Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify

Bitget2025/12/19 02:09

By:Bitget

Today’s Outlook

1、The U.S. Federal Open Market Committee (FOMC) announced in the early hours of December 19 that it would maintain the federal funds rate target range at 4.25%–4.50%, in line with market expectations. The dot plot shows that expected rate cuts in 2026 were revised down from three to two.

2、Cardano founder stated that Trump’s crypto investments have undermined bipartisan efforts in the U.S. to advance crypto regulation.

3、White House AI and Crypto Czar David Sacks said the crypto market structure bill, the

CLARITY Act, is one step closer to formal legislation and is expected to enter Senate review and revisions in January.

Macro & Hot Topics

1、U.S. November unadjusted CPI YoY came in at 2.7% versus an expectation of 3.1%; unadjusted core CPI YoY was 2.6% versus an expected 3.0%. In his press conference, Powell emphasized that inflation remains above target and that more evidence is needed before further easing.

2、The U.S. SEC released a

Statement Regarding the Custody of Crypto Asset Securities by Broker-Dealers, clarifying the applicability of Rule 15c3-3(b)(1) to crypto asset securities and providing a clearer compliance pathway for institutional custody.

3、The U.S. Senate confirmed Trump’s nominees to lead the CFTC and FDIC. Mike Selig will head the CFTC, while Travis Hill will lead the FDIC.

Market Performance

1、Over the past 24 hours, total crypto market liquidations reached $547 million, with long liquidations accounting for $390 million. BTC liquidations totaled $183 million, while ETH liquidations reached $133 million.

2、U.S. equities were mixed: the Dow Jones +0.14%, the S&P 500 +0.79%, and the Nasdaq Composite +1.38%. Notable movers included NVIDIA (NVDA) +1.87%, Circle (CRCL) -2.26%, and MicroStrategy (MSTR) -1.33%.

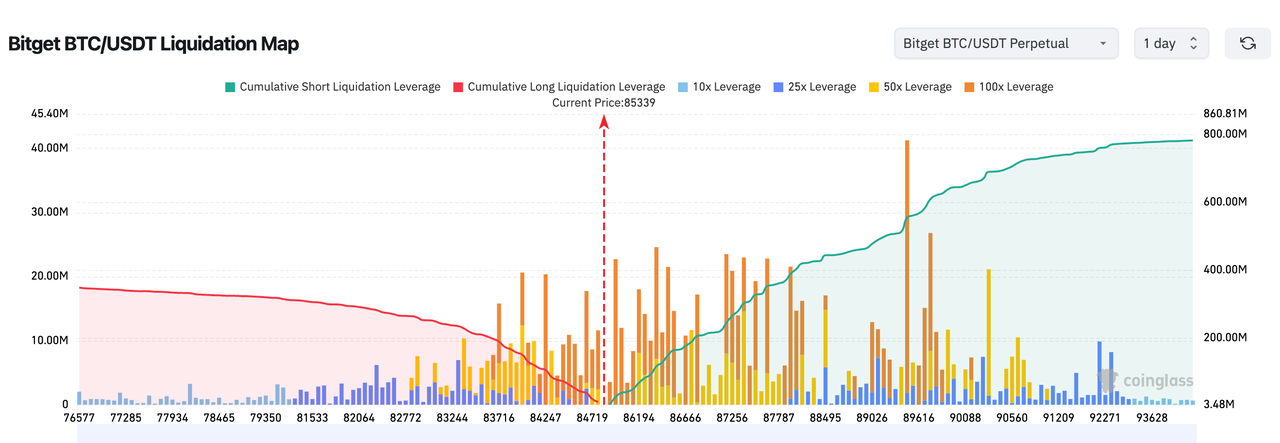

3、Bitget BTC/USDT liquidation heatmap shows the current price at $85,339 sitting within a dense long liquidation zone. A large concentration of 50x–100x long positions is stacked in the $86,500–$89,000 range; a breakout could trigger a long squeeze and cascade higher toward $90k+. On the downside, the short liquidation wall is extremely thin—below $84k there is almost no strong support. Long sentiment is extremely crowded, with a high risk of fake breakouts and stop-hunting.

