Hong Kong SFC Q3 2025 Report: Stablecoins Boost Demand as Virtual Asset Spot ETFs Reach HK$5.47B and Tokenized Funds Surge

According to the Securities and Futures Commission of Hong Kong, the Q3 2025 quarterly report shows ongoing expansion in the city’s virtual asset investment product segment. By the end of November, the market value of SFC-approved virtual asset spot ETFs stood at HKD 5.47 billion, up 33% year-on-year, with the number of products climbing to 11. This trajectory indicates durable demand for compliant exposure through regulated channels and underscores a maturing ETF framework that supports liquidity and access.

In the realm of tokenized financial products, growth is accumulating since their broader launch earlier this year. SFC-approved tokenized retail currency market funds recorded a 557% year-on-year rise in assets under management to HKD 5.48 billion as of November, with eight funds now listed. This uptake signals stronger retail acceptance of tokenized assets within regulated vehicles. Regulators also issued risk warnings in August, with the Hong Kong Monetary Authority and SFC cautioning on stablecoin volatility while reaffirming commitments to risk management and investor protection.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

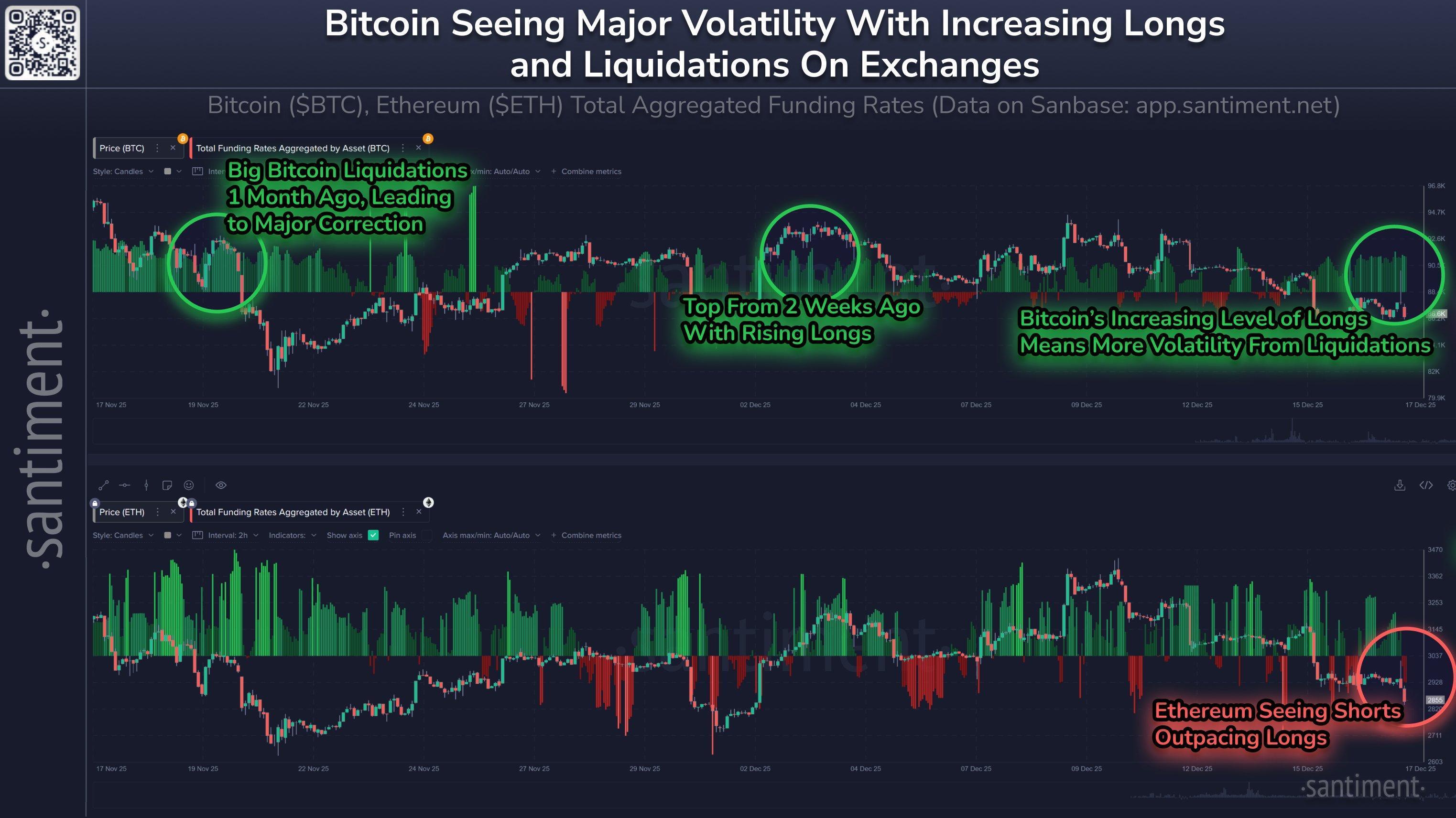

Bitcoin & Ethereum Diverge: Longs Dominate BTC, While ETH Shorts Rise

Stablecoins Post $4.5T On-Chain Month as New Issuers and RWAs Gain Traction

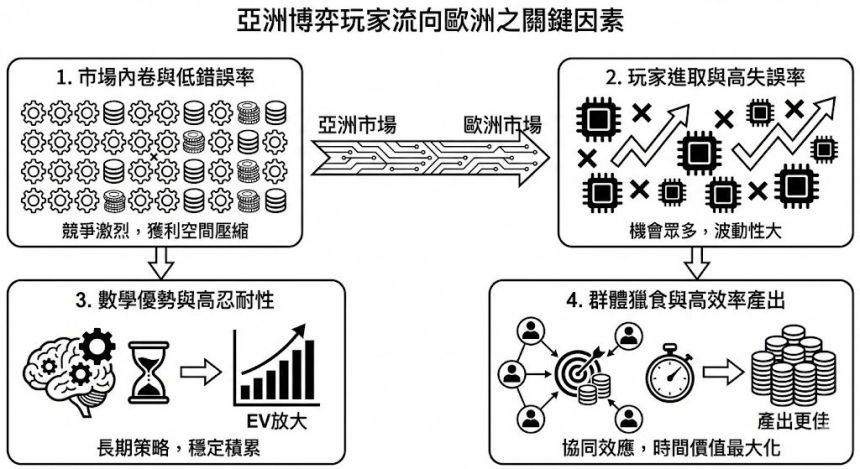

德州撲克趨勢|亞洲高級玩家轉戰歐洲撲克網內幕