Last updated: Dec 20, 2025.

Bitcoin cooled after reaching $90K… so why are buyers rotating into projects like IPO Genie?

Bitcoin briefly flirted with $90,000 and then pulled back, and that swing reminded traders how fast “risk-on” can reverse. (source: The Economic Times)

Meanwhile, U.S. lawmakers signaled that a key crypto market-structure bill won’t be finalized until 2026, which keeps regulatory uncertainty alive a bit longer. So, investors are doing what they always do in mixed markets: they’re hunting asymmetric entries where utility can outrun noise.

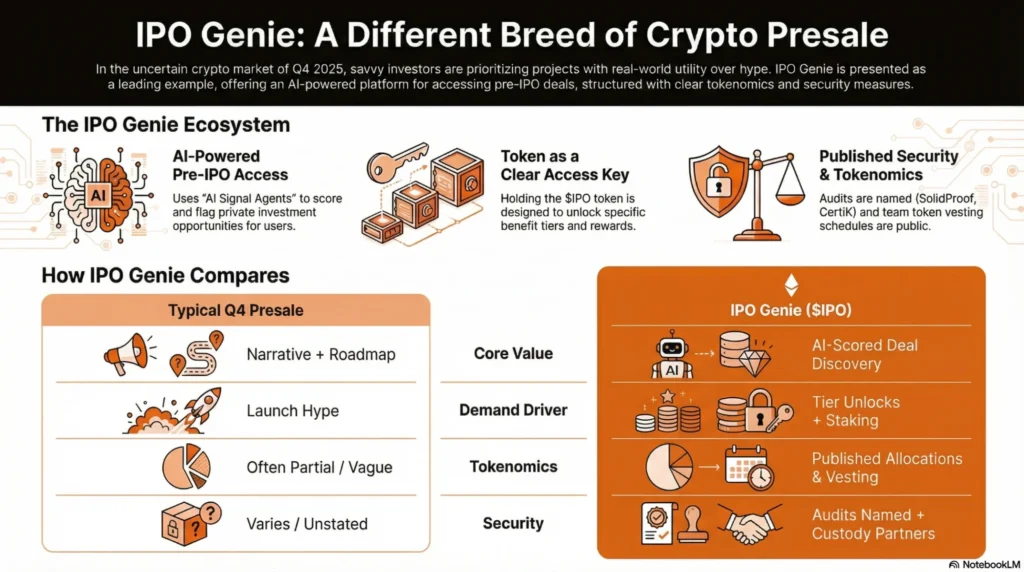

Why Q4 2025 Highlights Project Utility

When headlines swing, buyers get pickier. Therefore, projects that only sell memes struggle, while platforms that bundle real access + clear token demand drivers attract attention.

Also, there’s a second trend: tokenization is getting normalized. Consequently, when a regulated bank brand like SoFi pushes stablecoins forward, it indirectly validates the idea that tokenized value transfer is becoming mainstream.

That’s why a focus on real utility is now more important—success belongs to those who build the cleanest path from token → utility → repeat demand.

IPO Genie ($IPO) AI-driven Access to Private-Market Deal Flow – on-chain

IPO Genie positions itself as an AI-powered pre-IPO investment platform that brings “institutional-style” venture and pre-IPO opportunities to a wider audience.

Instead of asking users to trust vibes, it centers its pitch on AI Signal Agents that score and flag opportunities based on data signals, risk checks, and market context.

Just as importantly, $IPO isn’t presented as a “badge.” Rather, it’s designed as an access key for tiers, staking, governance, and ecosystem participation.

What makes IPO Genie Different From Other Projects This Quarter

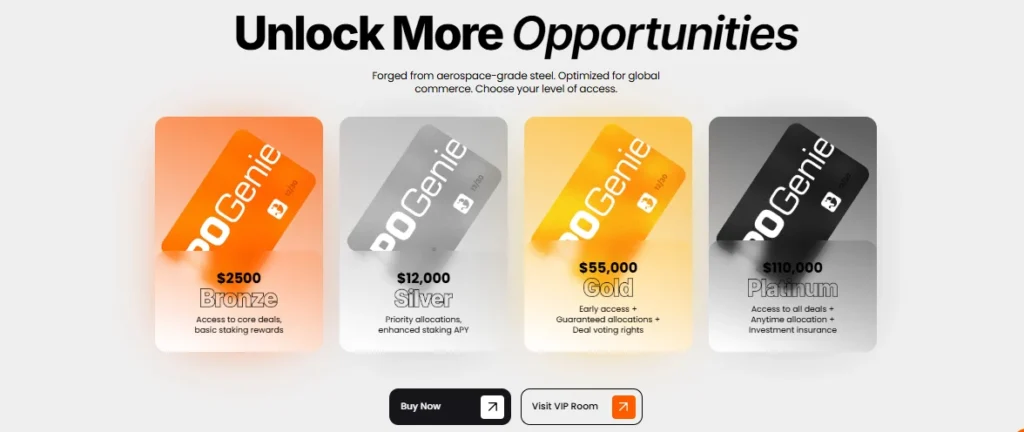

1) Tiered access that turns holding into a clear “why?”

