Robert Kiyosaki just said that this asset will "go to the moon" in 2026.

Robert Kiyosaki has once again issued a warning about the global economy, while boldly predicting the price of an asset he believes could surge significantly within the next year.

On December 17, the bestselling author of personal finance books Rich Dad Poor Dad posted a comment on X (formerly Twitter) following the latest interest rate cut by the Federal Reserve. He believes this decision marks the return of aggressive monetary easing, which he describes as a new round of money printing that could trigger severe inflationary pressures.

Kiyosaki believes the Fed’s move points to what investor Larry Lepard calls the “big plan,” namely large-scale quantitative easing. The financial guru thinks this will make the cost of daily life increasingly expensive for those unprepared. He warns that inflation risks are underestimated and says its long-term consequences could have a profound impact on global purchasing power.

In response, Kiyosaki reiterated his long-standing investment strategy, urging followers to increase their holdings in so-called “physical assets.” He stated that he still favors physical assets such as gold, silver, and bitcoin (bitcoin) and ethereum (ethereum) as safeguards against currency devaluation and financial instability.

Robert Kiyosaki’s 2026 Picks

However, Kiyosaki specifically pointed out that silver is his most favored metal. He revealed that after the Fed announced another rate cut last week, he immediately increased his holdings of physical silver, emphasizing that he believes silver is severely undervalued relative to its historical status as a store of value.

