- 28K BTC sold by long-term holders since October 15

- Selling indicates profit-taking during recent rallies

- Market sentiment remains cautiously optimistic

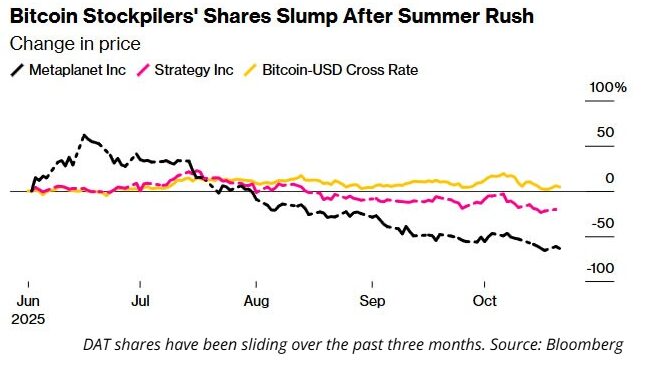

According to data from on-chain analytics firm Glassnode, long-term Bitcoin holders have offloaded 28,000 BTC since October 15. This marks a clear shift in behavior as seasoned investors, who typically hold their coins through volatility, begin to take some profits off the table.

This kind of distribution often occurs after strong price movements, where long-term holders see an opportunity to realize gains. While this might raise concerns about a potential market cooldown, it’s also a natural part of Bitcoin’s market cycle.

Why Long-Term Holders Are Selling

The reduction in long-term holder supply suggests confidence in Bitcoin’s recent performance, prompting some investors to cash in. Bitcoin has seen notable price activity in recent weeks, climbing amid ETF buzz and growing institutional interest. For long-term holders who bought during previous dips, current levels may offer an ideal exit point—or at least a chance to rebalance their portfolios.

Despite the selling, overall market sentiment has remained steady. Historically, such profit-taking doesn’t necessarily signal a bearish reversal, but rather healthy market behavior as capital moves from old hands to new.

What This Means for the Market

While a drop of 28K BTC in long-term holdings is significant, it represents a small fraction of the total supply. Newer buyers or institutions could be absorbing this selling pressure, which may explain why the price hasn’t sharply declined.

Investors and analysts will be watching closely to see whether this trend continues or stabilizes. A prolonged sell-off by long-term holders could cool the rally, but for now, the market appears resilient.

Read Also :

- Jupiter Launches First Prediction Market with Kalshi

- Bitcoin Volatility Index Spikes Above 95% Again

- TAO Rally Heats Up and ADA ETF Sparks Attention as BlockDAG’s Genesis Countdown Pushes Toward $600M

- Solana Spot ETF Approved in Hong Kong

- Long-Term Bitcoin Holders Cut Supply by 28K BTC