XRP Price Annual Forecast: As Ripple expands its infrastructure, XRP is expected to reach a new all-time high by 2026.

Ripple, after a turbulent 2025, saw its cross-border remittance token XRP hit a new high of $3.66 in July, and as the new year began, XRP was trading near $2.00.

This resolution of the lawsuit filed by the U.S. Securities and Exchange Commission (SEC) against Ripple in July paved the way for XRP to be actively incorporated into corporate financial systems as an institutional-grade digital asset.

The launch of the XRP spot exchange-traded fund (ETF) in the U.S. in November signals an optimistic outlook for 2026, especially if capital inflows remain steady. According to CoinGecko, XRP's growth in 2025 propelled it to become the fourth-largest cryptocurrency by market capitalization, reaching $120 billions.

On the other hand, Ripple has undergone a thorough transformation while maintaining its core business—facilitating cross-border transactions using fast, secure, and cost-effective blockchain technology.

Ripple’s ambitious growth phase is characterized by strategic partnerships, real-world asset (RWA) tokenization on the XRP Ledger (XRPL), expansion through acquisitions, and the launch of a stablecoin, all fueled by a new wave of crypto-friendly regulation in the U.S. as President Donald Trump’s second term begins.

XRP Performance in 2025: SEC v. Ripple, Institutional Adoption, and New Record Highs

The SEC lawsuit against Ripple, filed in 2020, finally concluded in 2025 after the SEC withdrew its appeal and reached a settlement in May. Ripple agreed to pay a $50 million fine to the SEC. In August 2024, the court ruled that Ripple’s direct sales of unregistered securities to institutional investors violated U.S. securities law. The ruling found that programmatic sales of XRP through third-party platforms such as crypto exchanges did not constitute securities transactions, resulting in a partial victory for Ripple.

Both parties worked together to request an indicative ruling from the court to lift the injunction on future XRP sales to institutional investors. Although the court rejected the motion in June, citing failure to dispel reasonable doubt about the need to amend the final judgment, Ripple and the SEC jointly filed a motion in August to dismiss their appeals. The lawsuit thus came to an end.

The end of the lawsuit paved the way for institutional adoption, with companies like Evernorth holding $1 billion worth of XRP reserves, Trident Digital Tech Holdings holding $500 million, Webus International holding $300 million, VivoPower International committing to over $100 million, and Wellgistics Health holding over $50 million, among others.

