Sell-side pressure from long-term Bitcoin holders nears saturation: K33

Bitcoin's prolonged sell-side pressure from long-term holders appears to be approaching saturation following a multi-year distribution phase, according to research and brokerage firm K33.

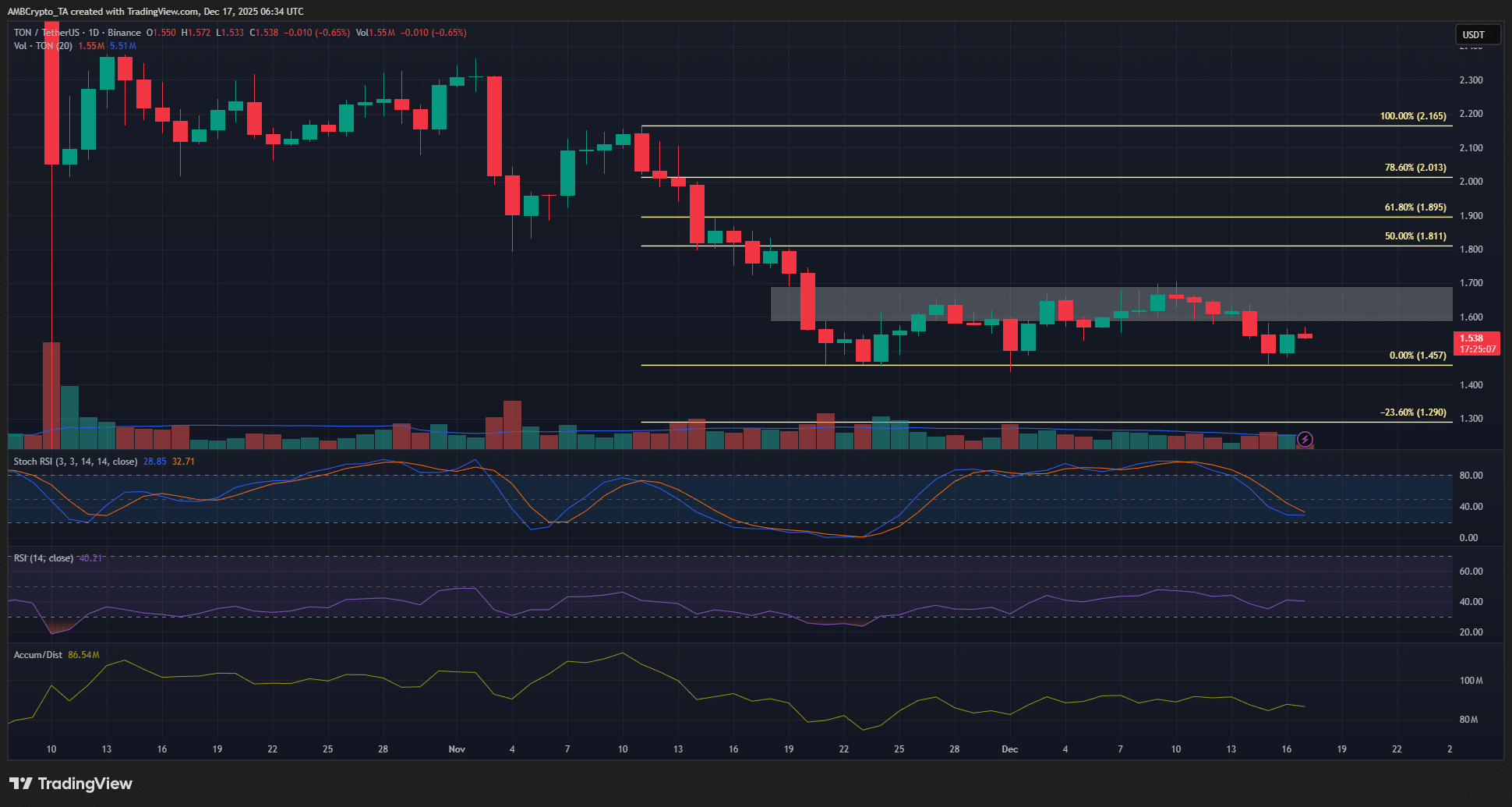

In a Dec. 16 report, K33 Head of Research Vetle Lunde noted that supply held in unspent transaction outputs older than two years has been in steady decline since 2024, with about 1.6 million BTC ($138 billion at current prices) reactivated over that period, signaling sustained onchain selling from early holders.

Lunde said the scale of the decline points to meaningful distribution rather than purely technical movements. While some early reactivations can be attributed to factors such as Grayscale's Bitcoin Trust converting from a closed-ended product to an exchange-traded fund, wallet consolidation, and security-related address upgrades, he argued these explanations do not fully account for the magnitude of supply coming back into circulation.

Supply aged 2 years or more. Image: K33/CoinMetrics.

