Ethereum Updates: BitMine’s Fresh Leadership Fuels Ethereum Growth, Striving to Connect Wall Street with the Crypto World

- BitMine appoints Chi Tsang as CEO amid strategic overhaul, adding 3 board members to strengthen governance. - Company boosts ETH holdings by 34% to $12.5B, aiming to control 5% of Ethereum's supply through aggressive accumulation. - Institutional Ethereum buying accelerates as exchange balances hit multi-year lows, with BitMine trailing only Bitcoin-focused rivals. - Despite 35% stock decline and 13.4% ETH price drop, $398M cash reserves signal long-term blockchain asset tokenization bets.

BitMine Immersion Technologies (BMNR) has named Chi Tsang as its new chief executive officer, marking a shift in leadership as the Ethereum-centric treasury company continues to grow its digital asset portfolio despite ongoing market fluctuations. The news,

This leadership transition happens alongside a major accumulation of Ethereum. BitMine

Industry experts point out that BitMine’s moves come as institutions across the sector are increasingly accumulating Ethereum.

Despite these moves, the company’s financial results reflect the crypto market’s volatility. BMNR shares have

BitMine’s approach mirrors broader industry trends.

As the company navigates a declining Ethereum/Bitcoin ratio and a bearish MACD signal

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

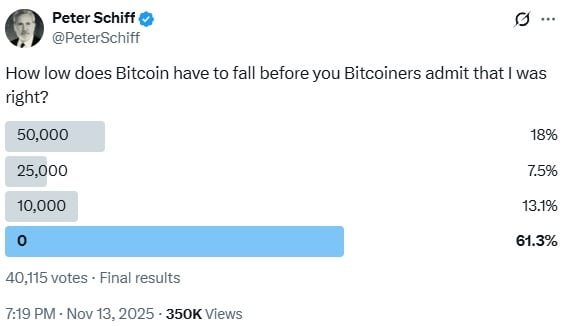

Peter Schiff Warns Bitcoin May Keep Sinking as Sentiment Tests Major Thresholds

Bitcoin Updates: As Crypto Markets Waver, Founder’s BTC Acquisition Reflects Enduring Confidence

- Cryptocurrency markets fell for a third day, with Bitcoin dropping below $100,000, erasing $130B in value as panic spread. - Equation founder's BTC purchase signaled long-term confidence despite bearish sentiment and a "consolidation limbo" trapping Bitcoin. - Macroeconomic uncertainty from the U.S. government shutdown and $1B in liquidations worsened the selloff, while the Crypto Fear and Greed Index hit "Extreme Fear." - Institutional interest in crypto products like Canary XRPC ETF and decentralized p

DCR is currently trading at $37.04, up 10.6% in the last 24 hours.

STRK broke through $0.23, with a 24-hour increase of 29.3%.