DASH Price Drops 7.21% Following Shareholder Sale Disclosures

- DASH fell 7.21% in 24 hours amid a 27.4% 7-day drop, despite a 99.6% annual gain. - A shareholder trust filed to sell 4,575 DASH shares via a 10b5-1 plan, signaling potential ownership shifts. - DoorDash faces intensified grocery delivery competition from Instacart, Walmart , and Venmo's new rewards program. - Technical analysis shows weak mean-reversion potential post-sell-offs, with high outcome dispersion requiring strict risk management.

On November 10, 2025,

A trust associated with Brown Shona L, called the Shona L Living Trust, submitted a Form 144 to the SEC to sell 4,575 shares of DASH. The filing, made on November 10, 2025, states that Morgan Stanley Smith Barney LLC will handle the sale under a pre-set 10b5-1 trading plan. The trust is required to complete the transaction within 90 days of the filing date. Such filings are routine for insiders selling restricted shares and do not necessarily reflect expectations for the company’s long-term performance.

This development comes as DoorDash faces heightened competition in the grocery delivery market, with rivals like Instacart and Walmart expanding their online grocery offerings. In recent quarters,

Despite these challenges, technical analysis indicates that DASH’s recent price swings may offer short-term rebound opportunities for investors. Historical data from January 3, 2022, to November 7, 2025, shows the stock tends to exhibit a slight mean-reversion tendency following sharp declines.

Backtest Hypothesis

The backtest reviewed DASH’s performance after its daily close dropped at least 10% below its previous closing high. Over this timeframe, 682 such drawdown events were recorded. The findings showed that, on average, DASH outperformed a buy-and-hold strategy by about 0.38 percentage points over the following 30 days. The win rate increased from roughly 51% on day one to 63% after 30 days, but the advantage was modest and not statistically significant by standard measures. This implies that, while there is a slight mean-reversion effect, the approach may not be sufficient as a standalone trading strategy once transaction costs and slippage are considered. The wide range of results also highlights the necessity of strong risk controls when trading after significant sell-offs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP to Unlock the Secret Strategy Used by the World’s Wealthiest Investors, Analyst Reveals

IOTA Publishes Public Digital Product Passport Demo to Showcase Blockchain Lifecycle Tracking

VIPBitget VIP Weekly Research Insights

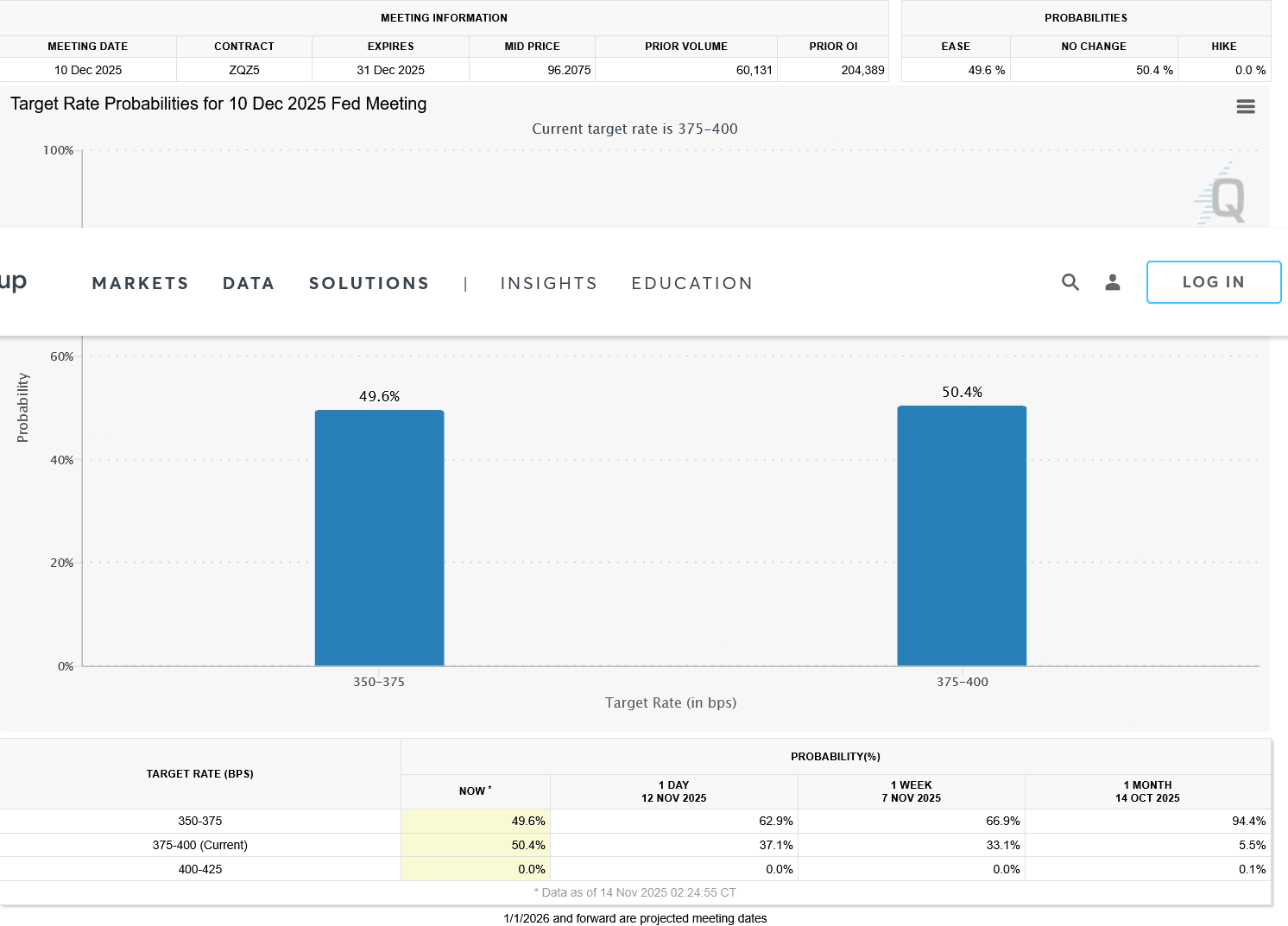

Global markets are experiencing multiple transformative catalysts supporting the recovery of risk assets. For instance, Trump has revived his proposal to distribute $2000 "tariff dividend" checks to every American using tariff revenues. While the plan faces hurdles such as congressional approval and inflationary concerns, it has already boosted consumer confidence and is expected to inject trillions of dollars in liquidity, benefitting high-growth technology sectors. Meanwhile, the U.S. government shutdown has reached a record 41 days. With the Senate having reached an agreement, it's expected to end on November 11—potentially triggering a renewed fiscal injection of tens of billions of dollars and a V-shaped rebound similar to past shutdown recoveries. Market expectations for a rate cut at the Federal Reserve's December FOMC meeting are also rising, with a 62.6% probability priced in for a 25-basis-point cut. Some Trump-backed officials even advocate for a 50-basis-point reduction, which would extend the easing cycle and further stimulate investment in crypto and AI infrastructure. Together, these factors may drive a 5–10% rebound in total crypto market capitalization, creating a window of opportunity for allocation to high-quality projects.

Massive $869M Outflow Slams Bitcoin. Is a Crash Coming?