Analyst: Data Gaps May Hinder the Federal Reserve's December Rate Cut Path

Jinse Finance reported that Inflation Insights analyst Omair Sharif believes a U.S. government shutdown and the resulting lack of official economic data could hinder the Federal Reserve's plan for a third consecutive rate cut in December. If there is no official data reflecting economic activity in October and November when the meeting is held on December 10, officials may not feel confident enough to cut rates again. It may be difficult for them to reach a consensus on another rate cut, especially considering the internal divisions within the FOMC shown in the September dot plot.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Data: 10x Research: Bitcoin is short-term bearish, with price trends influenced by policy and capital flows

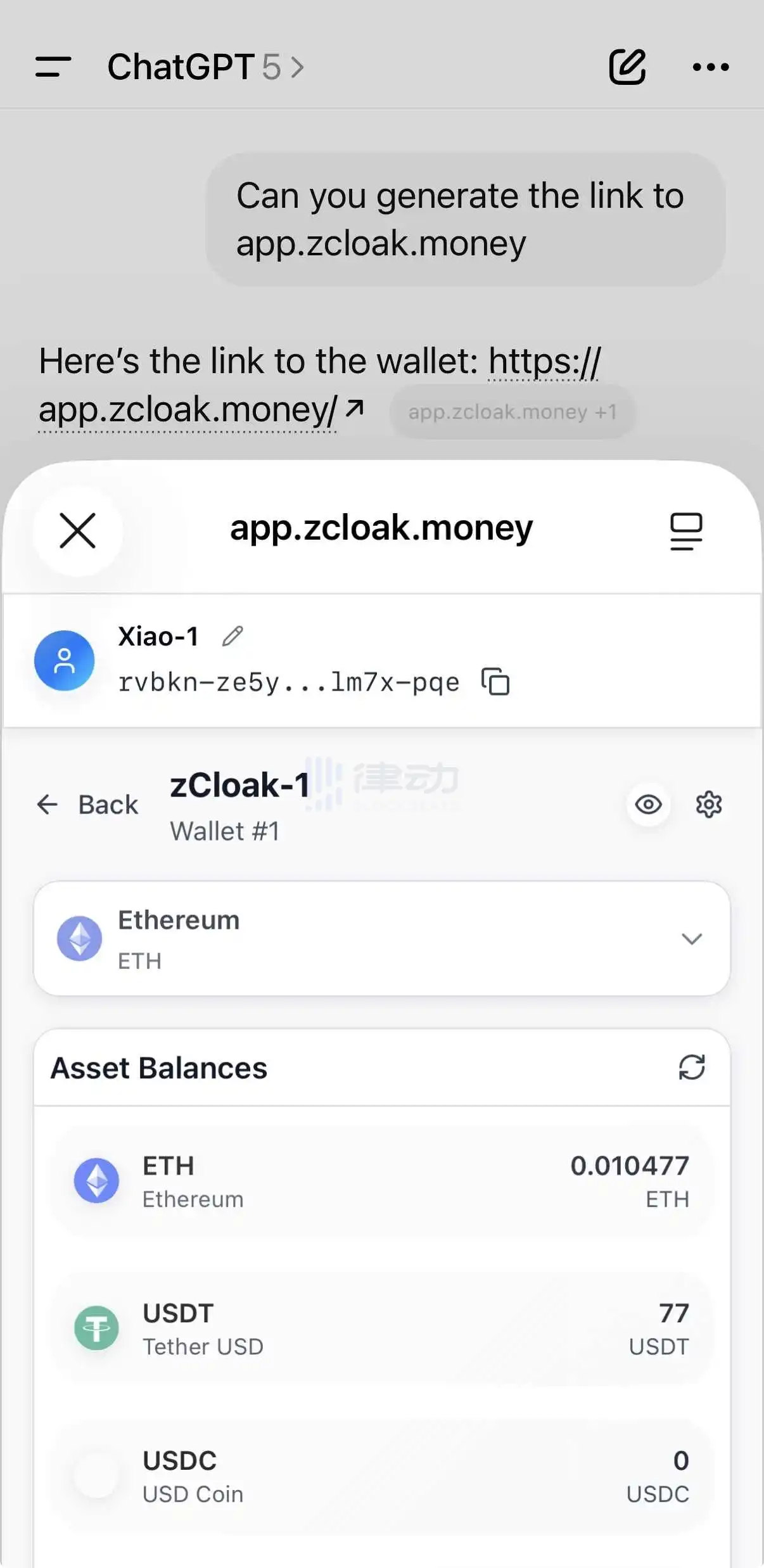

zCloak Passkey Wallet completes integration with ChatGPT and Claude APP

10% of ARIAIP tokens will be allocated to eligible IP holders

Astar community releases proposal to "reactivate Coretime auto-renewal for Astar"