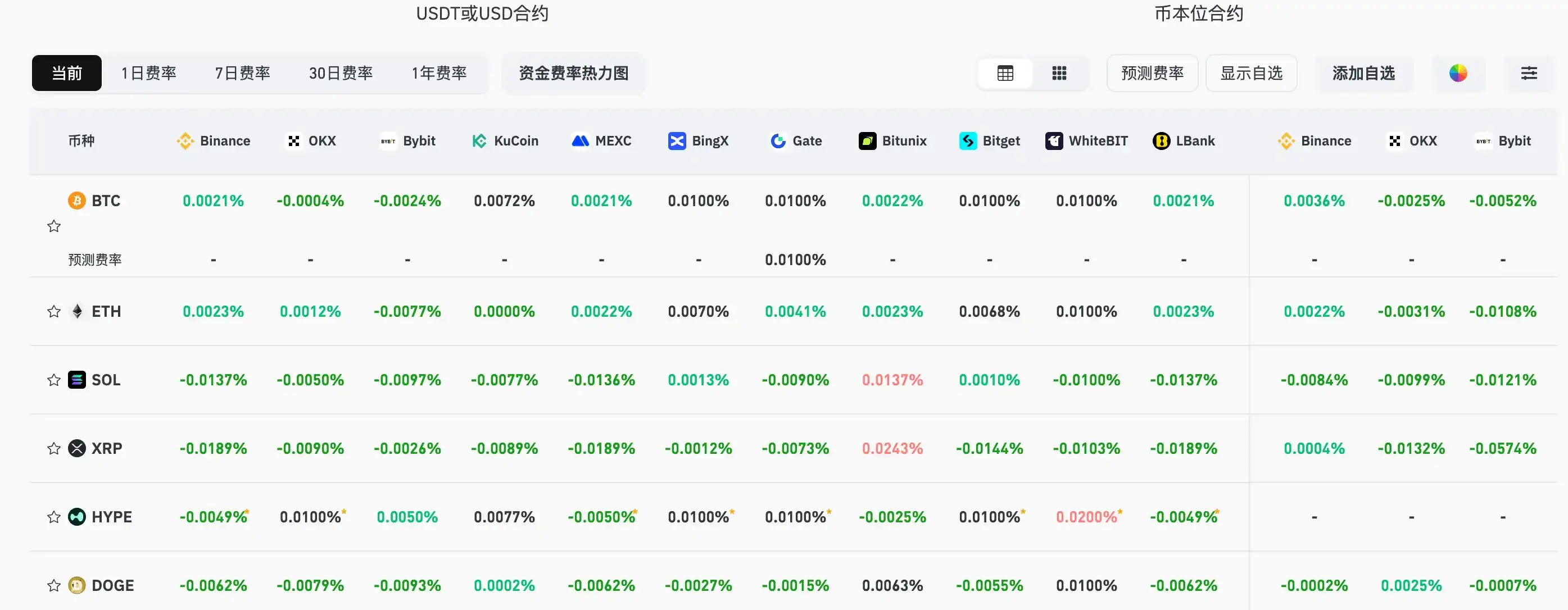

Data: Current mainstream CEX and DEX funding rates indicate the market remains broadly bearish

ChainCatcher News, according to Coinglass data, the current funding rates on major CEX and DEX platforms indicate that the market remains broadly bearish. The specific funding rates for major cryptocurrencies are shown in the attached chart.

ChainCatcher note: Funding rates are fees set by cryptocurrency trading platforms to maintain the balance between contract prices and the prices of underlying assets, usually applied to perpetual contracts. It is a mechanism for capital exchange between long and short traders. The trading platform does not charge this fee; it is used to adjust the cost or profit of holding contracts, so that contract prices remain close to the prices of the underlying assets.

When the funding rate is 0.01%, it represents the benchmark rate. When the funding rate is greater than 0.01%, it indicates that the market is generally bullish. When the funding rate is less than 0.005%, it indicates that the market is generally bearish.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

OpenAI: Launches New Image Model and Features in ChatGPT for All Users

Data: 1,335 ETH transferred out from Cumberland DRW, worth approximately $3.93 million

Data: If BTC falls below $83,062, the cumulative long liquidation intensity on major CEXs will reach $1.819 billions

The Federal Reserve accepted $1.554 billion in fixed-rate reverse repurchase operations.