Key takeaways

- HYPE is up by less than 1% and is trading at $27 per coin.

- The coin could reclaim the $30 psychological level amid plans to burn the assistance fund

Hyperliquid looks to burn assistance funds

HYPE, the native coin of the Hyperliquid DEX, is up by less than 1% in the last 24 hours, making it one of the best performers among the top 20 cryptocurrencies by market cap.

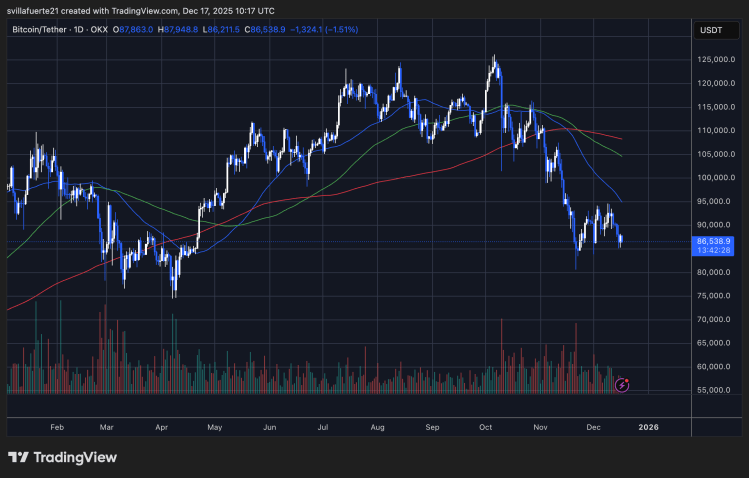

The positive performance comes as Bitcoin, XRP, and Ether are all trading in the red. It also comes as the Hyperliquid Foundation announced plans to permanently remove 37.11 million HYPE tokens from circulation, representing 3.71% of the total supply.

The Hyper Foundation is proposing a validator vote to formally recognize the Assistance Fund HYPE as burned, removing the tokens permanently from the circulating and total supply.

For context, the Assistance Fund converts trading fees to HYPE in a fully automated manner as part…

— Hyper Foundation (@HyperFND) December 17, 2025

The tokens are stored in its assistance fund address, and they will automatically convert the trading fees collected by the perpetual-focused exchange to purchase its native token.

According to the team, the absence of a private key meant that the assistance fund address was never controlled, and a hard fork was necessary to access the funds. With the voting currently ongoing, if the community approves the proposal, it will establish a social consensus that no protocol upgrades are to access this address.

However, the derivatives data show that traders are becoming bullish on this cryptocurrency. CoinGlass data reveals that the Open Interest (OI) surged by 1.63% in the last 24 hours to $1.53 billion, indicating a rise in the notional value of active positions.

The increase of HYPE’s OI-weighted funding rate to 0.0839% also shows that there is a surge in buying pressure, adding more confluence to the bulls.

HYPE could recapture $30 soon

The HYPE/USD 4-hour chart is bearish and efficient after losing 4% of its value in the last seven days. At press time, HYPE is trading above the $26 support level.

The news of a potential burn hasn’t been priced in, and this could push HYPE’s price over the next few days.

However, failure to close the daily candle fails to close above the $26 support, HYPE could extend its decline to the October 10 low near $20.

The RSI of 40 is below the neutral 50 but shows a fading bearish momentum. The Moving Average Convergence Divergence (MACD) and the signal line extend the declining trend, suggesting that the bears haven’t given up yet.

On the flip side, if the bulls continue the recovery and HYPE’s daily candle closes above $26, the coin could rally towards the $34 resistance level.