Have you checked the charts lately? In a display of classic cryptocurrency volatility, the Bitcoin price surge we just witnessed is turning heads. Over a mere five-minute window, Bitcoin’s value climbed a remarkable 1.57% on the Binance USDT market, pushing its price to $88,592.87. This kind of rapid movement isn’t just a blip on the radar; it’s a powerful reminder of the dynamic and often unpredictable nature of the crypto markets. Let’s break down what this swift Bitcoin price surge could signal and why every trader should be paying attention.

What Does This Rapid Bitcoin Price Movement Mean?

When a major asset like Bitcoin moves over 1.5% in under five minutes, it’s a significant event. This isn’t gradual growth; it’s a sharp, concentrated Bitcoin price surge. Such movements are typically driven by a confluence of factors that create a burst of buying pressure. For context, a similar percentage move in a traditional stock might take days or weeks. In crypto, it can happen before you finish your coffee. This highlights the market’s sensitivity to news, large institutional orders (often called “whale” activity), and technical trading levels being breached.

What Could Be Driving This Sudden Bitcoin Price Surge?

Pinpointing the exact catalyst for a short-term spike can be tricky, but several common triggers exist. Firstly, we must consider market sentiment. Has there been positive regulatory news or a major institutional announcement? Secondly, technical analysis plays a huge role. The price may have hit a key support level that triggered automated buy orders from algorithmic traders. Finally, we cannot overlook the impact of a single large purchase. A multi-million dollar market buy order on a major exchange like Binance can instantly soak up sell-side liquidity, causing the price to jump. This recent Bitcoin price surge serves as a perfect case study in market mechanics.

How Should Traders and Investors React?

For those active in the market, a sudden Bitcoin price surge presents both opportunity and risk. The key is to avoid emotional, reactive trading. Here is a simple framework to consider:

