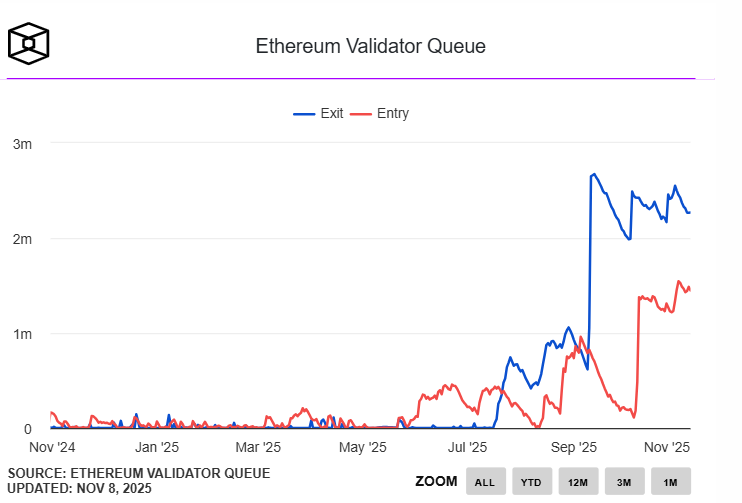

Ethereum Validator Queues Surge as 2.45M ETH Sits in Exit Line

Growing interest in Ethereum’s long-term outlook has pushed validator queues higher for both entry and exit. Recent data indicate that roughly 1.5 million validators are waiting to join the staking system, while approximately 2.45 million ETH are in the exit queue. These conditions mark a busy period for participants who choose native staking over liquid staking alternatives.

In brief

- Validator entry and exit queues grow as demand rises, stretching wait times and signaling confidence in Ethereum security.

- Native staking appeals to users who want direct control, despite slower liquidity and larger operational commitments.

- Institutions strengthen momentum as stablecoin settlement and DeFi activity reinforce Ethereum’s core economic role.

- Controlled exit mechanics protect network stability and ensure predictable validator withdrawals during heavy demand.

Growing Validator Backlog Signals Strong Long-Term Confidence

Validator queues serve as a built-in rate limit, helping to maintain network stability. Ethereum adds and removes validators at a steady pace during each epoch, which occurs every 6.4 minutes. Large, sudden shifts in validator activity could strain the security model, so the protocol processes requests in a controlled order. As demand grows in both directions, entry and exit wait times now extend across several days.

Native staking continues to attract users who value direct control over their assets. Liquid staking tokens such as stETH and rETH offer greater flexibility but rely on smart contracts and external operators. Many long-term participants prefer to hold their own keys and manage their infrastructure, despite the higher effort and slower liquidity.

Several trade-offs explain why some participants stick with native staking:

- Direct control over validator hardware and operations.

- No exposure to external operators or protocol token mechanics.

- Reduced reliance on third-party smart contracts.

- Requirement to commit 32 ETH per validator.

- Acceptance of longer withdrawal timelines and potential risk of slashing.

Growing interest from institutions adds another layer of momentum. Stablecoin settlement, DeFi lending flows, and on-chain activity continue to place Ethereum at the center of crypto’s economic foundation. Aave and other major protocols continue to process large volumes on the mainnet, reinforcing Ethereum’s role as a trusted settlement layer.

Buterin Affirms Controlled Exit Model as Ethereum Staking Momentum Builds

Rising entry queues suggest growing confidence in Ethereum’s long-term position. Many participants appear comfortable locking capital for extended periods in exchange for validator rewards and direct involvement in network security.

As more entities adopt this approach, staking activity reflects confidence that Ethereum will remain the leading smart-contract platform, despite liquidity and operational constraints.

Meanwhile, Vitalik Buterin stressed that staked ETH cannot be withdrawn instantly, noting that the waiting period serves as a form of protection . He explained that this process helps prevent sudden mass exits that could weaken network security and maintain consensus stability. The exit queue processes departures one block at a time, turning what could feel like a rush for the door into a controlled and predictable flow.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

This year's hottest cryptocurrency trade suddenly collapses—should investors cut their losses or buy the dip?

The cryptocurrency boom has cooled rapidly, and the leveraged nature of treasury stocks has amplified losses, causing the market value of the giant whale Strategy to nearly halve. Well-known short sellers have closed out their positions and exited, while some investors are buying the dip.

Showcasing portfolios, following top influencers, one-click copy trading: When investment communities become the new financial infrastructure

The platforms building this layer of infrastructure are creating a permanent market architecture tailored to the way retail investors operate.

Ripple raised another $500 million—are investors buying $XRP at a discount?

The company raised funds at a valuation of $40 billions, but it already holds $80 billions worth of $XRP.

CoinShares: Net outflow of $1.17 billion from digital asset investment products last week.