trillions of dollars in traditional capital. On the other, the high regulatory walls it establishes effectively declare the end of the “wild growth” era.

Privacy protocols that do not meet KYC/AML (Know Your Customer/Anti-Money Laundering) requirements and algorithmic stablecoin projects unable to satisfy reserve audits are explicitly excluded from the mainstream financial system, and may even face existential crises.

● Globally, a new regulatory landscape has formed, characterized by US dominance, EU standards, and Asian competition. This landscape is not monolithic, but full of regulatory arbitrage opportunities. Some projects have begun relocating their headquarters to more regulation-friendly jurisdictions, while multinational giants must learn to navigate the complex “rule jungle.”

III. Capital Revolution: How Wall Street Shorts Bitcoin

The most spectacular market scene in 2025 is not a hundredfold surge of some altcoin, but how traditional capital systematically and mechanically “devours” Bitcoin through new channels. The story of institutional entry, which began as a prelude in 2024, has become the grand main theme of 2025.

● Spot ETFs are the lifeblood of this revolution. They perfectly solve the custody, compliance, and tax challenges for traditional institutions, making buying Bitcoin as simple as buying Apple stock.

Capital flow data reveals a self-reinforcing cycle: Bitcoin price increases attract ETF inflows, large purchases further push up prices and reinforce the upward trend, which in turn attracts more capital. The brand endorsements of giants like BlackRock and Fidelity have opened the floodgates for conservative capital such as pension and endowment funds.

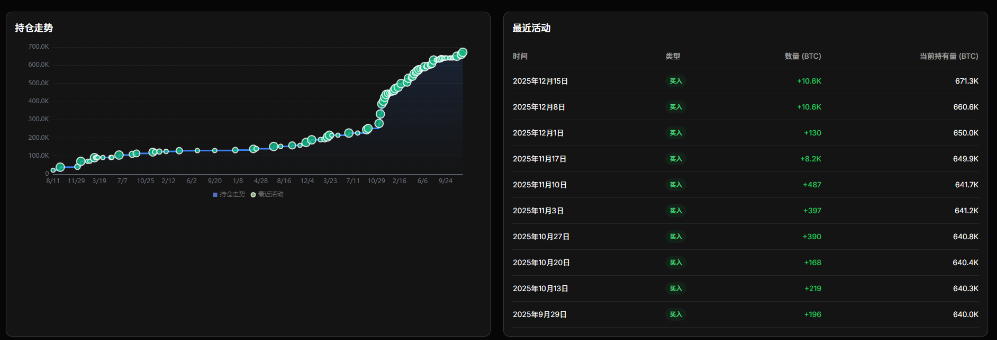

● Another silent revolution is taking place on corporate balance sheets. Strategy increased its Bitcoin holdings from about 446,000 at the beginning of 2025 to 671,000, with its stock price’s correlation to Bitcoin even surpassing that of its core business.

This “corporate Bitcoin hoarding wave” has spread from listed companies to private tech firms, forming a new corporate financial paradigm of treating Bitcoin as an “anti-inflation strategic reserve.”

● The evolution of capital has profoundly changed market behavior. Perpetual contract funding rate volatility in the futures market has become more subdued, as strong spot buying support has weakened the dominance of derivatives.

The addresses of “whales” have gradually shifted from anonymous early investors to ETF custody addresses with institutional labels. As the market becomes more “boring,” it also becomes more resilient.

IV. Sector Rotation: Searching for the New Holy Grail in Privacy and AI

● After the mainstream narrative was “taken over” by institutions and regulators, the market’s speculative instinct and innovative capacity began seeking outlets in niche sectors. The sector rotation of 2025 is characterized by strong event-driven and value re-rating features, with privacy and AI becoming the brightest twin stars.

● The comeback of the privacy sector is the year’s most dramatic turnaround. Zcash (ZEC) leapt from long-term obscurity to market stardom, with a single-month gain of over 200%. The direct trigger was the US government’s lawsuit against the “Prince Group” and its plan to confiscate a huge amount of Bitcoin in October.