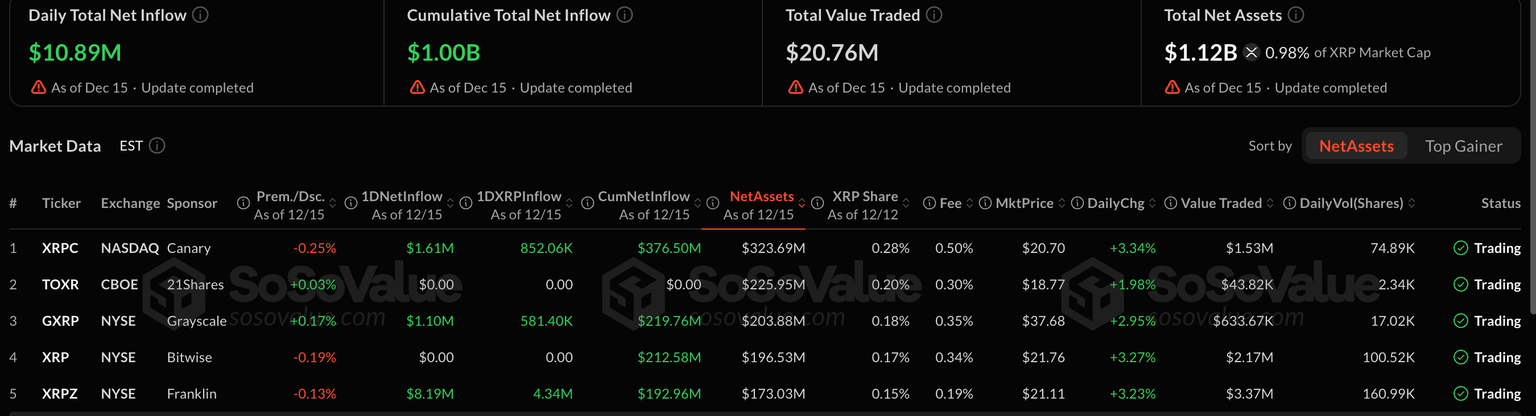

Several fund managers, including Bitwise Asset Management, Franklin Templeton, Canary Capital, Grayscale Investments, REX Shares/Osprey Funds, Amplify ETFs, 21Shares, Teucrium Trading, and Volatility Shares, have applied to the SEC to issue XRP spot ETFs.

In November, four XRP spot ETFs were approved: Canary Capital’s XRPC, Grayscale’s XRPG, Bitwise’s XRP, and Franklin Templeton’s XRPZ. Since their listing on November 13, market demand for XRP ETFs has stabilized, with cumulative inflows reaching $1 billion and net assets totaling $1.12 billion as of December 16.

Ripple Dollar Stablecoin Outlook

Ripple launched the Ripple Dollar RLUSD, a USD-based stablecoin, in December 2024. The stablecoin is redeemable 1:1 for U.S. dollars and is issued under a regulatory charter from the New York State Department of Financial Services (NYDFS).

Ripple at the Intersection of Crypto and Traditional Finance, Institutions Flock to XRP

Ripple has made a profound impact on the financial system, not only consolidating existing partnerships but also signing new strategic collaborations worldwide. These partnerships cover areas such as enterprise-grade crypto asset custody, stablecoins and cross-border payments, and RWA tokenization.

Regulatory compliance has always been one of Ripple’s strengths, enabling seamless integration with traditional finance (TradFi). The cost-effectiveness, security, and speed of XRPL continue to attract institutional investors’ attention and adoption. This cements Ripple’s role as a bridge between the blockchain industry and global banking infrastructure.

XRP Ledger Supports Treasury and RWA Tokenization

Ondo Finance partnered with Ripple to launch Ondo Short-Term U.S. Government Bonds (OUSG), now live on the XRP Ledger. Eligible buyers can seamlessly subscribe and redeem OUSG on-chain using RLUSD.

In its quest to become a financial giant, Ripple has also applied to establish Ripple National Trust Bank in cooperation with the U.S. Office of the Comptroller of the Currency (OCC), headquartered in New York. The bank is expected to have trust powers and provide digital asset custody services.