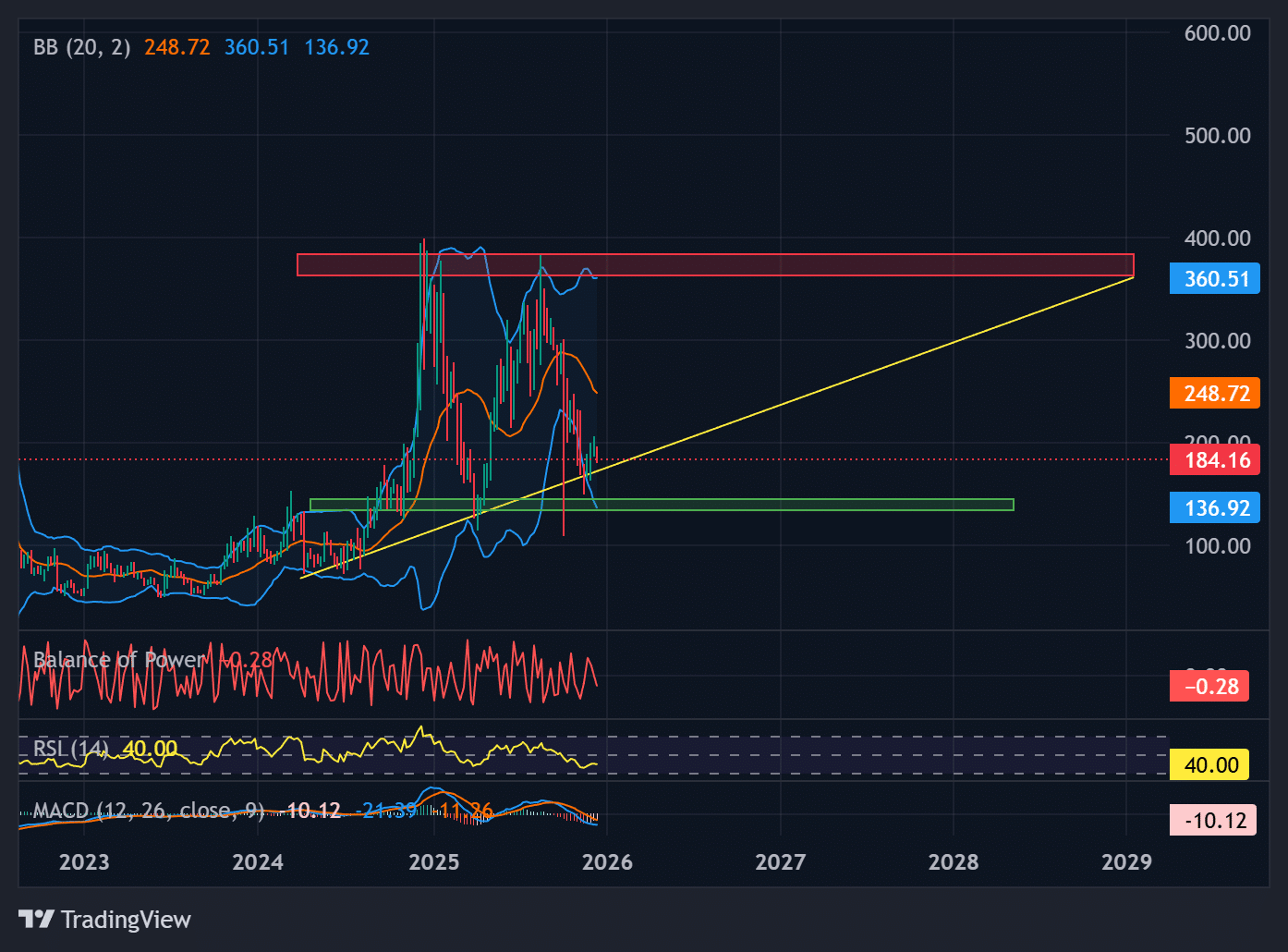

“Silver prices will soar to the moon,” the author wrote, predicting that by 2026, silver could reach as high as $200 per ounce. He noted that in 2024, silver was trading near $20 per ounce and predicted that if inflationary pressures intensify, silver prices could rise tenfold.

Lesson 9: How to Get Richer When the World Economy Collapses.

— Robert Kiyosaki (@theRealKiyosaki) December 17, 2025

The Fed just announced their future plans to the world.

The Fed lowered interest rates… this signals the implementation of Quantitative Easing (QE), or in other words, the start of the money printing machine… Larry Lepard calls it the “Big Print”…

Kiyosaki has repeatedly pointed out that precious metals and certain cryptocurrencies can provide a safe haven during periods of monetary expansion and rising debt levels. His latest remarks are consistent with his previous warnings, in which he described inflation as systemic and accused central banks of masking long-term risks through short-term policy interventions.

Although Kiyosaki’s predictions often spark controversy, his market commentary continues to attract widespread attention from retail investors, especially during times of economic uncertainty. His latest forecast further reinforces the views of hard asset advocates, who believe central bank policies will continue to erode the value of fiat currencies in the coming years.

Cover image from the “Rich Dad” YouTube channel

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Aave to Enter 2026 With a Master Plan, SEC Ends 4-Year Investigation

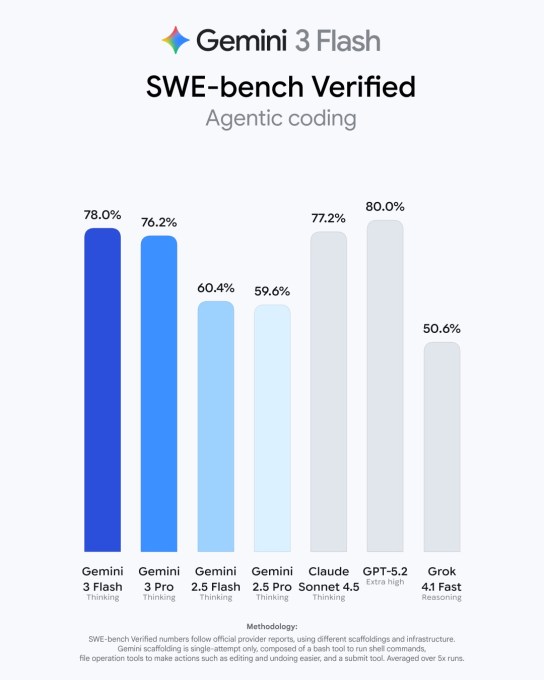

Google launches Gemini 3 Flash, makes it the default model in the Gemini app

Michael Saylor says quantum will “harden” Bitcoin, but he’s ignoring the 1.7 million coins already at risk

Buy or sell? What do technical indicators suggest for Shiba Inu (SHIB)?