Expert: XRP Does Not Need the CLARITY Act. Here’s Why

As digital asset regulation moves higher on the U.S. policy agenda, a growing misconception continues to shape public debate. Many assume that every blockchain asset must wait for retail-focused legislation before it can be used at scale.

This assumption overlooks a critical distinction between consumer-facing products and the financial infrastructure that quietly powers institutional settlement.

In a recent post on X, market commentator SonOfaRichard challenged this narrative, arguing that XRP operates in a regulatory and functional category that the proposed CLARITY Act was never designed to govern. His analysis reframes XRP as infrastructure already in use, rather than a retail asset awaiting legal authorization.

Understanding the Purpose of the CLARITY Act

The CLARITY Act is primarily a retail rulebook. Its focus is on disclosures, asset offerings, and investor protections for digital assets sold to the public. The legislation seeks to clarify how such assets should be marketed and regulated, reducing uncertainty for consumers and issuers.

XRP does not need the CLARITY Act.

CLARITY is a retail rulebook.

It’s about disclosures, offerings, and investor protections for assets being sold.XRP isn’t being sold.

It’s being used.Different layer.

XRPL sits in the plumbing layer — the part of the system regulators care…

— SonOfaRichard (@heythereRich) December 16, 2025

SonOfaRichard argues that this framework does not apply to XRP’s core role. XRP is not being distributed through ongoing retail sales. Instead, it is being utilized as a functional tool within payment and settlement processes.

XRP Operates at a Different Regulatory Layer

A central pillar of SonOfaRichard’s argument is the distinction between retail assets and financial infrastructure. The XRP Ledger, he explains, sits in the plumbing layer of the financial system. This is the layer regulators prioritize when failures could disrupt markets rather than merely affect investor sentiment.

In this context, XRP acts as the pressure that moves through the system. Infrastructure is not approved through promotional disclosures or investor guidance. It is evaluated through stress testing, risk controls, and operational reliability before being integrated into live environments.

Why Infrastructure Does Not Wait for New Laws

SonOfaRichard compares XRPL to legacy systems such as Fedwire and DTCC. These platforms did not require new acts of Congress to enable usage. Once regulators and institutions were satisfied with their resilience and compliance, adoption followed automatically.

This same logic applies to blockchain-based settlement rails. When the infrastructure meets institutional standards, it is plugged into existing systems. Usage becomes a function of efficiency and trust, not legislative labeling.

Institutional Signals Already Tell the Story

According to SonOfaRichard, real-world activity supports this view. XRP has appeared in regulated market contexts without reliance on the CLARITY Act. CME-listed products, participation from OCC-regulated entities, and clearing activity through prime brokers indicate that the asset is already functioning within accepted regulatory boundaries.

These developments suggest that infrastructure-level approval has effectively occurred, even in the absence of retail-focused legislation.

What the CLARITY Act May Still Influence

While SonOfaRichard does not dismiss the relevance of the CLARITY Act entirely, he frames its impact as downstream. The legislation may eventually shape how digital assets are presented to retail participants. It may improve transparency at the storefront level.

Settlement systems, however, do not pause for signage. They evolve through integration and performance. From this perspective, XRP’s role is already active. The pipes are live, and the system is in motion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Big Bull Cathie Wood Discusses Bitcoin Price: “The Four-Year Cycle Is No More”

New Arbitrum Wallet Executes TWAP to Buy $2M Worth of HYPE Tokens While Holding About $7M USDC

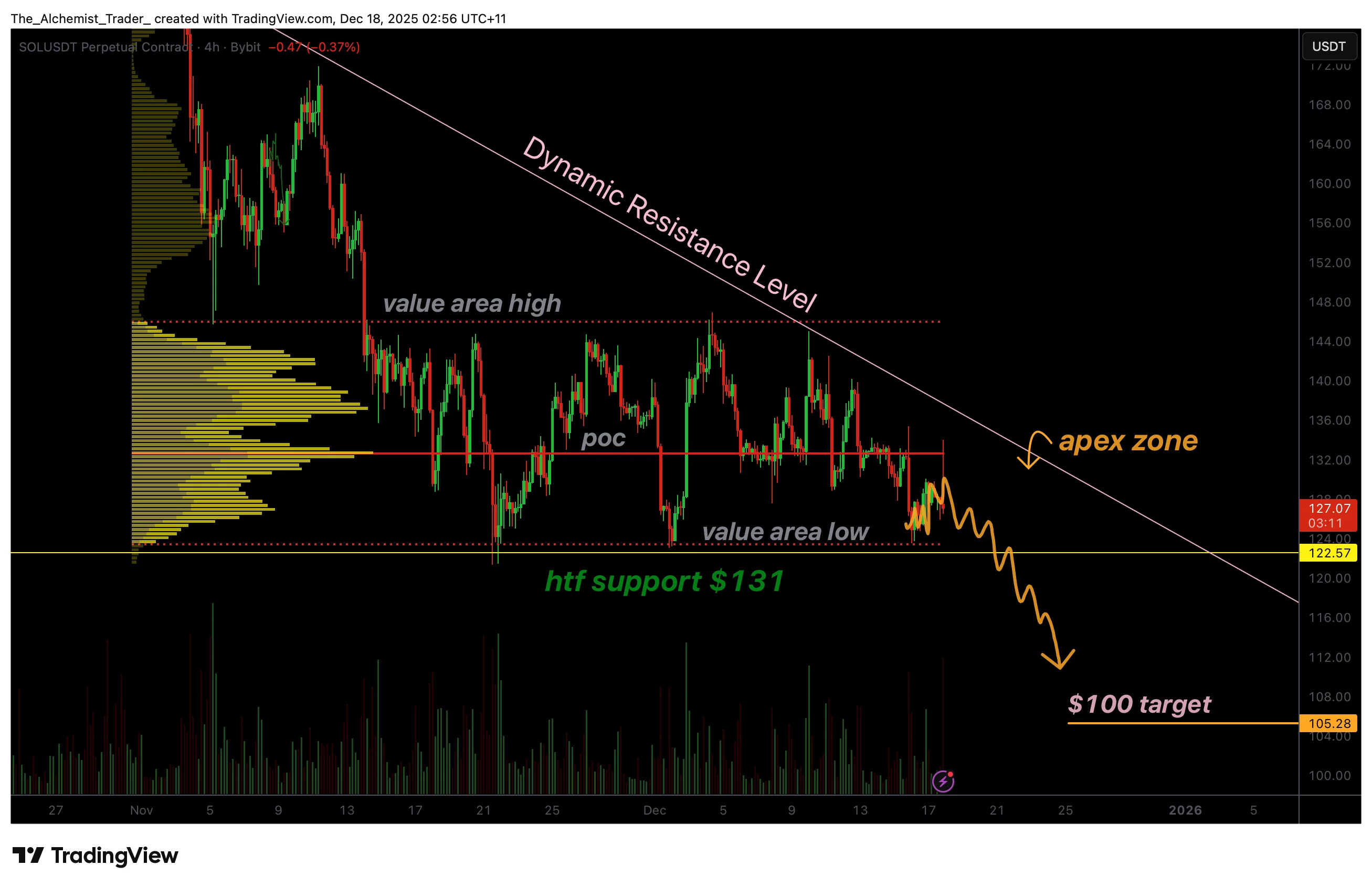

Solana price compresses into triangle apex, breakout risk builds

Ethereum price forms an ABCD correction pattern, putting $2,500 in focus