The truth behind Bitcoin's overnight 9% surge: Is December the turning point for the crypto market?

Bitcoin strongly rebounded by 6.8% on December 3 to $92,000, while Ethereum surged 8% to break through $3,000, with mid- and small-cap tokens seeing even larger gains. The market rally was driven by multiple factors, including expectations of a Federal Reserve rate cut, Ethereum’s technical upgrades, and policy shifts. Summary generated by Mars AI. This summary was produced by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative updates.

After two consecutive months of a steady decline and market sentiment hitting rock bottom, Bitcoin staged a dramatic comeback in the early hours of December 3 (UTC+8). The price rebounded strongly by 9.5% from a low of $84,000, climbing back above the $92,000 mark, while Ethereum surged over 10% to break through $3,000.

Meanwhile, mid- and small-cap tokens such as Solana, Cardano, SUI, and LINK recorded double-digit gains.

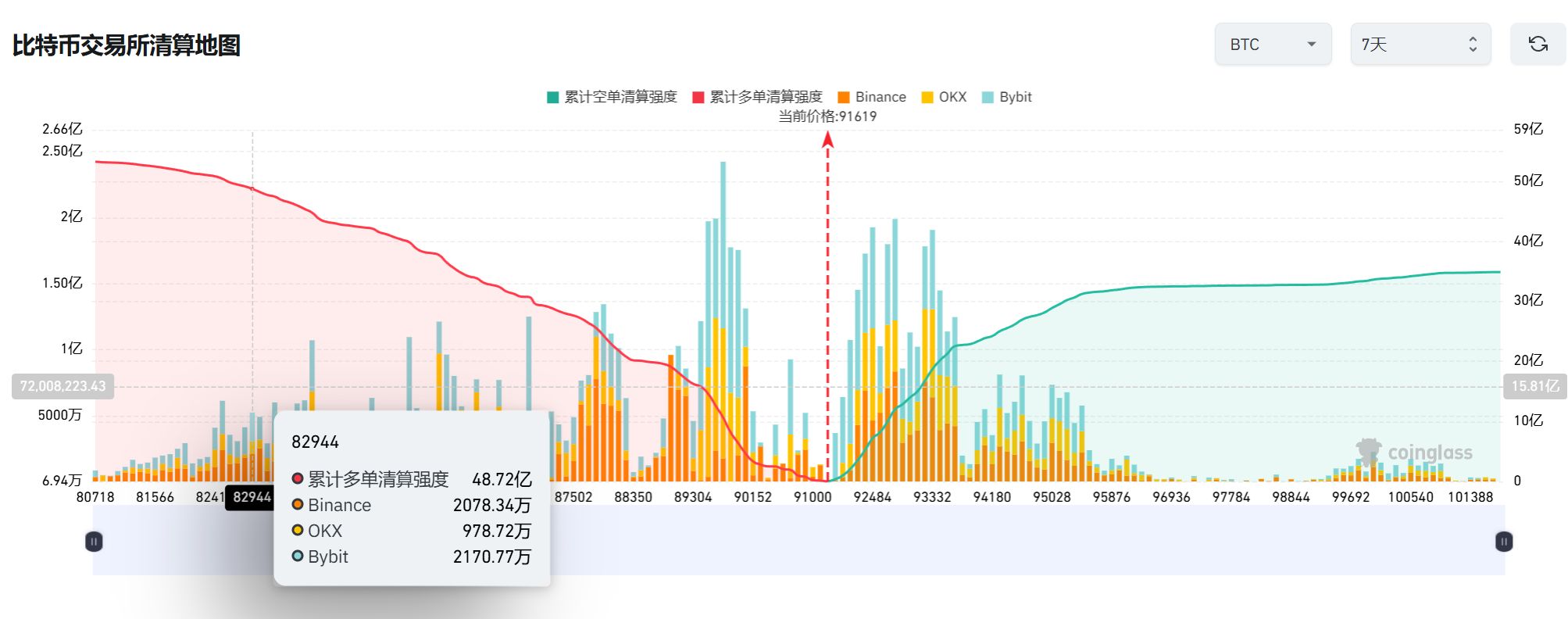

This reversal seems to have injected a shot of adrenaline into the market. In the past 24 hours (UTC+8), total liquidations across the network still reached $400 million, mainly from short positions, with 110,000 traders forcibly liquidated. The largest single liquidation occurred on Bybit, where a BTCUSD contract worth $13 million was wiped out instantly.

