Selig Faces CFTC Hurdles: Balancing Crypto Progress and Divided Regulations

- Trump appoints Michael Selig as CFTC chair to oversee crypto regulation amid industry growth. - Selig, former SEC crypto task force counsel, advocates for blockchain innovation and criticized SEC's strict enforcement. - DraftKings acquires CFTC-registered Railbird to expand into prediction markets, facing state regulatory scrutiny over sports bets. - Selig's leadership may shape federal crypto policy, balancing innovation with fragmented state regulations and consumer protection.

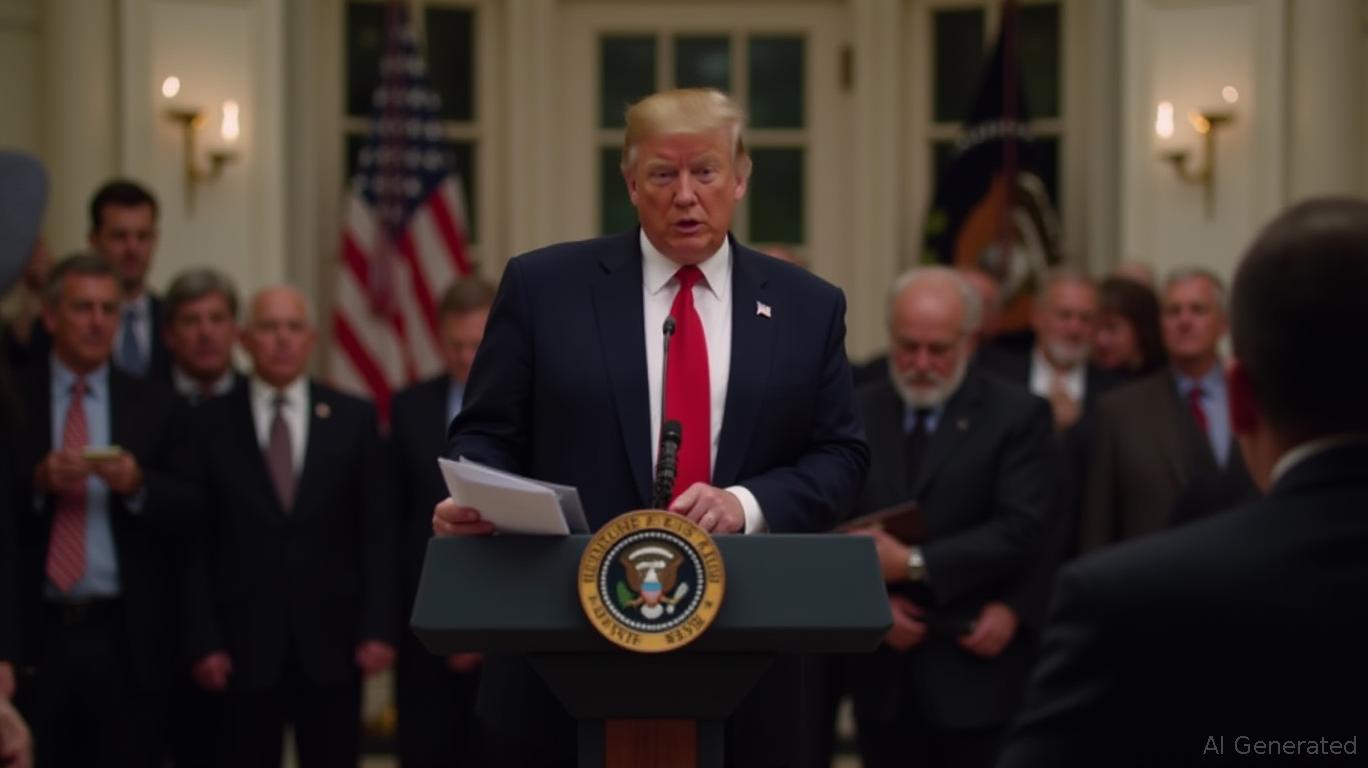

Trump Names Michael Selig as CFTC Chair Amid Crypto Sector Expansion

President Donald Trump has tapped Michael Selig, a well-known authority in crypto regulation, to lead the Commodity Futures Trading Commission (CFTC). This decision, part of a larger overhaul of digital asset oversight, places Selig—a former general counsel for the SEC’s crypto task force—at the helm of the agency that supervises derivatives and commodities markets, including those involving cryptocurrencies, according to a

This leadership change comes as the prediction market and crypto derivatives sectors gain momentum.