XRP in 2026: Volatility, Utility-Driven Demand, and Potential New Highs

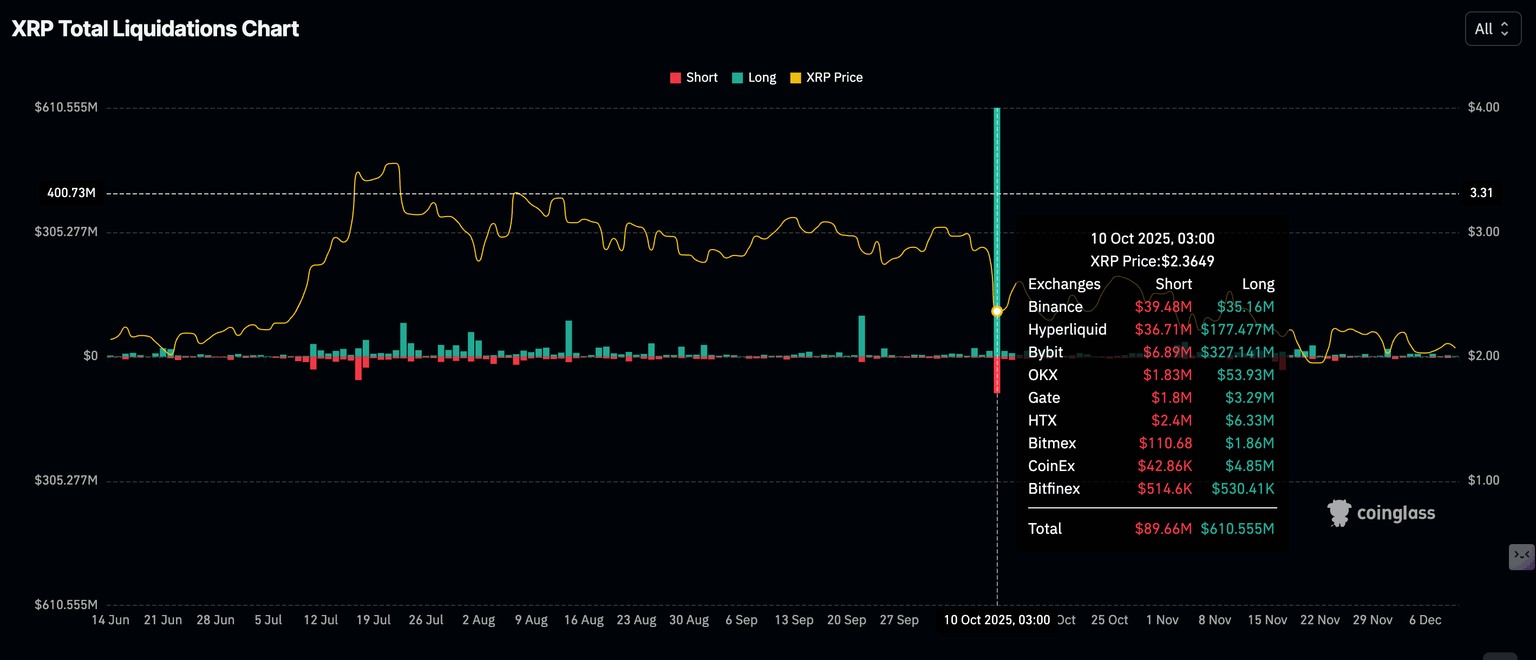

Since July, XRP, like other major assets such as bitcoin (BTC) and ethereum (XRP), has generally trended downward. Multiple factors, including macroeconomic uncertainty, the October 10 deleveraging event, and ongoing profit-taking, caused XRP’s price to drop as low as $1.25 before rebounding slightly above $2.00 (UTC+8).

At the time of writing, XRP’s price has stabilized above the $2 support level, with volatility from macroeconomic uncertainty gradually subsiding. As the market shifts its focus to 2026, XRP’s development will revolve around several aspects: institutional adoption via ETFs and other XRP-related investment products; retail demand; and utility demand driven by Ripple’s infrastructure for supporting cross-border payments.

Lacie Zhang, research analyst at Bitget Wallet, told FXStreet in an exclusive comment that XRP may remain volatile in 2026, with downside risk pointing to $1.40, while upside potential could see new records above $4.00 (UTC+8) by year-end.

Zhang stated: “Although the Federal Reserve has recently adopted an accommodative policy, the market is still adapting to macroeconomic uncertainty, so XRP’s trajectory after entering 2026 may remain volatile. In the short term, due to overall fragile risk sentiment, XRP may further retrace to the $1.40 range. However, the medium-term outlook is more optimistic.”

Zhang added that the next phase may depend on macroeconomic factors stabilizing, increased institutional participation, utility-driven adoption, and continued regulatory clarity. Despite short-term volatility, these factors could still provide significant growth momentum for XRP.