This event, like a bolt of lightning, illuminated the “flaw” of complete transparency in Bitcoin and Ethereum ledgers. Overnight, financial privacy shifted from a libertarian philosophical demand to a real fear and rigid need for high-net-worth users and institutions. The market suddenly realized that in an era of comprehensive regulation and on-chain monitoring, protocols offering compliant privacy solutions such as “selective disclosure” may have rare long-term value.

● The integration of AI and blockchain has moved from concept to infrastructure competition. The focus of speculation has shifted from “tokens with AI concepts” to “decentralized infrastructure essential for AI operations.”

Decentralized computing and machine learning protocols represented by Bittensor (TAO), and decentralized rendering networks represented by Render Network (RNDR), have been re-rated by the market for solving real resource bottlenecks in AI development. The market is now looking for blockchain projects that do not simply ride the hype, but can capture real demand in the AI value chain.

● Meanwhile, internal differentiation within traditional DeFi and public chain sectors has intensified. Solana, with its lower fees and more active developer ecosystem, continues to take market share from Ethereum. Emerging modular blockchains and Layer2 solutions are fiercely competing for the “next Ethereum” throne.

V. Market Analysis: Divergence Map and Doomsday Carnival

The price trend in 2025 is not a universal bull market, but a floating world painting composed of extreme divergence. The following key data reveal how the fate of different asset classes varies dramatically:

● Bitcoin and Ethereum have experienced a steady “institutional bull market.” Their candlestick charts are increasingly correlated with the Nasdaq index and US Treasury yields, and volatility has dropped to multi-year lows. This marks their transition from high-risk speculative assets to allocation assets in institutional portfolios, with pricing logic increasingly resembling that of traditional growth tech stocks.

● Meanwhile, Zcash and some small-cap AI tokens have staged an extreme “speculative frenzy.” ZEC’s surge perfectly illustrates the old crypto market adage: “buy the rumor, sell the news.” Its price peaked amid privacy panic and KOL shilling, but the usage of its core privacy transaction function did not surge in tandem, highlighting a huge bubble risk from price dislocation with fundamentals. Such extreme rallies in specific sectors at the end of a bull market are often called “doomsday chariots” by market veterans, warning that the party may be nearing its end.

● Stablecoins are the special “winners” in this game. Their value lies not in price appreciation, but in scale and ecosystem dominance. Compliant stablecoins like USDC, backed by regulation, have become the absolute bridge connecting traditional dollars and the on-chain world, with annual settlement volumes reaching tens of trillions of dollars. They define the unit of account for the entire DeFi sector.

VI. Black Swans and the Test of Market Immunity

Even amid the trends of institutionalization and compliance, the crypto market’s inherent fragility underwent several brutal stress tests in 2025. These black swan events, like earthquakes, tested the “seismic resistance” of this emerging financial system.

● The Bybit hack in February was the first disaster of the year. With losses reaching $1.46 billion, it not only triggered a price crash but also shook the industry’s faith in the “absolute security” of top exchanges. In the aftermath, exchanges publicly disclosed the frequency of their “proof of reserves” audits and cold wallet management rules, sparking a new wave of demand for insurance and custody services.

● The “perfect storm” in October was even more comprehensive. The US government shutdown starting October 1 created ongoing macro uncertainty. Subsequently, the US Department of Justice’s lawsuit against the “Prince Group” and its request to confiscate 127,000 Bitcoins triggered deep market fears of a “government dump.” Multiple negatives finally exploded on October 11, with $19 billion in liquidations in a single day. This crash wiped out a large number of high-leverage positions, acting as a brutal “market chemotherapy” that killed unhealthy cells and laid a healthier foundation for subsequent rallies.

● Trump’s pardon of Binance founder CZ in late October was a display of deep political and financial entanglement. The pardon itself was seen as a signal of regulatory leniency, but the complex political-business relationships behind it made market participants realize that in this emerging industry, policy risk may manifest in a more personal and unpredictable way.

The mark of the “crypto president” is now deeply imprinted in Washington, the Bitcoin holdings line on BlackRock’s ETF reports has become routine, and Zcash holders are still debating whether privacy is a fundamental right or a shield for crime.

As the story of 2025 comes to an end, the old rulebook has been torn up, but the new order is not yet fully established. The only certainty is that cryptocurrency is no longer a fringe experiment of the internet; it has become a core chapter in the global narrative of power, capital, and technology that can no longer be ignored.