Under Selig’s guidance, the CFTC may shape how these new markets evolve. His previous support for blockchain-driven capital markets, including collaboration with SEC Chair Paul Atkins on the “Project Crypto” deregulation effort, points to a possible alignment with industry expansion, as noted by BitcoinSistemi. Still, the CFTC’s jurisdiction over prediction markets is a contentious issue. State officials, such as those in Ohio and Nevada, have cautioned that sports event contracts could be classified as illegal gambling, which may result in enforcement against operators, according to

The prediction market industry is expanding rapidly, with Kalshi and Polymarket posting record trading activity. DraftKings’ acquisition of Railbird mirrors similar moves by competitors, such as FanDuel’s alliance with CME Group and Underdog’s partnership with Crypto.com, as reported by an

Selig’s appointment arrives as the crypto sector seeks clearer regulatory direction amid a patchwork of rules. His background at both the SEC and CFTC, along with his public opposition to excessive enforcement, could encourage a more innovation-friendly climate for derivatives and digital assets. Nevertheless, significant hurdles remain, especially in harmonizing federal and state regulatory approaches to prediction markets and crypto trading. The CFTC’s challenge under Selig will be to strike a balance between fostering innovation and ensuring consumer protection, particularly as firms like DraftKings and Kalshi continue to test regulatory limits, as reported by Bloomberg and referenced by Legal Sports Report.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

JPMorgan Connects Wall Street and Cryptocurrency through Collateral Initiative as Regulatory Frameworks Converge

- JPMorgan allows institutional clients to use Bitcoin/Ether as loan collateral by 2025, integrating crypto into Wall Street credit systems. - Shift reflects JPMorgan's evolving stance on crypto and aligns with global regulatory developments under Trump, EU, and UAE frameworks. - DeepSnitch AI's $450K presale gains traction as market seeks utility-driven tokens amid crypto's $10B Q3 institutional lending surge. - Regulatory clarity efforts, including CFTC leadership changes, aim to resolve jurisdictional a

XRP News Today: Advancements and Efficiency Foster Strength in Energy and Cryptocurrency Industries

- Matador Resources Co. reported record Q3 2025 production (209,184 BOE/d) but faced revenue declines due to falling oil prices, triggering an 8.77% stock dip. - Aave's "hub and spoke" liquidity framework aims to stabilize crypto markets, while XRP gains bullish forecasts amid Ripple's regulatory efforts and DeepSeek AI predictions. - PayPal projects 104% stock growth by 2030 through digital payment expansion, contrasting Mattel's Q3 earnings miss and downgraded price target to $25. - Energy and crypto sec

Tech Leaders Face Q3 Earnings Challenge: Balancing AI Expansion and Regulatory Hurdles

- Tech giants Apple, Amazon, and Microsoft face scrutiny during Q3 earnings as AI competition intensifies and regulatory pressures mount. - Apple's iPhone 17 launch and AI expansion contrast with regulatory risks in its Services division, while analysts warn of potential 33% stock undervaluation. - Amazon's AWS revenue ($32.4B) and AI investments ($25-30B/year) highlight growth amid margin declines and automation plans for 600,000 jobs by 2033. - Microsoft's Azure AI growth (31% YoY) clashes with its oppos

Reagan’s Legacy Looms Over Trade Row: Trump Slaps Canada with Steep Tariffs

- Trump imposed a 10% tariff on Canadian goods, accusing Ontario of misrepresenting Reagan's tariff views in a controversial ad campaign. - Ontario paused its ad campaign to de-escalate tensions, while the White House called Canada's actions "political gamesmanship." - The dispute halted U.S.-Canada trade talks and risks worsening economic impacts, with experts warning of 5-15% sectoral cost increases. - Canada plans to diversify trade beyond the U.S. as 20% of its exports already face U.S. tariffs on stee