Written by: Haotian

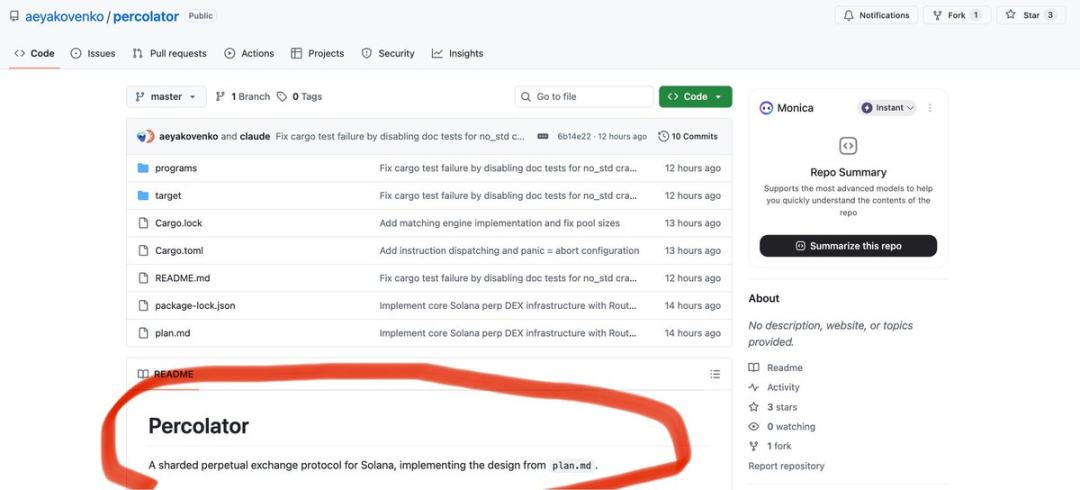

I've previously written analyses stating that Perp DEX will definitely explode within the Solana ecosystem. Sure enough, @aeyakovenko unexpectedly revealed a Github repository, and a sharded perpetual contract protocol framework called Percolator has become the focus of attention:

1) Its architectural innovation is roughly to split the order book into multiple shards for parallel processing, including a Router for global scheduling and margin management, plus a Slab independent matching engine. It also adopts high-frequency trading optimizations and risk control designs, such as a reserve-commit two-phase execution mechanism to prevent MEV attacks.

Interestingly, when Toly interacted with others in the comments, he also mentioned the possible introduction of a prop AMM competition experiment mechanism, allowing LPs to customize their own matching engines and risk parameters.

2) Unexpectedly, I originally thought Solana would enter the Perp DEX competition by supporting emerging Perp DEXs within its own ecosystem, such as @DriftProtocol, @pacifica_fi, @bulktrade, etc., but instead, it has been elevated to a strategic level directly handled by the official Solana Labs. This shows just how eager Solana is to continue the Perp DEX boom.

3) The logic behind this is clear. In my view, Perp DEX is a track that can simultaneously accommodate high-frequency, high-leverage, and large-volume characteristics. Solana has spent over a year refining performance optimizations like Alpenglow consensus and the Firedancer client, and it can withstand peak trading volumes such as during Meme Season. Now is the best time to bring this infrastructure capability into the Perp DEX scenario and ignite it.

Moreover, the potential for further optimization at the validator layer, as well as @doublezero's further improvements in network bandwidth, are all raising Solana's performance ceiling. @jito_sol has already proven that professional optimization at the validator layer can work. In terms of technical foundation, it's entirely feasible for a @HyperliquidX-level Perp DEX to emerge within the Solana ecosystem.

4) Perhaps at this point, core executives like Toly and @calilyliu must feel indignant—given Solana's excellent infra foundation, how can projects like @Aster_DEX and @Lighter_xyz, whose true capabilities are still unclear, be allowed to show off excessively?

The key issue is that Perp DEXs currently driven behind the scenes by exchange camps are plagued by problems such as fake trading volumes stimulated by airdrops, the unsustainability of trade mining, and the lack of real high-frequency trading demand, all of which give Solana a reason to step in and intercept.

5) And with its basic layout in US stock tokenization and long-term positioning in the ICM internet capital market, Solana has the chance to provide Perp DEX infrastructure with a real application scenario that can meet the trading demands of traditional financial assets, not just stay at the level of crypto-native asset trading.

Imagine this: after US stocks are tokenized, users can directly open leveraged long or short positions on Tesla and Nvidia on Solana, settle with $SOL or stablecoins, and have trading fees flow back into the ecosystem. Isn't this "on-chain Nasdaq" narrative far more ambitious than simply speculating on perpetual contracts for BTC, SOL, or ETH?

That's all.

Next, let's see how the Perp DEX counterattack on Solana will play out!