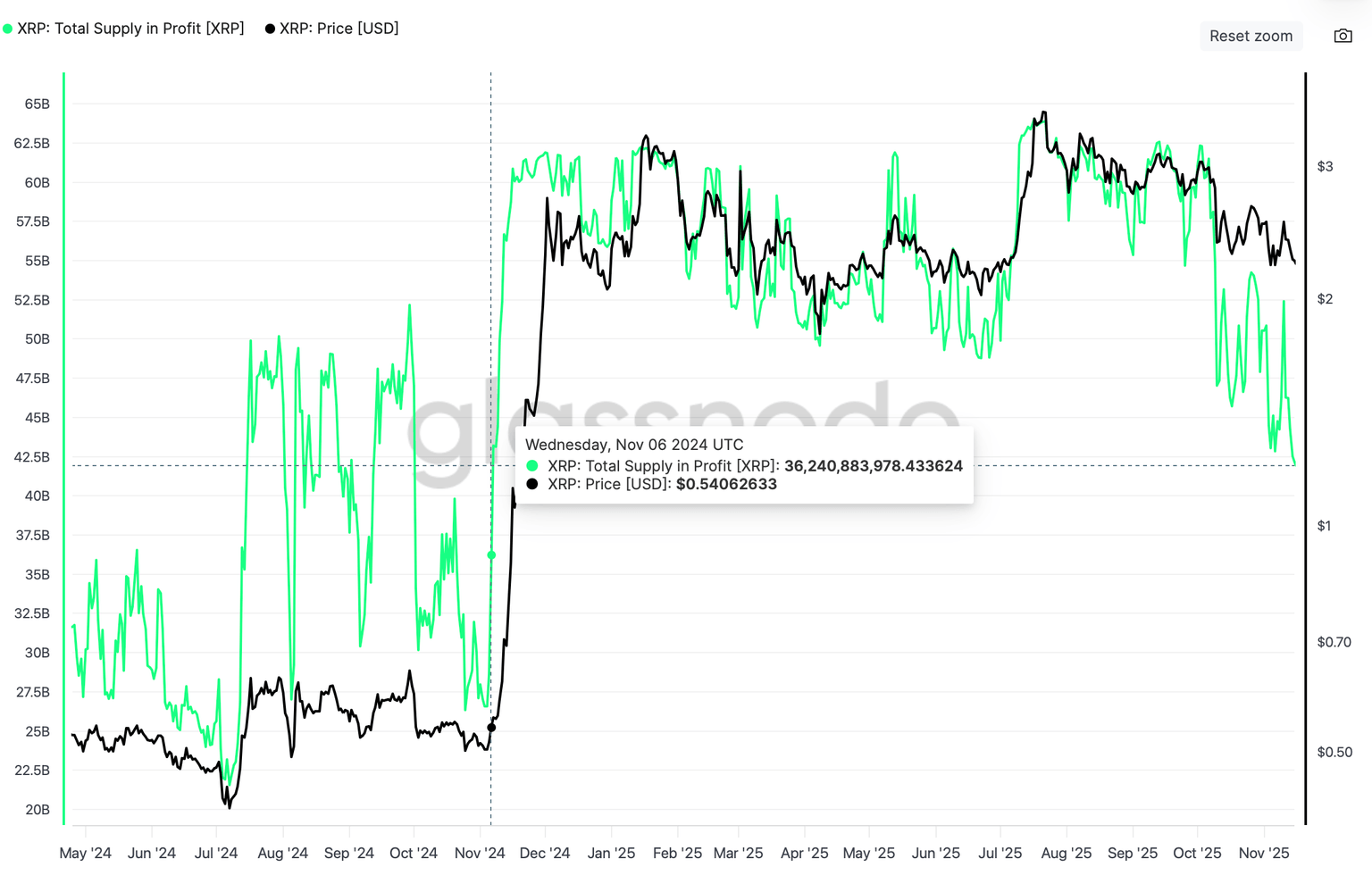

Meanwhile, supply chain profit indicators show that potential selling pressure is narrowing, which could signal a sustained recovery in the coming months.

Currently, about 37 billion XRP tokens are in profit, down from the nine-year high of 64 billion XRP in July, which was the highest record in 2025.

Active profit-taking reduces potential selling pressure. If the downward trend in profit-driven supply continues, it could pave the way for an XRP price rebound. Investors are less likely to continue selling when facing unrealized losses.

XRP Technical Analysis: Will XRP Reach $3?