This rebound is not an isolated event, but rather the inevitable result of multiple intertwined factors.From macro liquidity expectations and institutional capital flows to on-chain data and policy signals, the market is searching for a new direction at a delicate balance point.

Three Major Catalysts in Sync: The Resonance of Liquidity, Technical Upgrades, and Policy Shifts

Fed Rate Cut Probability Soars, Liquidity Expectations Reshape Market Logic

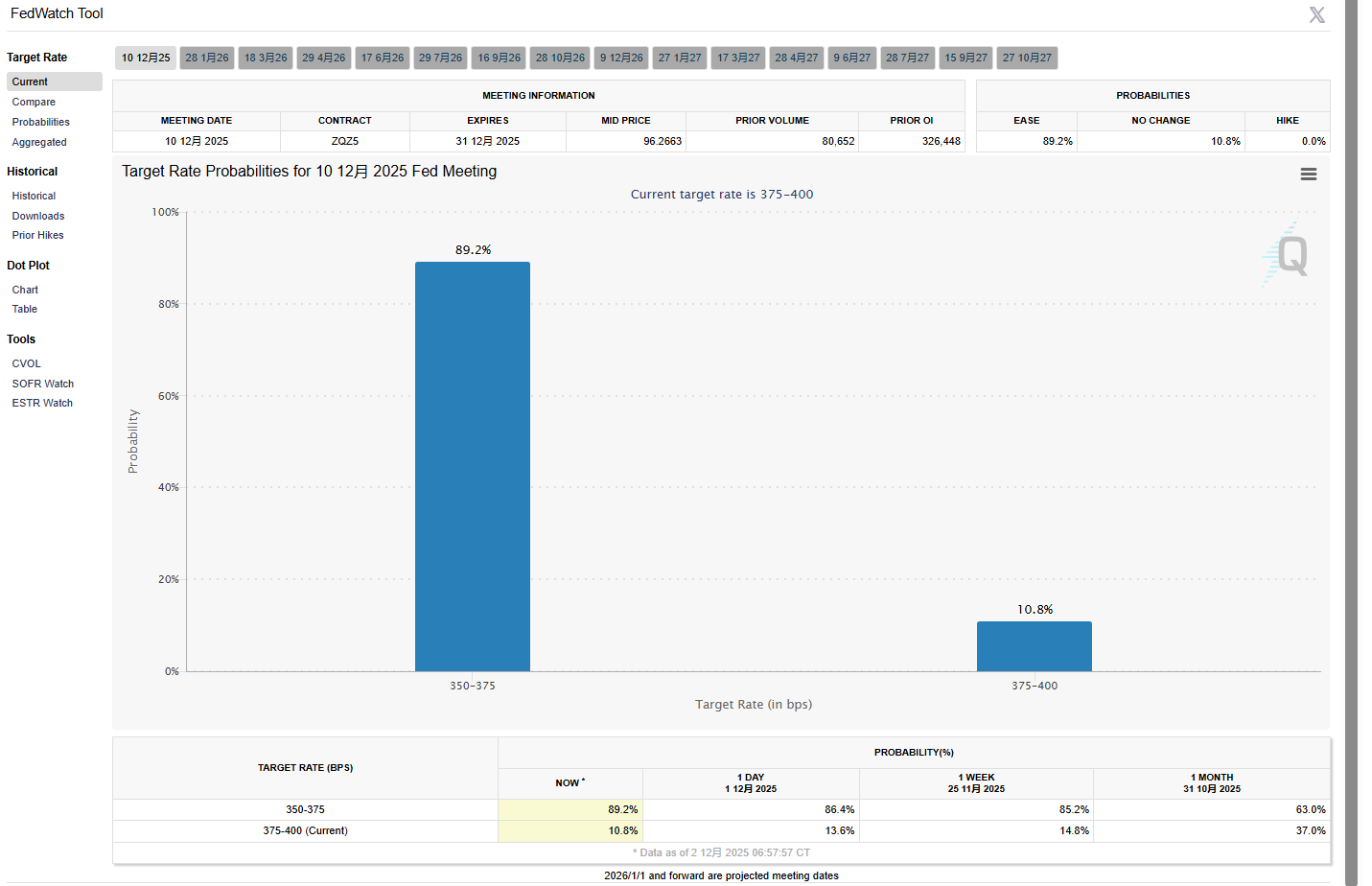

According to the latest data from the CME FedWatch tool, the market's bet on a 25 basis point Fed rate cut on December 10 (UTC+8) has soared from 35% a week ago to 89.2%.

The direct trigger for this dramatic shift was the November PPI data coming in far below expectations, with inflationary pressures continuing to ease.

Although the Trump administration's tariff policies have temporarily pushed up costs, Fed officials have repeatedly emphasized that a "soft landing" remains the core goal through 2026, avoiding a premature shift to tightening.

If the rate cut materializes, a weaker dollar and falling US Treasury yields will directly benefit risk assets like Bitcoin. More importantly, this could open the window for consecutive rate cuts in Q1 2026, prompting capital to preemptively position for a "rate cut trade."

Ethereum Fusaka Upgrade: Technical Leap Activates Ecosystem Value

The Fusaka upgrade, set to be activated on December 4 (UTC+8), marks another milestone for Ethereum following the Merge.

Its core PeerDAS technology will increase Blob capacity from 9 to 15, reducing Layer2 transaction fees by another 30%-50%, and for the first time, enabling regular accounts to have "account abstraction" features such as social recovery and batch operations. This upgrade not only optimizes data availability management, but more importantly, paves the way for Verkle Trees stateless clients, reducing node sync time from weeks to hours. The technical dividend comes as the market bottoms out, with the ETH/BTC ratio stabilizing and rebounding, suggesting capital may rotate from Bitcoin to altcoins.

