The Federal Deposit Insurance Corp. (FDIC) is moving forward with rule-making under the US GENIUS Act, proposing a framework for regulated banks to issue payment stablecoins. This will legitimize the integration of digital assets into the traditional banking sector.

As the rails for this new economy are built, investors are assessing which assets will attract the most value. While infrastructure assets like Bitcoin Hyper offer long-term growth, the Bitcoin Hyper price prediction is slow compared to the potential of utility tokens like DeepSnitch AI.

With the Bitcoin Hyper long-term projection targeting 2030 for high returns, DeepSnitch AI is delivering value now. Its product has surged past $825,000, a confirmed January launch, and significant incentives available for early buyers.

FDIC advances stablecoin rules under GENIUS Act

The crypto industry received a massive vote of confidence on December 15, as the FDIC released a 38-page document detailing proposed approval requirements for bank-issued payment stablecoins. This initiative is part of the implementation of the GENIUS Act, a legislative effort designed to modernize the US financial system.

Under the proposal, subsidiaries of FDIC supervised institutions would be able to apply to issue payment stablecoins, subject to strict criteria regarding financial condition, management quality, and redemption policies.

Once approved, the FDIC would serve as the primary federal regulator overseeing these activities. This change is monumental. For years, banks have been hesitant to engage with digital assets due to “reputational risk.” The FDIC, under the GENIUS Act, has removed this ambiguity, inviting banks to innovate.

For the Hyper adoption outlook, it validates the need for high-speed blockchain settlement (which Bitcoin Hyper aims to provide). On the other hand, it empowers traditional banks to dominate the stablecoin market, potentially sidelining decentralized alternatives.

This regulatory clarity creates a “safe” environment for institutions, but for retail investors seeking significant gains, “safe” often means “slow.”

DeepSnitch AI: The investment for 2026?

DeepSnitch AI offers a more attractive risk-reward profile because its utility is live before the token launch. While other projects sell vaporware, DeepSnitch AI has a live dashboard that investors can access right now. The platform has deployed three out of its five powerful AI agents, such as SnitchGPT for instant market analysis, SnitchScan for smart contract auditing, and SnitchFeed for real-time whale tracking.

The project is confirmed to launch in January, and excitement is building up for a possible major exchange listing. The community has shown massive conviction by staking over 20 million tokens. This volume of staked tokens creates a supply shortage, ensuring that sell pressure is minimized when the token hits the open market.

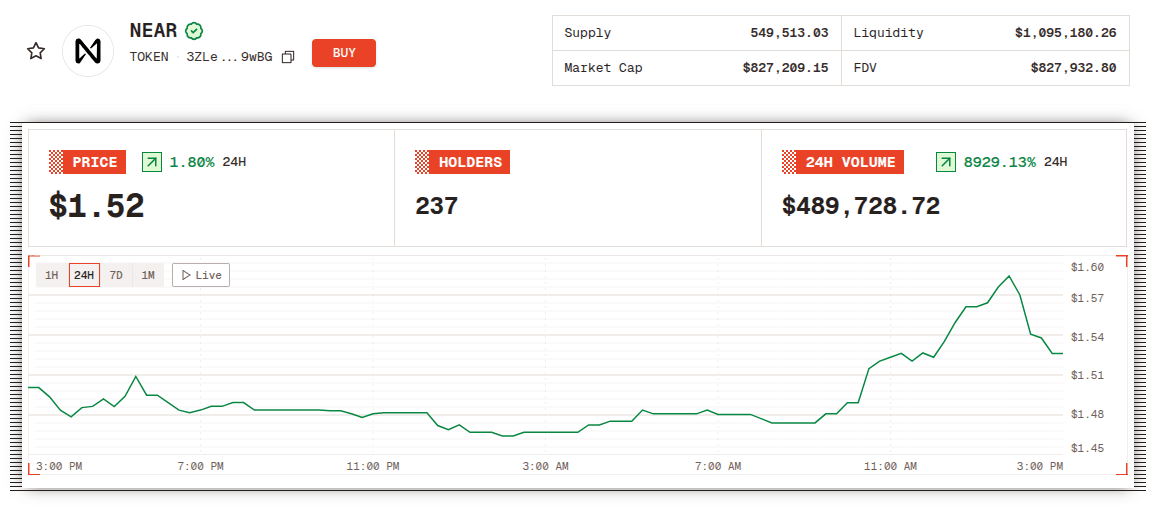

The token price is at $0.02846.

