Bitcoin Leverage Wipeout Event in November 2025

- November 2025's 10% Bitcoin drop triggered $3.2B in liquidations, exposing overleveraged positions and systemic risks in crypto markets. - ETF outflows ($318M in one day) and Ethereum/XRP struggles highlighted waning investor confidence and thin liquidity exacerbating volatility. - Retail investors faced repeated margin call crises, with November's event reinforcing vulnerabilities after October's $19B liquidation. - Institutional alternatives like RockToken emerged to mitigate risks, while regulators fa

Market Dynamics Behind the Downturn

Bitcoin’s price movements in November 2025 mirrored a broader bearish sentiment, with the coin trading above $97,000 as market confidence faded. Exchange-traded funds (ETFs) tracking

The drop in liquidity across these assets created a highly unstable environment, where even minor price changes could set off a chain reaction of liquidations. As one expert observed, “With such thin liquidity, the market was susceptible to panic selling, where a single large order could trigger a domino effect.”

The Liquidation Shock: $3.2 Billion in Perspective

The November 2025 wave of liquidations was set off by a swift 10% fall in Bitcoin’s value, which overwhelmed leveraged traders across various platforms. Although the split between institutional and retail losses is not fully known, data from the time paints a picture of widespread speculative instability. For example,

Retail traders, in particular, were exposed to greater dangers after the October 10 deleveraging event,

Systemic Threats and Future Directions

The events of November 2025 reveal a major weakness in crypto markets: the heavy concentration of risk in leveraged trades. When both institutional and retail interest fades, as seen in late 2025, even small price drops can set off a chain of defaults. This risk is made worse by the absence of strong circuit breakers or regulatory protections to steady the market during periods of extreme volatility

For institutional players, the turmoil highlights the importance of diversifying their crypto exposure. Platforms like RockToken have started to offer alternatives,

Retail participants, on the other hand, must recognize that leveraged trading in cryptocurrencies remains extremely risky. The November liquidations are a clear warning that margin-based tactics can flourish in bull markets but unravel quickly when sentiment turns negative.

Takeaways for What Lies Ahead

The leveraged liquidation turmoil in Bitcoin during November 2025 encapsulates the broader hurdles facing the crypto sector. While there is still long-term confidence in Bitcoin’s future—some analysts

Investors should weigh their ambitions against prudent risk controls, steering clear of excessive leverage in turbulent markets. For both regulators and market players, the crisis points to the pressing need for stronger safeguards, such as better liquidity support and clearer margin guidelines.

As the industry matures, the November 2025 episode will likely be seen not as a rare event, but as a pivotal correction—one that compelled the market to address its weaknesses and move toward greater resilience.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dash Coin Value Climbs 4.86% Amid Strategic Growth and Positive Analyst Revisions

- DASH surged 4.86% in 24 hours, driven by strategic expansions and upgraded analyst sentiment. - Partnerships with Coco Robotics and Old Navy expanded delivery services and diversified revenue streams. - Q3 2025 results showed 49.2% gross margin and 0.34 debt/equity ratio, supporting bullish analyst price targets up to $260. - Technical analysis identified $208 breakout and $200 support levels, aligning with positive backtest results showing 28% average gains post-earnings.

Internet Computer (ICP) Experiences a Surge: What Factors Are Fueling the Latest Uptrend?

- Internet Computer (ICP) surged in late 2025 due to blockchain infrastructure upgrades and rising DeFi adoption. - Key innovations like Fission, Protium, and Chain Fusion enhanced scalability, interoperability, and cross-chain integration with Bitcoin , Ethereum , and Solana . - AI-powered Caffeine platform boosted TVL by 22.5% and drove 1.2M active wallets, supported by partnerships with Microsoft and Google Cloud. - Despite record $1.14B trading volume, ICP faces challenges in closing its TVL gap with E

Bitcoin Updates Today: Cardone Blends Real Estate and Bitcoin in a Strategic Move to Navigate Market Fluctuations

- Cardone Capital increased Bitcoin holdings to 888 coins while acquiring a $235M Florida multifamily property. - The hybrid strategy combines real estate stability with crypto growth, reinvesting $10M annual property income into Bitcoin. - Grant Cardone emphasized using real estate profits to hedge volatility, with 935 new Bitcoin purchases funded by cash flows. - Institutional Bitcoin adoption grows as Harvard allocates $443M to crypto ETFs, mirroring Cardone's diversified approach. - The model contrasts