Fed Chair Succession: Hassett May Lead an Era of "Super-Easy" Policy

Trump sent signals at a cabinet meeting, hinting that National Economic Council Director Kevin Hassett is the frontrunner to succeed as Fed Chair.

As a representative of the rate-cutting camp, Hassett has publicly criticized Powell for excessive rate hikes and advocated for including Bitcoin in the national strategic reserves.

Polymarket predicts his nomination probability has risen to 86%. If realized, Fed policy may shift to full-scale easing. Even if another candidate takes office, all of Trump's shortlisted candidates favor friendly policies, and the cycle of confrontation between the Fed and cryptocurrencies may come to an end.

Hidden Clues in Capital Flows: Institutions Quietly Position as Retail Leverage Collapses

Whale Transfers and ETF Capital Reversal: Silent Accumulation Has Begun

On the morning of December 3 (UTC+8), Arkham data showed that 1,800 BTC (about $82.1 million) were transferred from a Fidelity custody address to two anonymous wallets.

Such large transfers usually signal institutional position adjustments. At the same time, after the US stock market opened,BlackRock's IBIT ETF saw trading volume exceed $1 billion in just half an hour, and Vanguard triggered a capital inflow on the first day after lifting its Bitcoin ETF ban.

This stands in contrast to the recent trend of ETF net outflows: November saw a single-week withdrawal of $2 billion, but the current AUM still accounts for 6.6% of Bitcoin's total market cap. If it rises above 8%, it will mark a true restoration of institutional confidence.

Leverage Liquidations and Market Structure Vulnerability

In this round of rebound, total liquidations reached $400 million, but the long-short structure has quietly changed: if BTC falls in the next 7 days (UTC+8), long liquidations will intensify; over a 30-day (UTC+8) period, short liquidation pressure rises significantly.