Long-term distribution reshapes bitcoin ownership

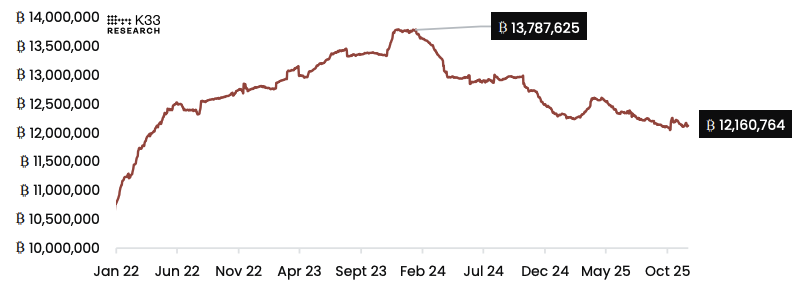

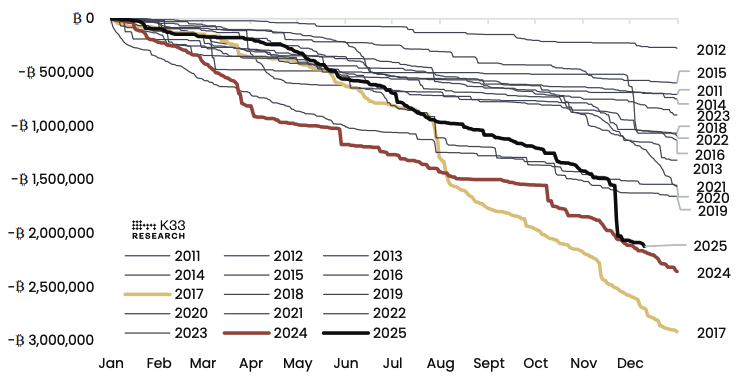

The report highlights 2024 and 2025 as the second and third-largest years for long-term supply reactivation in bitcoin's history, surpassed only by 2017. Unlike that earlier cycle, which was driven by altcoin trading, ICO participation, and protocol incentives, in Lunde's view, the current wave reflects direct selling into deep liquidity created by U.S. spot Bitcoin ETFs and substantial corporate treasury demand, he said.

Total amount of BTC aged 2 years or more revived per year. Image: K33.

K33 pointed to several large transactions as evidence of this trend, including an 80,000 BTC over-the-counter sale concluded by Galaxy in July, a whale selling 24,000 BTC for ether in August, and another selling roughly 11,000 BTC between October and November. The firm noted that similar activity from other large holders has been widespread and is likely a key contributor to bitcoin's relative underperformance in 2025.

In total, K33 noted approximately $300 billion worth of bitcoin supply aged one year or more has been revived this year alone. Lunde said the newfound availability of institutional liquidity has enabled long-term holders to realize profits at six-digit prices, materially reducing ownership concentration and establishing new reference prices for large portions of the circulating supply.

USD Value of Revived BTC Supply. Image: K33/Checkonchain.

Potential rebalancing effects

Looking ahead, K33 expects sell-side pressure to ease. "With 20% of BTC's supply reactivated over the past two years, we expect onchain sell-side pressure to approach saturation," Lunde said. He predicted that bitcoin's two-year supply will end its downtrend and close 2026 above its current level of roughly 12.16 million BTC, as selling from early holders subsides and net buy-side demand emerges.

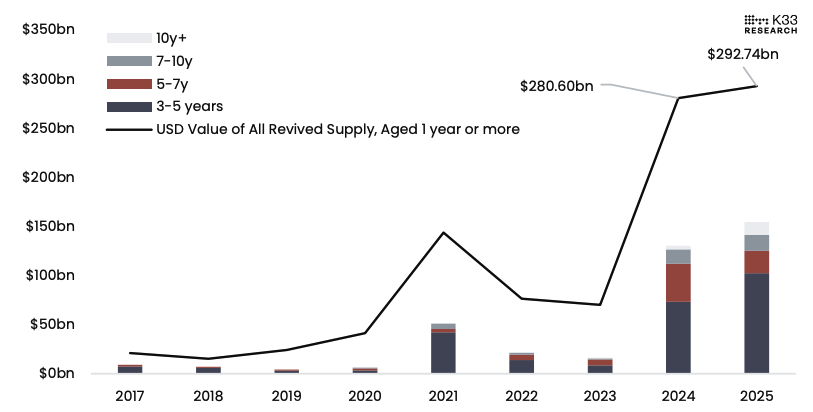

K33 also highlighted potential portfolio rebalancing effects as the current quarter draws to a close. Bitcoin has historically tended to move in the opposite direction of the prior quarter early in a new quarter, Lunde noted. With the cryptocurrency having materially underperformed other asset classes in Q4, he said rebalancing by managers with fixed allocation targets could support inflows into late December and early January, similar to dynamics observed in late September and early October.

Early new quarter reaction in BTC tends to move in the opposite direction of the past quarter. Image: K33.

Lunde cautioned, however, that historical cycles show supply reactivation typically peaking near broader market tops rather than bottoms. Even so, he argued the current cycle differs due to bitcoin's growing integration into mainstream finance, including expanding access through ETFs, advisory platforms, and clearer regulatory frameworks, which Lunde said could support a more durable demand backdrop once distribution pressure fades.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Changpeng Zhao’s Calculated Comeback: Restoring US Influence After Presidential Pardon

Zach Rector Share Quick XRP Update

Can Toncoin eye $2? – Why THIS level remains TON’s major hurdle