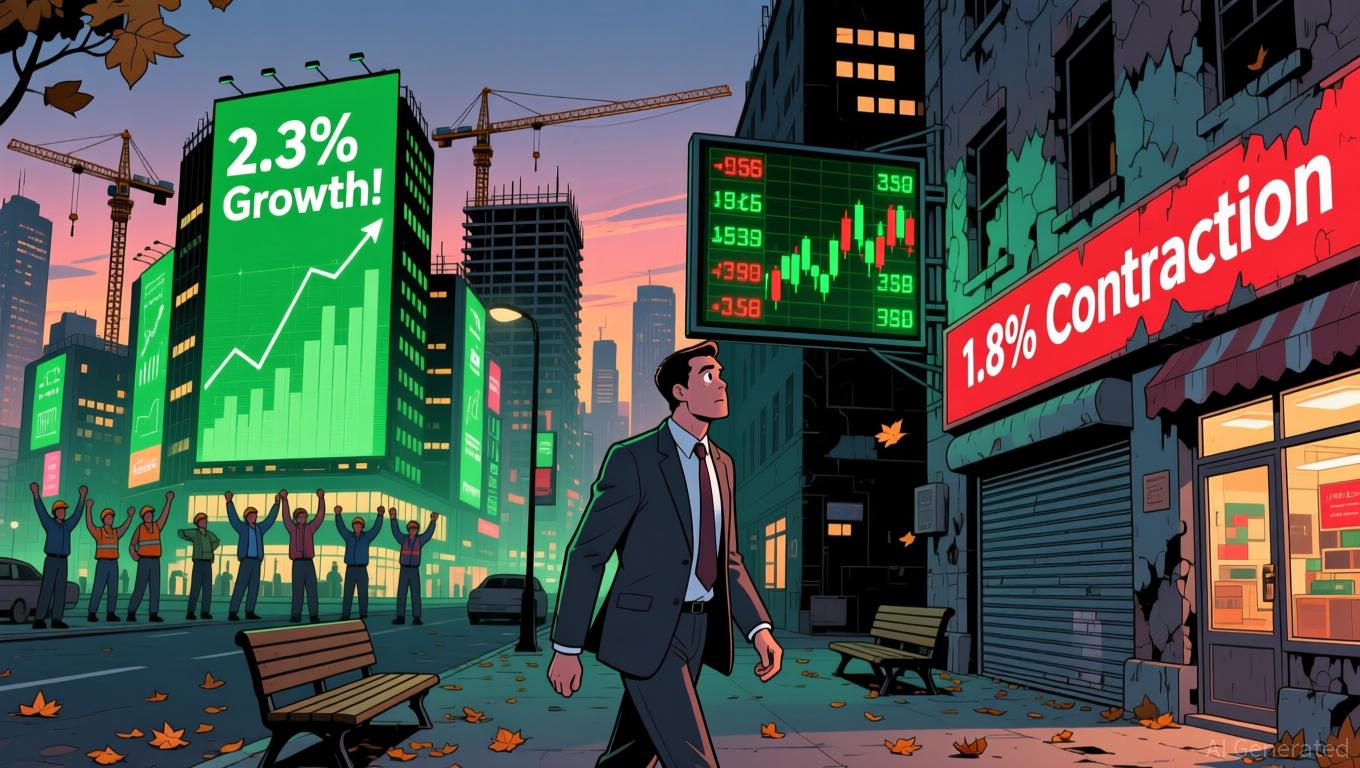

Global trade barriers and increasing expenses lead to Japan's initial economic downturn after six consecutive quarters of growth

- Japan's Q3 2025 economy contracted 1.8% annually, first decline in six quarters, driven by 0.4% GDP drop and weak private consumption amid global trade tensions and domestic cost pressures. - Nexon Co. defied downturn with ¥118.7B revenue and 61% growth in MapleStory, showcasing digital innovation's resilience despite broader economic headwinds. - BOJ faces balancing act as growth wanes, with U.S. tariffs and rising energy/food costs constraining domestic demand while capital spending remains supported b