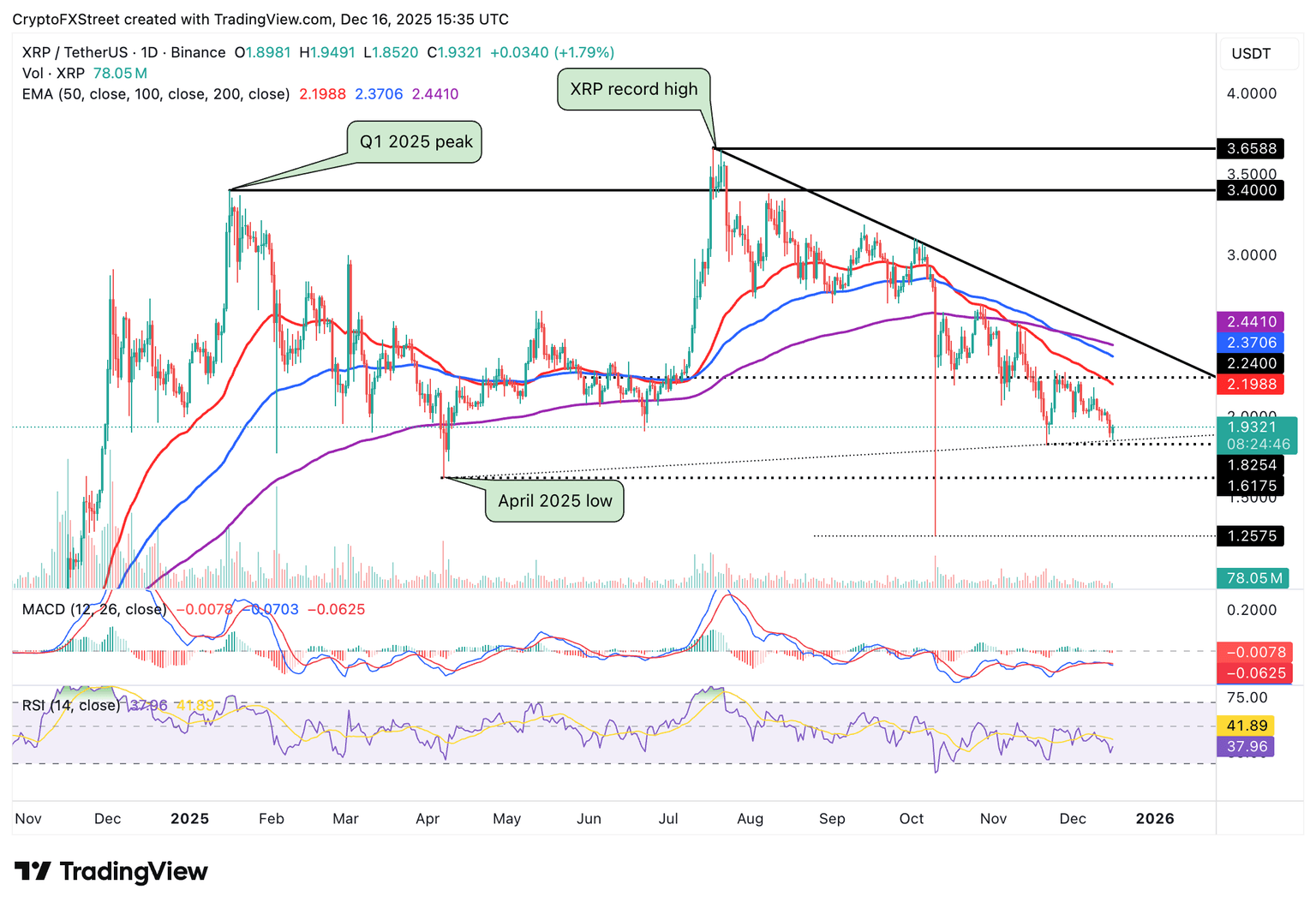

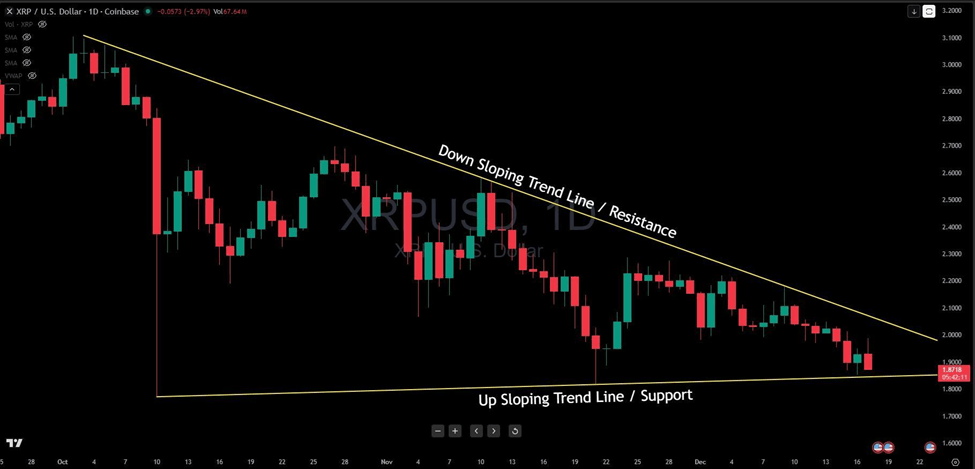

At the time of writing, XRP is trading around $2 (UTC+8), affected by weak retail interest. Since hitting an all-time high of $3.66 (UTC+8) in July, cross-border remittance trading has been volatile and has fallen below a descending trendline. Only a breakout above this key trendline could restore a bullish market outlook.

