Brazil's largest private bank asset management company recommends that investors allocate 1% to 3% of their portfolios to Bitcoin.

On December 14, Brazil's largest private bank asset management company Itáu Asset Management recommended in its year-end report that investors allocate 1% to 3% of their portfolios to Bitcoin. Renato Eid, head of responsible investment at Itáu Asset Management Beta strategy, stated that using cryptocurrencies as a complementary asset helps absorb the shocks caused by currency depreciation and global volatility.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Critical Bitcoin (Btc) Data Affecting The 14 Largest Banks In The Us Has Arrived! “First They Opposed It, Then…”

Crypto Markets Rocked as $600M+ Liquidations Sweep Exchanges in 24 Hours

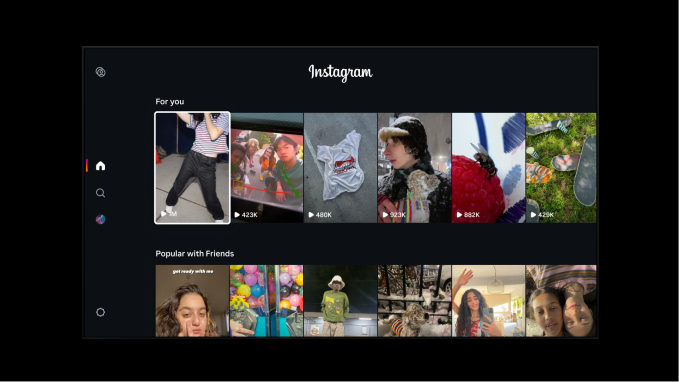

Instagram brings Reels to the big screen, starting with Amazon Fire TV