Dogecoin Price Prediction: Can DOGE Reach $0.40 Before 2025 Ends?

Dogecoin Consolidates Around $0.17

Dogecoin’s current price hovers around $0.178, marking a phase of sideways consolidation after weeks of volatility. The chart shows $DOGE repeatedly testing the $0.17 support, while facing rejection near $0.186 – $0.19, where both the 21-MA and 200-MA converge. This tight price range suggests indecision among traders, with momentum indicators like the Stochastic RSI showing weak buying pressure.

DOGE/USD 4-hour chart - TradingView

If Bitcoin remains stable near $100 K, Dogecoin could continue consolidating between $0.165 and $0.19. However, a break above $0.19 could open the door toward $0.21 and $0.25 — a psychological barrier last seen months ago.

Dogecoin Price Prediction before 2025 Ends

Downside Scenarios: $0.10 – $0.08 Possible in a Market Crash

If the broader crypto market enters a correction phase , Dogecoin may revisit its historical lower zones. Key downside targets include $0.10, which aligns with previous macro support, and a worst-case level of $0.08, representing a 55 % decline from current prices. These would only be triggered if Bitcoin loses key supports and global risk sentiment turns sharply bearish.

Upside Targets: $0.25 and $0.30 as Realistic Milestones

Based on the technical structure, Dogecoin would first need to reclaim $0.20 and then $0.25 to confirm a bullish reversal. The $0.30 zone is the next logical resistance — reachable only if Bitcoin rallies above $120 K and overall market momentum shifts back to greed.

How Feasible Is $0.40 in 2025?

From $0.178 to $0.40, Dogecoin would need a performance gain of roughly +125 % within less than two months. Historical monthly returns show that DOGE rarely achieves such a rally late in the year:

- Highest monthly return in 3 years: +161.5 % (Nov 2024)

- Average positive month: +20 % to +40 %

- Negative months common in Q4: –20 % to –25 %

Dogecoin monthly returns in USD over the past 3 years - coinrank

Given these figures, expecting another +125 % rally before December’s end is statistically improbable unless $Bitcoin enters a parabolic phase similar to 2021.

DOGE vs Bitcoin Correlation

Dogecoin’s price trajectory continues to mirror Bitcoin’s trend. Historically, DOGE lags behind BTC rallies but amplifies retracements. If Bitcoin climbs from $100 K toward $115 K or $120 K in Q4 2025, DOGE could realistically revisit $0.25 – $0.30 but $0.40 remains an unlikely target this year.

Will Dogecoin reach $0.40?

Dogecoin is currently stabilizing, showing neither a clear bullish nor bearish breakout. Unless Bitcoin triggers another major rally, DOGE is more likely to trade between $0.16 and $0.25 through the remainder of 2025. Long-term investors, however, may view $0.10 and $0.08 as attractive accumulation levels should a correction occur.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Red Bull Racing’s advantage? An engineer who approaches workflows with the precision of timing laps