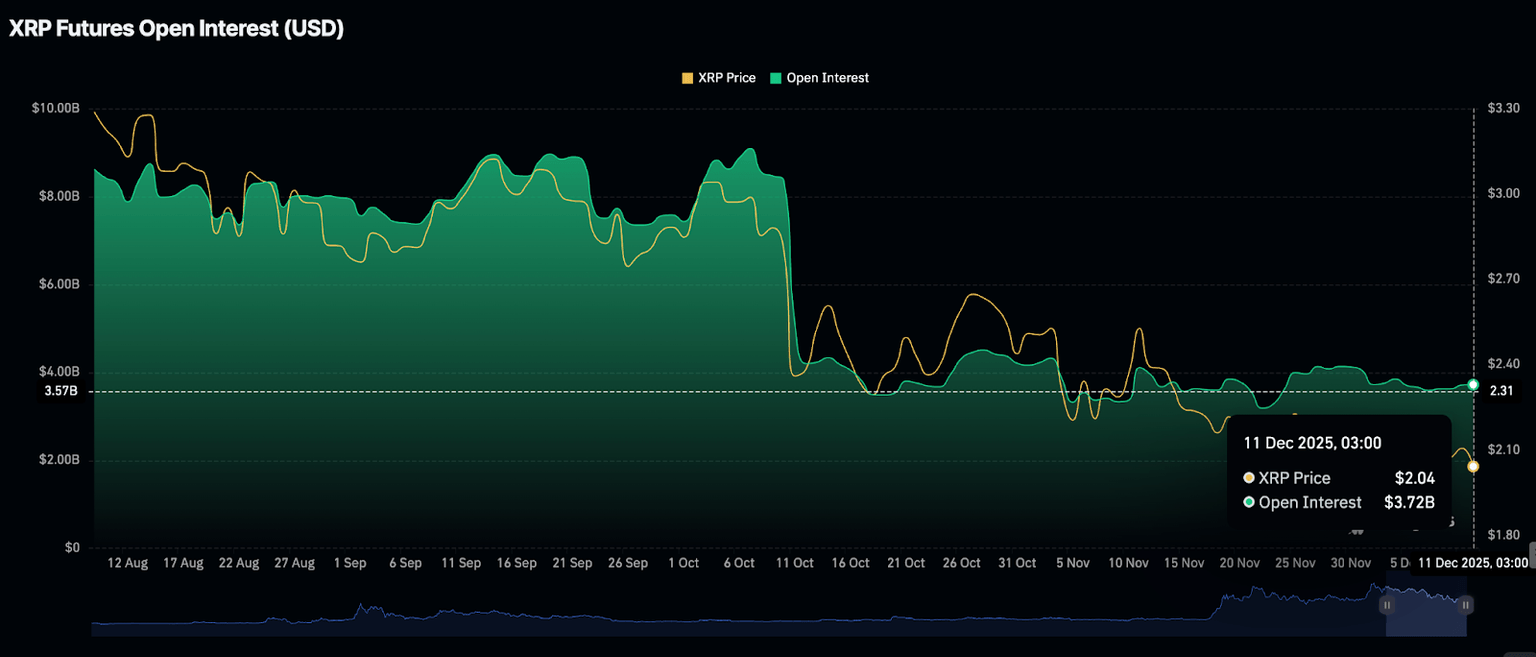

However, a weak derivatives market paints a bleak picture for XRP, as conditions have worsened since the October 10 deleveraging event, which liquidated nearly $610 million (UTC+8) in XRP-related long positions and $90 million (UTC+8) in short positions in a single day.

At the time of writing, XRP futures open interest (OI) remains at $3.72 billion (UTC+8), down 66% from the record high of $10.94 billion (UTC+8) set in July. Open interest measures investor interest in an asset.

Continued declines or stabilization of XRP prices at lower levels indicate that investors do not believe XRP can sustain an uptrend in the short term. Looking ahead, the derivatives market and XRP ETFs may influence market sentiment around 2026.

Meanwhile, XRP remains below the 50-day exponential moving average (EMA) of $2.19 (UTC+8), the 100-day EMA of $2.37 (UTC+8), and the 200-day EMA of $2.44 (UTC+8), all of which are trending downward, further reinforcing the bearish outlook in the short to medium term.

The Relative Strength Index (RSI) remains in the bearish zone at 37, indicating that bearish momentum is increasing. If the RSI falls further into the oversold region, it could accelerate a drop below $2 (UTC+8).

The Moving Average Convergence/Divergence (MACD) indicator on the same daily chart shows sellers in control, with the blue line below the red signal line, further strengthening the bears’ grip.

If the blue MACD line remains below the red signal line, the downtrend will continue, increasing the likelihood of a drop to the April support level of $1.61 (UTC+8). In the worst case, XRP could fall below the $1.25 (UTC+8) liquidity level, which was tested as support on October 10.