IPO Genie’s tier system is simple. Moreover, it’s easy for readers to map to intent:

- $2,500 tier: access to core deals + basic staking rewards

- $12,000 tier: priority allocations + enhanced staking

- $55,000 tier: early access + guaranteed allocations + deal voting rights

- $110,000 tier: access to all deals + anytime allocation + investment insurance (as stated by the platform)

So, instead of hoping demand appears later, the model tries to create demand through gated benefits from day one.

2) Tokenomics that are published clearly (and include vesting)

Token supply and allocations are spelled out on the official tokenomics page. Notably, it lists 50% supply allocation, 20% liquidity & exchanges, 18% community rewards, 7% staking rewards, and 5% team, with the team allocation locked for 2 years and then linearly vested over 12 months.

3) Security posture is stated (audits + custody language)

IPO Genie states its smart contracts are audited and that assets are safeguarded through custody partners like Fireblocks, with multi-signature governance controls. Also, the tokenomics page explicitly references audits by SolidProof and CertiK.

Misfits Boxing Sponsored By IPO Genie ($IPO)

In Q4, attention is expensive. However, attention that turns into community actions is priceless. IPO Genie tied awareness to a real-world moment by officially sponsoring Misfits Boxing’s “Fight Before Christmas,”. Fans can enjoy the event in Dubai if they apply for the Free IPO Genie VIP giveaway; five winners will receive a hosted VIP experience.

But now entries closed December 14, 2025, which created a hard deadline and a measurable spike in social engagement.

Then, as the project disclosed, the five luckiest winners were revealed on December 17, right as the event weekend approached.

Event Schedule & Arrangements (Dubai):

- Friday, 19th December – Official Weigh-In (10:00 AM), Studio 2, The Creekside Hotel (closed doors)

- Friday, 19th December – Ceremonial Weigh-In (8:00 PM), The Secret Garden, The Creekside Hotel

- Saturday, 20th December – Fight Night (Doors 8:00 PM), Dubai Duty Free Tennis Stadium

Therefore, the giveaway did something many projects fail to do: it gave the community a time-boxed story with a real destination, real dates, and a mainstream venue.

While the promotion itself stayed the “hub” where newcomers landed. If you missed the giveaway, don’t worry, but the special opportunity will expire within a couple of hours.