If DeepSnitch AI matches the growth potential in the Bitcoin Hyper price prediction, it only needs to hit a few cents, a target it is likely to reach in its first week of trading. With over $825,000 raised and a product that is a live utility, DeepSnitch AI is positioned for immediate portfolio growth.

Bitcoin Hyper price prediction: The slow burn

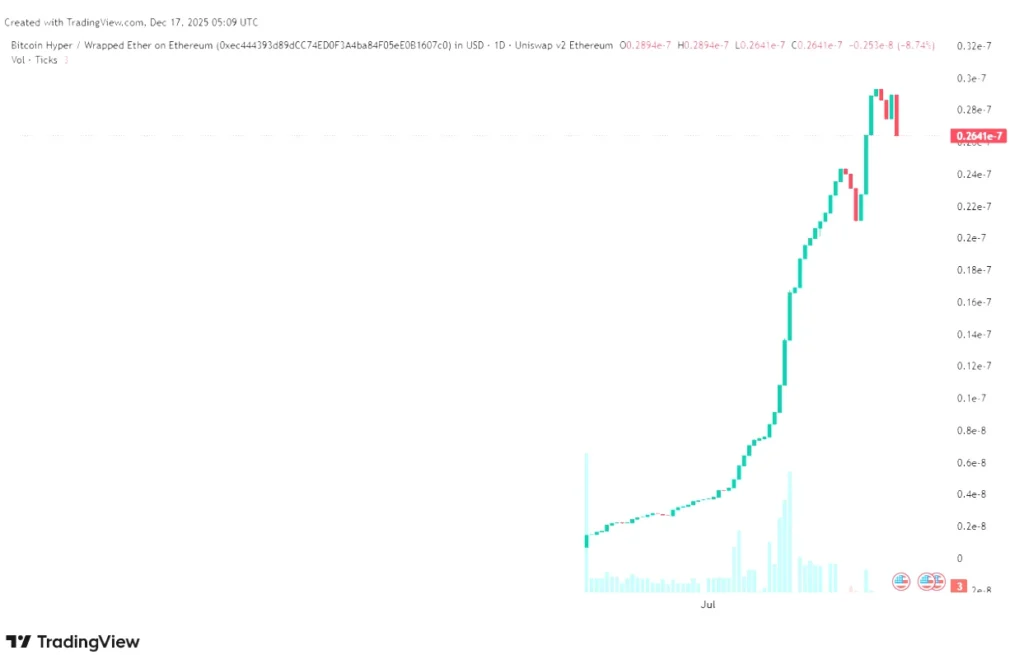

Bitcoin Hyper is a major infrastructure upgrade, pitching the first true Bitcoin Layer 2 with Solana Virtual Machine (SVM) execution. It combines Bitcoin’s battle-tested security with Solana’s speed to enable RWA tokenization and fast dApps. This narrative is strong, particularly for the $30 billion RWA sector. However, the Bitcoin Hyper price prediction shows that it takes time to build such infrastructure.

Analysts project that HYPER could reach $0.5614 by 2030. While this is a solid return from its early price, it requires investors to lock up capital for five years. The Bitcoin Hyper valuation is dependent on the successful execution of its mainnet and the subsequent adoption by developers, a process that is faced with technical risks and competition.

For investors looking for immediate gains, waiting until 2030 for a $0.56 target is an opportunity cost when DeepSnitch AI is launching in weeks.

SUBBD: Another long-term asset

SUBBD is a tool for the creator economy space. SUBBD allows creators to own their work and reach fans directly through blockchain by flipping the subscription model upside down. The platform promises AI tools for content creation and a network of 250 million followers to start adoption.

Like Bitcoin Hyper, SUBBD is a long-term asset. The SUBBD price prediction suggests the token could reach $1.5271 by 2030. While the concept of democratizing creator revenue is powerful, the timeline is extended. The token’s value is tied to the slow adoption curve of non-crypto native users.

In contrast, DeepSnitch AI serves the active, hungry market of crypto traders who need tools now. This immediate product market fit is why DeepSnitch AI is expected to outperform both SUBBD and the Bitcoin Hyper price valuation in the short term.

Conclusion

The FDIC’s move to regulate stablecoins under the GENIUS Act means that banks and institutions are adopting. In this era, infrastructure projects like Bitcoin Hyper will face stiff competition and slow growth curves. The Bitcoin Hyper price prediction of reaching $0.56 by 2030 confirms this “slow and steady” outlook.

For retail investors who want the high side of the crypto market, DeepSnitch AI is a better asset. With over $825,000 raised, three suites of live AI agents and a dashboard you can use today, it offers significant potential for gains in 2026 rather than limited gains in 2030.