- Ethereum outperforms altcoins while tracking Bitcoin closely

- MA50 continues to serve as critical support for ETH

- Market eyes ETH’s strength for upcoming trend direction

Despite a shaky crypto market , Ethereum vs Bitcoin is showing impressive strength. While many altcoins have taken a hit recently, ETH has managed to hold its ground, particularly when measured against BTC . This relative performance suggests that Ethereum remains one of the more stable digital assets during uncertain times.

The ETH/BTC trading pair is often used as a barometer to measure Ethereum’s performance against the market leader. Right now, that pair is staying strong, indicating that Ethereum isn’t losing ground—even as volatility increases across the broader crypto space.

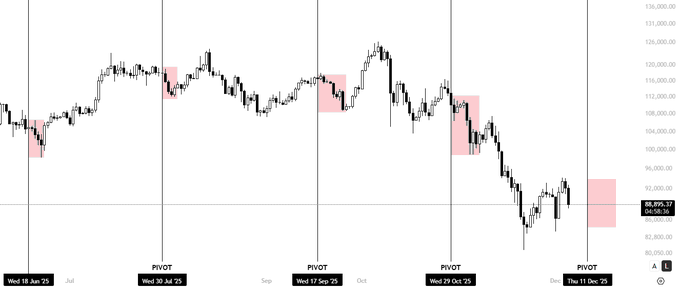

MA50: A Critical Level for ETH

One key technical level that traders are watching closely is the 50-day moving average (MA50). For Ethereum, the MA50 has acted as a consistent support level. It has helped prevent deeper pullbacks and could play a crucial role in maintaining upward momentum.

If Ethereum can stay above this line, it may signal that bulls are still in control, even amid broader market pressure. Falling below it, however, could trigger further downside and open the door to stronger Bitcoin dominance in the short term.

What This Means for the Market

The fact that Ethereum is holding up well against Bitcoin is encouraging for ETH holders. It means the asset is not just surviving, but potentially setting up for future strength. Investors and traders will be watching ETH/BTC closely, especially if Ethereum continues to outperform altcoins and maintain its MA50 level.

With the broader market uncertain, the ETH vs BTC dynamic could give clues about which asset is poised to lead the next rally—or survive the next correction.

Read Also :

- Dogecoin Price Prediction: Solana and Base Bridge Liquidity via Chainlink as DeepSnitch AI Targets Massive Launch Rally

- Europol Busts €700M Crypto Fraud Network

- XRP Price Prediction for 2026 Is Upgraded Due to Record ETF Inflows, but Truly Exponential Returns Will Come Instead From DeepSnitch AI

- Fidelity CEO Backs Bitcoin as “Gold Standard”

- Solana Price Prediction December 2025: SKR Token Launch Signals Perfect Entry as DeepSnitch AI Explodes 70%