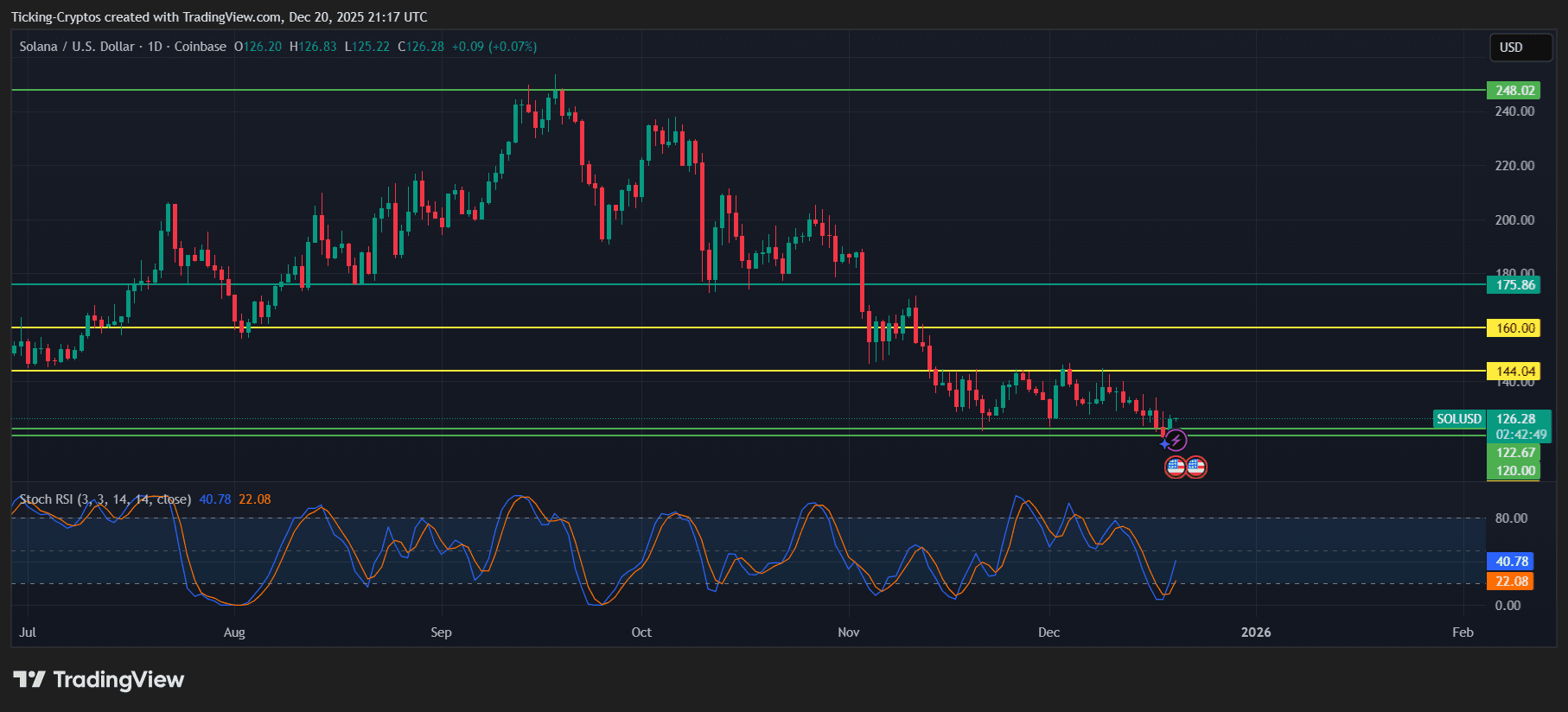

Comparison Table: IPO Genie vs typical projects vs. “hold-only” tokens

Here’s a simple way to evaluate whether a project deserves attention beyond marketing:

| Criteria (what buyers care about) | Typical Q4 project | Hold-only utility token | IPO Genie ($IPO) |

| Core value proposition | Narrative + roadmap | Discounts/points | AI-scored deal discovery + private-market access |

| Demand driver | Launch hype | Platform usage | Tier unlocks + staking + governance + deal flow access |

| Tokenomics transparency | Often partial | Medium | Published allocations + vesting timeline |

| Security messaging | Varies | Varies | Audits named + custody language + multisig governance |

| Community activation | Airdrops | Campaigns | Airdrop + Black Friday Offer + Giveaway + event tie-in + ecosystem positioning |

Project Status and “How Investors Are Framing it” Right Now in December Q42025

At the time of writing, IPO Genie’s Stage 24 is referenced at $0.00010830 (always verify live pricing on the official portal before making decisions).

So, the investor projects usually boil down to three simple points:

- AI deal scoring is easier to understand than vague “AI buzz,” because it maps to selection and risk filtering.

- Tiered access turns holding into a measurable unlock system instead of a promise.

- Published tokenomics + vesting gives risk-aware buyers a clearer framework than most early-stage launches.

How to Evaluate IPO Genie like a Serious Investor (Quick Checklist)

- Confirm you’re using the official domain and portal linked from the site.

- Read tokenomics allocations and vesting, then decide if unlock risk fits your timeframe.

- Compare the tier thresholds to your budget and intended access level.

- Check the project’s stated security posture (audits/custody/multisig) and treat it as a baseline.

Why IPO Genie is Climbing “Watchlists” into 2026

Q4 2025 is rewarding projects that ship credible narratives and defensible utility. Consequently, IPO Genie stands out for blending AI-driven discovery, tier-based access, and published tokenomics. This approach allows users to hold $IPO, unlock vetted opportunities, and participate in a system designed for private-market style exposure.

For crypto users analyzing project trends in 2025, IPO Genie looks less like a “maybe someday” token and more like a structured ecosystem aiming to convert attention into ongoing demand.

FAQs

What is an AI crypto presale, and why does it matter in 2025?

An AI crypto launch is when AI is part of the core product, not just branding. With IPO Genie, AI Signal Agents are described as scoring deals and screening risk, which gives the “AI” claim a clear function.

How does staking and tiered access work for IPO Genie ($IPO)?

IPO Genie states that holding/staking $IPO unlocks tiers (from $2,500 to $110,000) and provides staking rewards plus governance participation.

Is IPO Genie’s tokenomics transparent compared with others?

The official tokenomics page publishes supply, allocation splits, and team vesting (2-year lock + 12-month linear vest), which is typically more explicit than many other projects.