Trader Unveils Line in the Sand Price Level for Ethereum, Predicts Crypto Rallies in Coming Weeks

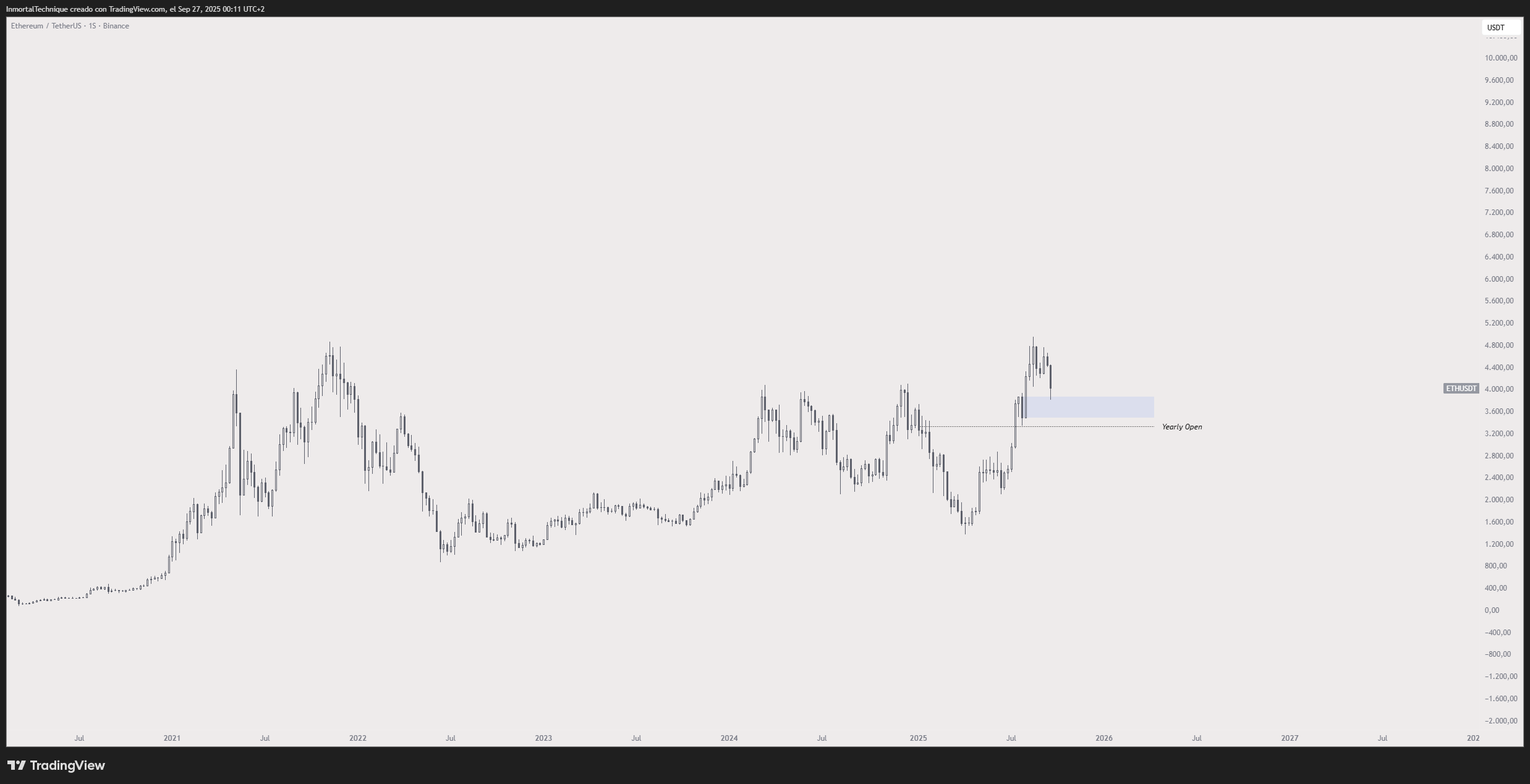

A closely followed crypto trader believes that Ethereum (ETH) bulls should defend a crucial price area to keep its uptrend alive.

Pseudonymous analyst Inmortal tells his 235,500 followers on X that Ethereum needs to stay above its 2025 opening price to sustain its long-term bullish momentum.

“Testing weekly demand.

2025 Open at $3,300 is the line in the sand.”

At time of writing, Ethereum is worth $4,021.

