Bitcoin Rebound Sparks Turmoil as High-Risk Trader Wynn Doubles Down on Massive Shorts

Bitcoin’s sharp rebound, fueled by optimism over the end of the 40-day U.S. government shutdown, has split traders. While most market watchers welcomed the recovery, aggressive short sellers faced a costly squeeze. High-risk trader James Wynn is at the center of the turmoil after a series of rapid losses pushed him into an even larger short bet.

In brief

- Wynn suffers repeated liquidations yet commits all remaining stablecoins to one more 40x leveraged Bitcoin short position.

- His new short risks full liquidation if BTC rises above $106,856, adding to two months of heavy cumulative losses.

- Market optimism around the end of the U.S. shutdown fuels Bitcoin’s rally and squeezes aggressive short sellers.

- Smart-money wallets also hold sizable net short exposure, signaling divided expectations on Bitcoin’s next move.

Heavy Liquidations Fail to Stop New 40x BTC Short Position

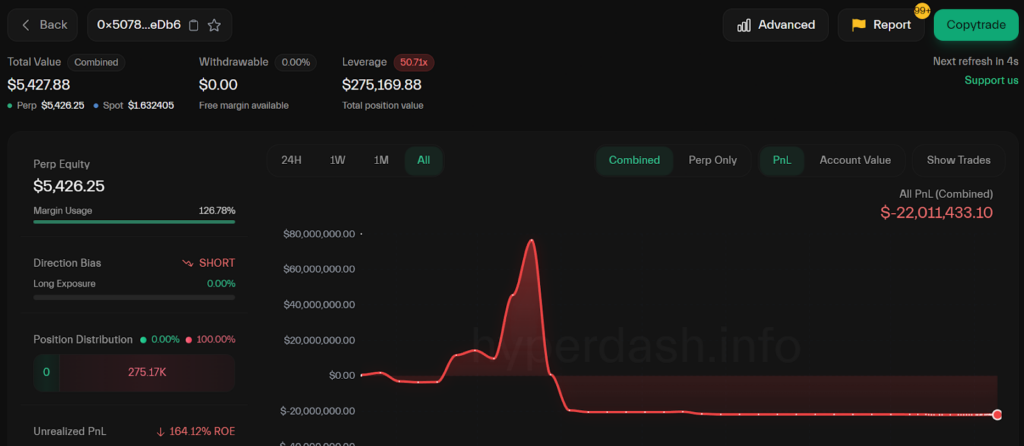

Wynn went “all in” on shorting Bitcoin despite being liquidated 12 times within 12 hours as prices moved against him. Hyperdash data shows his main Hyperliquid account fell to about $5,422 after repeated liquidations over the past day. His losses stretch over two months, totaling 45 liquidations, according to on-chain data.

The strong price recovery caught Wynn off guard, as he had been running multiple high-leverage Bitcoin shorts while expecting a deeper pullback. Prices instead climbed on optimism that the U.S. government shutdown would soon end, shaking out traders who had positioned themselves for a downward move.

Wynn doubled down rather than stepping back, noting that he had moved all his stablecoin holdings into additional short positions, targeting a drop below $92,000. In a post on X, he stated he was “as all-in as I can get” and accepted that he would either make “hundreds of millions” or go “bust.”

At the time of reporting, his main account held a 40-times-leveraged short position worth $275,000. Liquidation would occur if Bitcoin climbed above $106,856. Wynn entered the trade when Bitcoin was below $101,800 and was sitting on an unrealized loss of $11,147 by late Monday morning.

Wynn Ramps Up Aggressive Bitcoin Shorts Despite Mounting Losses

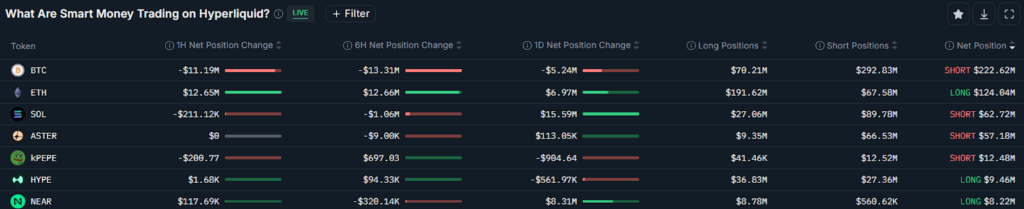

Market data shows that some experienced traders are also bracing for further declines. Nansen reported that “smart money” wallets carried a net perpetual short position of $223 million on Hyperliquid, with $5.2 million in fresh shorts added in the past 24 hours.

Some traders are closely tracking Wynn’s moves because his trading patterns often reflect aggressive shifts in market sentiment.

His actions right now center on:

- Taking repeated high-multiple short positions despite earlier losses.

- Allocating all remaining stablecoins into new shorts.

- Targeting a sharp drop below $92,000.

- Accepting the risk of a complete wipeout.

- Drawing broader trader attention due to his history and scale.

Wynn is no stranger to high-risk trading and has a record of extreme bets. In June, he placed a new $100 million Bitcoin short not long after losing nearly the same amount in late May. He also faced a $25 million partial liquidation shortly afterwards.

Market watchers now see Wynn’s renewed “all-in” stance as a high-risk gamble at a volatile moment . Bitcoin’s rebound has created tension between those betting on renewed strength and those expecting a deeper correction. Wynn remains firmly in the latter camp, even as losses mount.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$RAVE unveils tokenomics, igniting the decentralized cultural engine of global entertainment

$RAVE is not just a token; it represents a sense of belonging and the power of collective building. It provides the community with tools to create together, share value, and give back influence to society.

Interpretation of the ERC-8021 Proposal: Can Ethereum Replicate Hyperliquid's Developer Wealth Creation Myth?

The ERC-8021 proposal suggests embedding builder code directly into transactions. Along with a registry, developers can provide wallet addresses through the registry to receive revenue.

ADP data sounds the alarm again: US companies cut 11,000 jobs per week

The government shutdown has delayed official employment data, so ADP data has stepped in to reveal the truth: in the second half of October, the labor market slowed down, and the private sector lost a total of 45,000 jobs for the entire month, marking the largest decline in two and a half years.

The US SEC and CFTC may accelerate the development of crypto regulations and products.