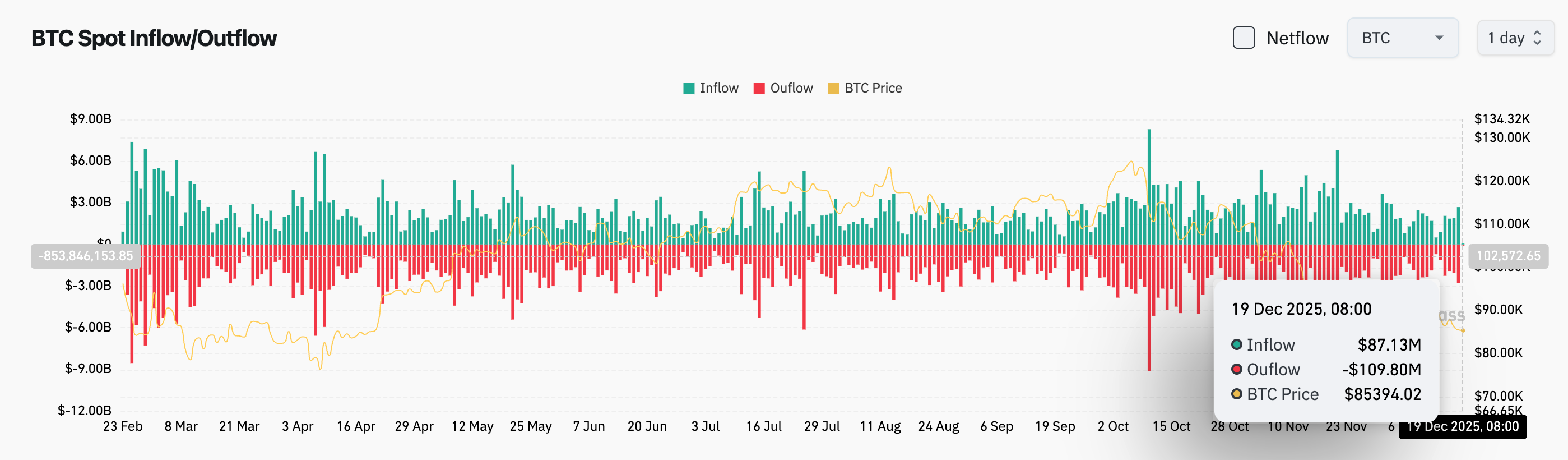

4、Over the past 24 hours, BTC spot inflows totaled approximately $87 million, outflows about $109 million, resulting in a net outflow of $22 million.

News Updates

1、Cointelegraph: If MSCI proceeds with plans to remove crypto treasury companies from its indices, these firms could be forced to sell up to $15 billion worth of crypto assets.

2、Bloomberg analyst James Seyffart agrees with Bitwise’s forecast that over 100 crypto ETFs could be launched by 2026, but notes many will struggle to survive. A wave of crypto ETP closures may occur, potentially by late 2026, though more likely before the end of 2027.

3、CF Benchmarks views Bitcoin as a core portfolio asset and forecasts its price could reach $1.4 million by 2035.

Project Developments

1、CryptoQuant data shows Ethereum exchange supply has fallen to its lowest level since 2016, reducing short-term selling pressure.

2、The previous day saw total net inflows of $457 million into Bitcoin spot ETFs, led by Fidelity’s FBTC with $391 million in net inflows; Ethereum spot ETFs recorded net outflows of $22.43 million, marking five consecutive days of net outflows; U.S. Solana spot ETFs saw total single-day net inflows of $10.99 million.

3、Cointelegraph reports that Ethereum network throughput will increase again next month, with developers planning to raise the gas limit from 60 million to 80 million in January.

4、JPMorgan has deployed JPM Coin on the Base blockchain, limited to transfers among whitelisted users.

5、According to Decrypt, driven by the December 10 Fed rate cut and new FASB rules, crypto asset treasuries (DATs) focused on Bitcoin and Ethereum recorded $2.6 billion in net inflows over the past two weeks, a seven-week high. Strategy acquired over 20,000 BTC across two purchases in a single week, totaling nearly $2 billion.

6、U.S. nationwide bank SoFi has launched its USD stablecoin, SoFiUSD, now live on Ethereum.

7、Near Protocol’s NEAR token is now bridged to the Solana network.

8、Bloomberg: Options markets indicate Bitcoin is under significant pressure heading into the final weeks of 2025, with approximately $23 billion in contracts set to expire next Friday, potentially amplifying already high volatility.

9、A Bitcoin OG whale has deposited 5,152 BTC into a CEX, worth approximately $445 million.

10、Bitwise has submitted a registration statement to the U.S. SEC for a Bitwise SUI ETF.

Disclaimer: This report is generated by AI and manually verified for information accuracy. It does not constitute any investment advice.

2

1

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ripple CEO Declares ‘Nobody Can Manipulate XRP Prices’ amid December Volatility. Here’s Why.

Tipranks•2025/12/19 13:33

Expert to XRP Holders: This Will Be One of the Biggest Fakeouts in History If This Happens

TimesTabloid•2025/12/19 13:06

BTC price outlook: short-term bounce inside a larger downtrend

Cryptonomist•2025/12/19 13:03

Best Solana Wallets as Visa Chooses Solana and USDC for US Bank Settlements

Cryptonomist•2025/12/19 13:03