This indicates that although short-term leverage risk remains, medium- to long-term bearish forces are being weakened.

Notably, MicroStrategy has set up a new $1.4 billion reserve fund to cover dividend payouts and avoid forced Bitcoin sales, alleviating market concerns about institutional selling pressure.

The Rift Between Historical Patterns and Current Reality: Can the Christmas Rally Reappear?

Seasonal Patterns: A Tug-of-War

In the past eight years, Bitcoin has risen in December in six of those years, with an average gain of 9.48%. In 2017 and 2020, it even soared by 46% and 36%, respectively.

The underlying logic of this "Christmas rally" lies in year-end bonus inflows, buying opportunities after tax-loss harvesting, and reduced selling pressure as institutions scale back activity.

But history does not simply repeat itself—currently, the Fear & Greed Index remains at an extremely fearful level of 20, and analysts' expectations for a Christmas rally have dropped from 70% to 30-40%.

Diverging Macro Environment Challenges

Bitcoin's correlation with traditional risk assets is strengthening. Since October, Nvidia's earnings have exceeded expectations, driving a surge in US stocks, while Bitcoin fell 3% in contrast, highlighting its sensitivity as a "high-beta asset" in a high-interest-rate environment.

On the other hand, after the US government shutdown ended, the Treasury General Account (TGA) balance of $959 billion, if gradually released, could recreate the liquidity dividend seen in 2019 when Bitcoin rose 35% after the government restarted. However, this process takes time, and the TGA has not yet shown a significant decline, so the liquidity injection effect may not be felt until mid-December (UTC+8).

The New Normal of the Crypto Market: Structural Shift from Retail Frenzy to Institutional Dominance

Regulatory Compliance Reshapes Capital Landscape

The US Securities and Exchange Commission will meet on December 4 (UTC+8) to discuss tokenized securities rules. Texas took the lead in purchasing Bitcoin through BlackRock's ETF, and Thailand imposed a 0% capital gains tax on Bitcoin traded on exchanges.

These policy moves are accelerating the integration of traditional finance and the crypto world, but also introduce new sources of volatility—for example, S&P downgraded Tether's rating to the lowest level, triggering a trust crisis in stablecoin pegs.

Mining Companies Transform and Hashrate Value Reassessed

With the explosion in AI computing power demand, some mining companies like TeraWulf are shifting to a dual-track model of "Bitcoin mining + AI processing." These companies, leveraging their electricity reserves and computing flexibility, are favored by tech giants like Google, and the trend of their stock prices decoupling from Bitcoin is becoming a new option for hedging market volatility.

Key Events in the Next 30 Days: Three Major December Events to Set Market Direction

December 4 (UTC+8): Ethereum Fusaka upgrade and SEC tokenization meeting will be held simultaneously, potentially creating a resonance between technology and policy.

December 10 (UTC+8): The Fed's FOMC meeting will decide whether to cut rates. If it happens, Bitcoin may quickly test the $100,000 resistance level.

December 16 (UTC+8): The delayed release of November's non-farm payroll data will reveal the true state of the job market. If the data is weak, it may reinforce expectations of a rate cut in early 2026.

Conclusion: Rational Restraint Amid the Festivities

This Bitcoin rebound feels more like a carefully orchestrated liquidity test—the Fed's dovish tilt, Ethereum's technical upgrade, and Trump's political hints together weave a hopeful narrative for December. But the market remembers well: during November's crash, the same leverage frenzy led to $547 million in single-day liquidations for 170,000 traders.

Perhaps Galaxy Digital founder Mike Novogratz's observation is more sober: while he firmly believes Bitcoin will return to $100,000 by year-end, he also reminds the market to digest the medium-term psychological trauma from the "1011" crash.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum treasury demand collapses: Will it delay ETH’s recovery to $4K?

Can BNB price retake $1K in December?

Bitcoin’s strongest trading day since May cues possible rally to $107K

XRP faces ‘now or never’ moment as traders eye rally to $2.50