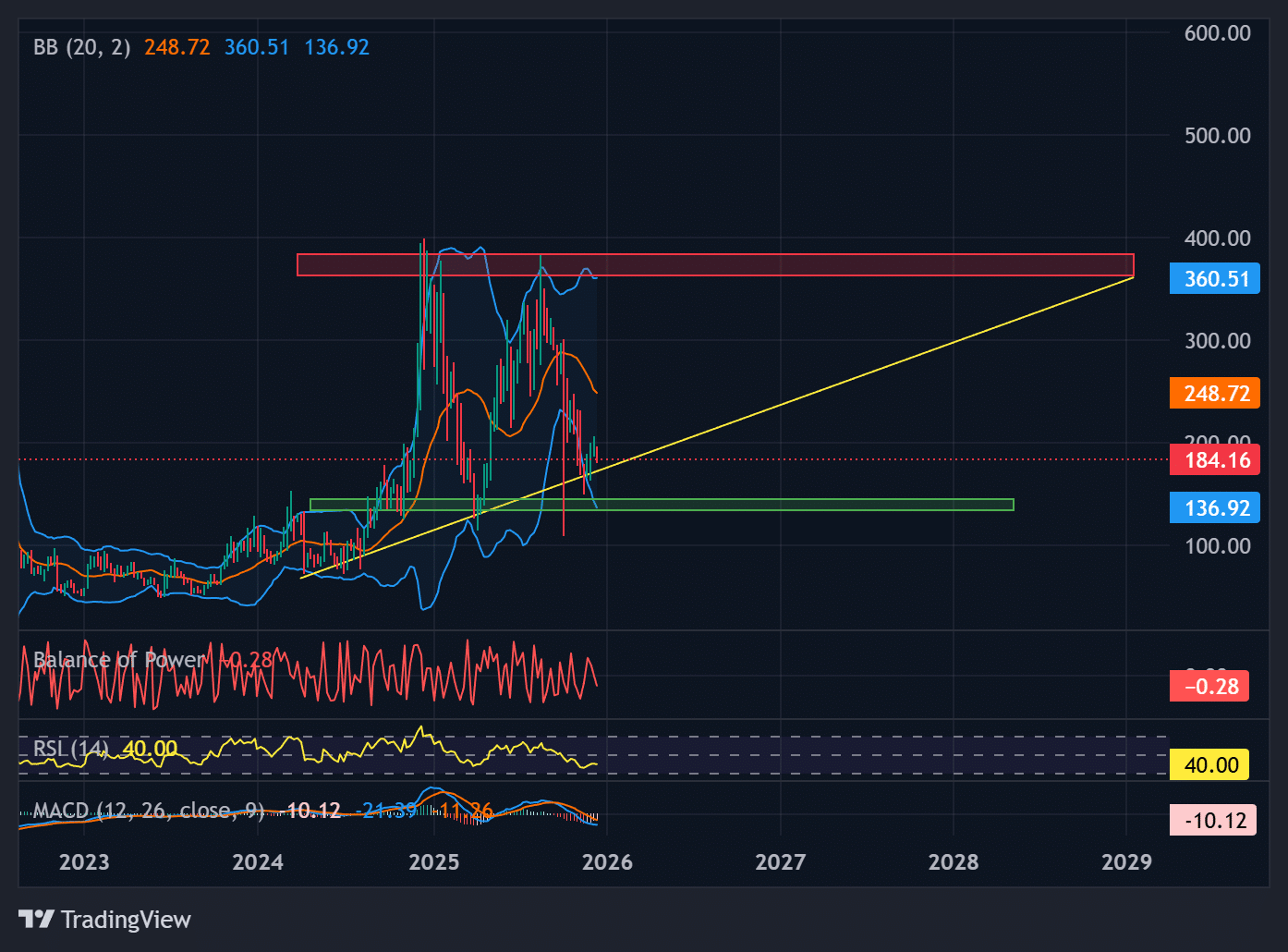

- Assess the Context: Is this surge part of a larger trend, or an isolated spike? Check higher timeframes (1-hour, 4-hour charts).

- Review Your Strategy: Does this move invalidate your entry or exit points? Stick to your predefined plan.

- Manage Risk: Volatility can reverse just as quickly. Ensure stop-loss orders are in place if you are trading.

- Look for Confirmation: A sustained move requires follow-through. Watch to see if the price holds above new support levels.

Remember, while exciting, a five-minute Bitcoin price surge is a short-term event. Long-term investment decisions should be based on fundamentals, not minute-to-minute fluctuations.

The Bigger Picture: Volatility is the Name of the Game

This event perfectly encapsulates the double-edged sword of cryptocurrency investing: high potential reward paired with high risk. The same market structure that allows for a breathtaking 1.57% gain in minutes can also produce equally sharp declines. Therefore, understanding and respecting this volatility is crucial. It’s what attracts speculative traders but also demands extreme discipline from long-term holders. The current Bitcoin price surge to $88,592.87 is a snapshot in time, a data point in Bitcoin’s ongoing narrative of adoption and price discovery.

Conclusion: Navigating the Waves of Crypto Markets

In conclusion, the dramatic Bitcoin price surge observed today is a potent reminder of the crypto market’s incredible pace. It underscores the importance of staying informed, having a clear strategy, and maintaining a level head amidst the noise. Whether this marks the beginning of a larger upward trend or a temporary spike, it reinforces Bitcoin’s position as a leading, albeit volatile, digital asset. For savvy participants, these moments are less about frantic action and more about calm analysis and strategic positioning for what comes next.

Frequently Asked Questions (FAQs)

Q: Is a 1.57% move in 5 minutes normal for Bitcoin?

A: While not an everyday occurrence, such short-term volatility is characteristic of the cryptocurrency market, especially during periods of high trading volume or significant news.

Q: Should I buy Bitcoin immediately after a price surge like this?

A> Chasing a rapid price increase (“FOMO” or Fear Of Missing Out) is often risky. It’s generally wiser to wait for a consolidation or pullback to assess a healthier entry point, based on your investment strategy.

Q: What tools can I use to track these sudden price movements?

A> Most major exchanges like Binance offer real-time charts with candlestick intervals as low as one minute. Price apps and websites that track large transactions (“whale s”) can also provide early signals.

Q: Could this surge be caused by market manipulation?

A> While possible, it’s difficult to prove. Rapid movements are often due to a combination of large orders, algorithmic trading, and collective market sentiment reacting to perceived opportunities.

Q: How does this affect other cryptocurrencies?

A> Bitcoin often sets the tone for the broader crypto market (“altcoin” market). A strong Bitcoin price surge can lead to increased confidence and buying across other major cryptocurrencies.

Q: Where can I learn more about analyzing these trends?

Found this analysis of the sudden Bitcoin price surge helpful? The crypto market moves fast, and knowledge is power. Share this article with your network to help other traders stay informed and navigate the volatility with confidence!