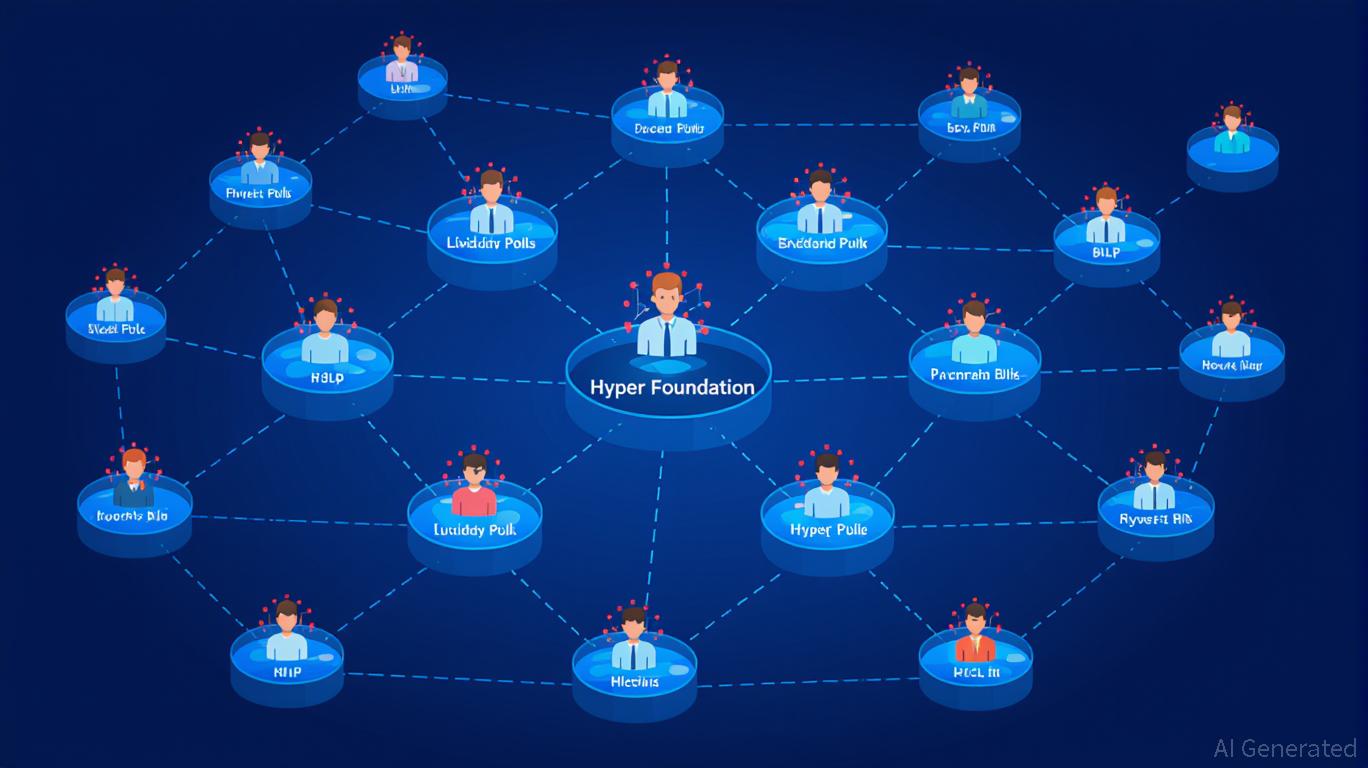

Hyperliquid's Growing Influence in Crypto Trading: Can It Maintain Long-Term Investment Appeal?

- Hyperliquid dominates 80% of 2025 perpetual contract market via on-chain governance and user-driven liquidity innovations. - Centralized governance (HIP-3 protocol, USDH stablecoin launch) balances permissionless market creation with validator dominance risks. - HLP liquidity model generates $40M during crashes but faces regulatory scrutiny and token economics challenges from 2025 HYPE unlock. - TVL growth to $5B and 518K active addresses highlight adoption, yet governance centralization and institutiona

Ethereum Latest Updates: JPMorgan and Bitmine Make $1.3B ETH Investment, Showing Institutional Trust Amid Market Fluctuations

- Institutional Ethereum investments surged $1.3B as JPMorgan and Bitmine capitalized on price dips, with Bitmine now holding 3.4M ETH (2.8% of supply). - JPMorgan's $102M Bitmine stake reflects strategic crypto exposure via traditional instruments, aligning with U.S. ETF approvals and regulatory clarity on staking ETPs. - Bitmine's 5% supply target and SharpLink's 6,575 ETH staking highlight growing institutional confidence, despite 27.7% monthly price declines creating buying opportunities. - Regulatory

Bitcoin News Today: Bitcoin Miners Bet on AI: Will Technological Advances Outpace Market Fluctuations?

- Bitcoin miners adopt AI/HPC to offset bear market pressures, leveraging energy infrastructure for GPU workloads. - TeraWulf's $1.85M/MW/year AI hosting benchmark and CleanSpark's Texas campus highlight infrastructure diversification. - Grid constraints and GPU shortages challenge transitions, while Bitcoin ETF outflows ($558M) signal shifting investor sentiment. - Analysts warn of potential $100,000 price correction if $104,000 resistance fails, despite positive on-chain demand signals. - JPMorgan identi