Aster News Today: Major Investors Place Bold Wagers on ASTER's Surge While Questions About Sustainability Persist

- Whales accumulate ASTER tokens, pushing price toward $1.21 resistance amid mixed on-chain signals. - Derivatives volume jumps 34.47% to $1.89B, with open interest rising to $550.87M as traders speculate on breakout. - Technical analysts highlight a key ascending triangle pattern, but sustainability concerns linger due to stagnant adoption and low fees. - Market optimism grows with bullish tweets and 10% price surge, yet $2.14M in liquidations underscores volatility risks.

ASTER Price Swings Sharply as Whales Accumulate and Technical Patterns Emerge

In recent trading, Aster (ASTER) has climbed more than 8%, with bullish traders targeting the crucial $1.21 resistance. On-chain metrics present a mixed outlook for the token’s sustainability. The Binance-supported decentralized exchange (DEX) has surpassed $3.1 trillion in trading volume, but user growth has stalled and protocol fees have

Despite these headwinds, large holders have ramped up their activity, with significant investors

Technical experts are split in their outlook, though some anticipate a breakout.

Sentiment among traders is cautiously upbeat. "

At present, ASTER is a high-risk play, with whale buying and derivatives activity fueling short-term moves. Its ability to maintain levels above $1.20 will hinge on overall market trends and whether adoption challenges can be overcome.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

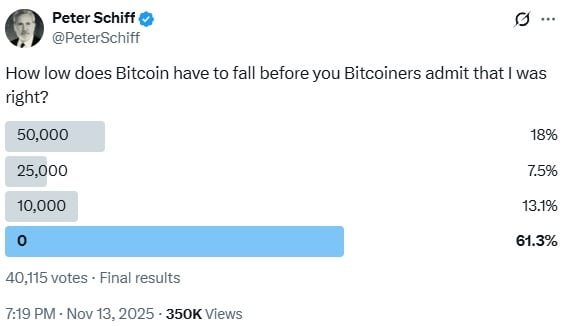

Peter Schiff Warns Bitcoin May Keep Sinking as Sentiment Tests Major Thresholds

Bitcoin Updates: As Crypto Markets Waver, Founder’s BTC Acquisition Reflects Enduring Confidence

- Cryptocurrency markets fell for a third day, with Bitcoin dropping below $100,000, erasing $130B in value as panic spread. - Equation founder's BTC purchase signaled long-term confidence despite bearish sentiment and a "consolidation limbo" trapping Bitcoin. - Macroeconomic uncertainty from the U.S. government shutdown and $1B in liquidations worsened the selloff, while the Crypto Fear and Greed Index hit "Extreme Fear." - Institutional interest in crypto products like Canary XRPC ETF and decentralized p

DCR is currently trading at $37.04, up 10.6% in the last 24 hours.

STRK broke through $0.23, with a 24-hour increase of 29.3%.