On the other hand, if the MACD indicator continues to rise above the moving averages and maintains a buy signal, the price could rebound above the descending trendline and pave the way for a breakout above the 50-day, 100-day, and 200-day moving averages.

A breakout above the months-long descending trendline could signal a shift from a bear to a bull market and accelerate a move above the psychological $3 (UTC+8) level. After breaking this resistance, the key target zone will be the $3.40 (UTC+8) to $3.66 (UTC+8) resistance range. If this range is breached, it could pave the way for a rally above $4 (UTC+8).

Summary

XRP is at a crossroads, affected by market volatility. The cryptocurrency is trading at nearly a 50% discount from its all-time high of $3.66 (UTC+8).

The derivatives market is severely suppressed, with open interest remaining relatively stable, indicating extremely low retail interest compared to July, when open interest averaged a record $10.94 billion (UTC+8).

However, market demand for XRP spot ETFs remains steady, with total net inflows reaching $1 billion (UTC+8). As Ripple builds its cross-border infrastructure, institutional investor interest, market acceptance, and utility-driven demand may become highlights in 2026.

Demand and positive sentiment could drive XRP prices to new highs around $4.00 (UTC+8), but if downside risks persist, prices could fall back to the October 10 low of $1.25 (UTC+8).

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP/USD price consolidates: Triangle pattern signals imminent breakout

Dark Defender: Expect the Unexpected for XRP

Ethereum – Can Bitmine’s $140.6M ETH buy offset a liquidity trap?