Doppler Finance partners with SBI Ripple Asia to launch institutional-grade XRP yield products.

An interesting development is that the leading XRPL project Doppler Finance has established a strategic partnership with SBI Ripple Asia.

According to the statement, the cooperation agreement was announced today and will focus on developing institutional-grade XRP yield products and advancing the tokenization of real-world assets (RWA) on the XRP Ledger (XRPL).

SBI Ripple Asia's First Collaboration with an XRPL-Native Protocol

Notably, this agreement marks SBI Ripple Asia's first partnership with a native XRPL protocol. According to the agreement, Doppler Finance will work closely with SBI Ripple Asia to jointly create XRP yield products for institutional clients.

This move highlights the growing interest of traditional financial institutions in blockchain-based yield solutions. This trend is particularly evident in regions with clearer regulatory environments, such as Japan and Singapore, where regulations continue to encourage institutional participation.

It is noteworthy that the partners have designated SBI Digital Markets, an institution authorized by the Monetary Authority of Singapore (MAS), as the institutional custodian for the project. SBI Digital Markets will provide independent and segregated custody solutions to ensure the safety and comprehensive protection of client assets.

Providing Institutions with Access to XRP Yield

This move marks an important step for the XRP Ledger in expanding institutional participation. Although institutions have participated in the network for years, their involvement has mainly focused on payment applications or financial management.

Furthermore, XRPL has lagged behind more established networks such as Ethereum and Solana in providing yield opportunities. Projects like Torch Network and Axelar have introduced alternative ways for XRP holders, especially retail investors, to participate in yield-related activities.

Now, through this latest collaboration, Doppler Finance and SBI Ripple Asia are actively exploring the development of XRP yield products for institutions while advancing the tokenization of RWA on XRPL.

"An Interesting Move"

Rox Park, Head of Institutions at Doppler Finance, stated in a release that the partnership with SBI Ripple Asia will expand the use cases of XRP, taking it beyond payments and making it a yield-bearing asset.

Similarly, a spokesperson for State Bank of India (SBI) expressed a similar view, emphasizing that the collaboration aims to accelerate the development of yield-focused infrastructure on the XRP Ledger.

Meanwhile, this partnership has also attracted the attention of the broader XRP community. Notably, community figure WrathofKahneman described the collaboration as an interesting initiative.

Interesting move! SBI Ripple Asia has partnered with Doppler Finance to explore #XRP yield products and tokenization on #XRPL. Their goal is to build "institutional-grade yield infrastructure and expand the use of tokenized real-world assets." How about the yield for SBI's parent company? #defi https://t.co/bnGpkYUSog

— WrathofKahneman (@WKahneman)December 17, 2025

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dark Defender: Expect the Unexpected for XRP

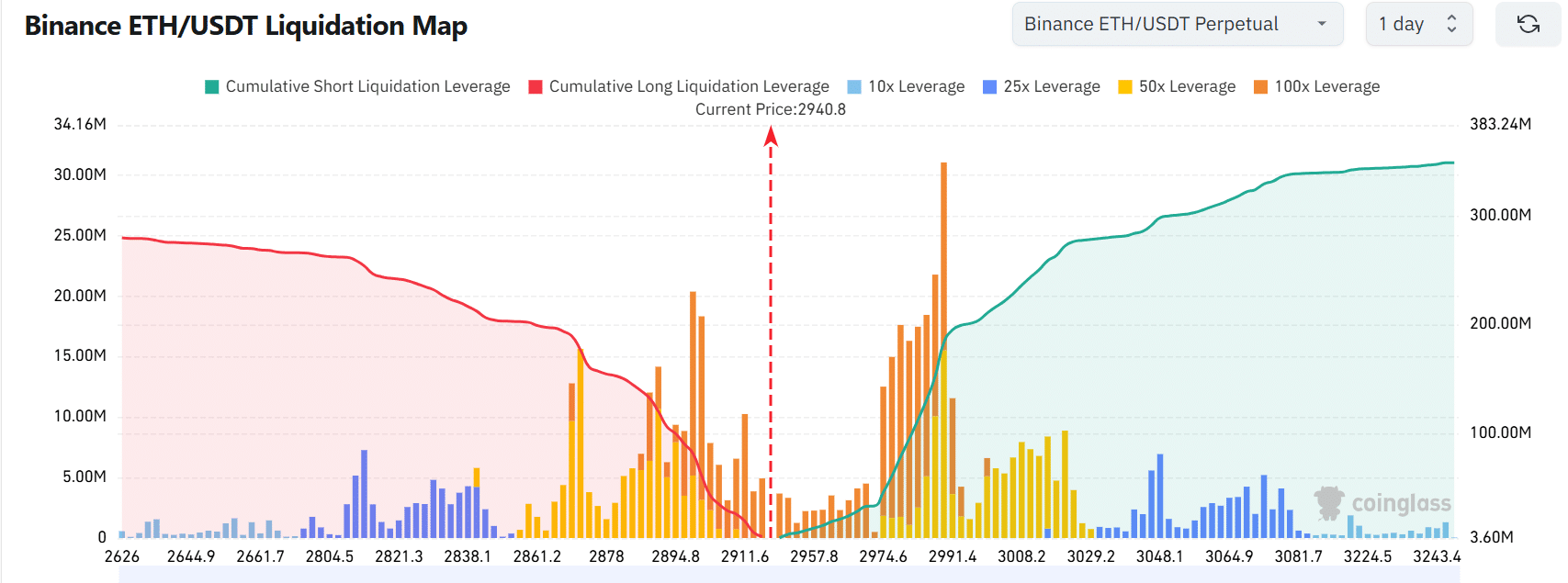

Ethereum – Can Bitmine’s $140.6M ETH buy offset a liquidity trap?

Bitcoin’s $3,000 Up-and-Down Swing Liquidates 123,200 Traders in Volatile Pump and Dump