Despite calls that the bull market top is in for crypto, Inmortal believes that the market will soar to greater heights in the next three months.

“Bull market is not over… I don’t know where it will bounce or how much it will retrace. I just know two things. It’s not over. Prices will be higher in Q4.”

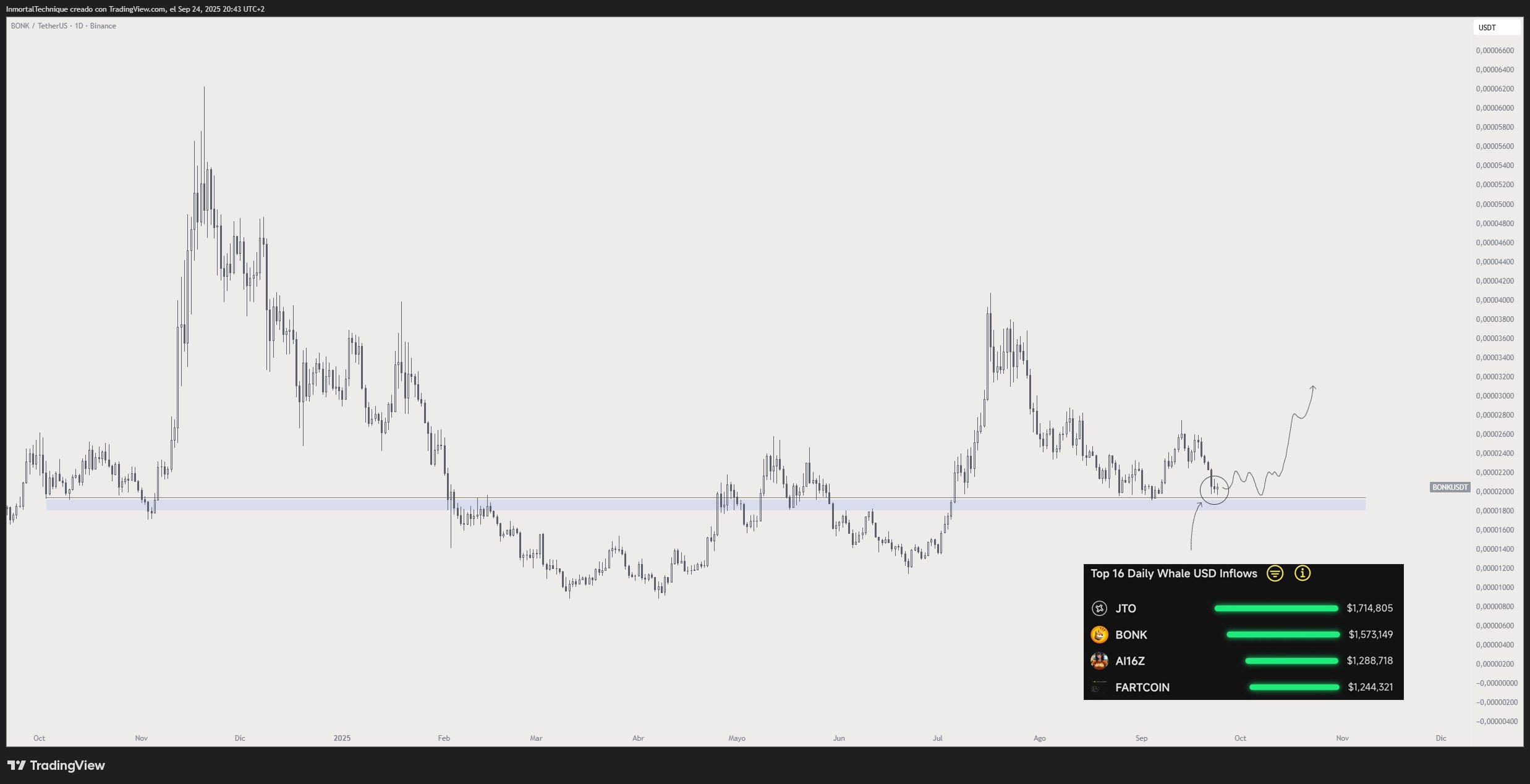

Looking at the altcoin market, the trader predicts that the meme token Bonk (BONK) will surge as long as it stays above $0.000018. He also notes that crypto whales have been accumulating BONK over the past few weeks.

“Checking top memecoins whale inflows. I feel like they know something I don’t…”

At time of writing, BONK is trading at $0.000019.

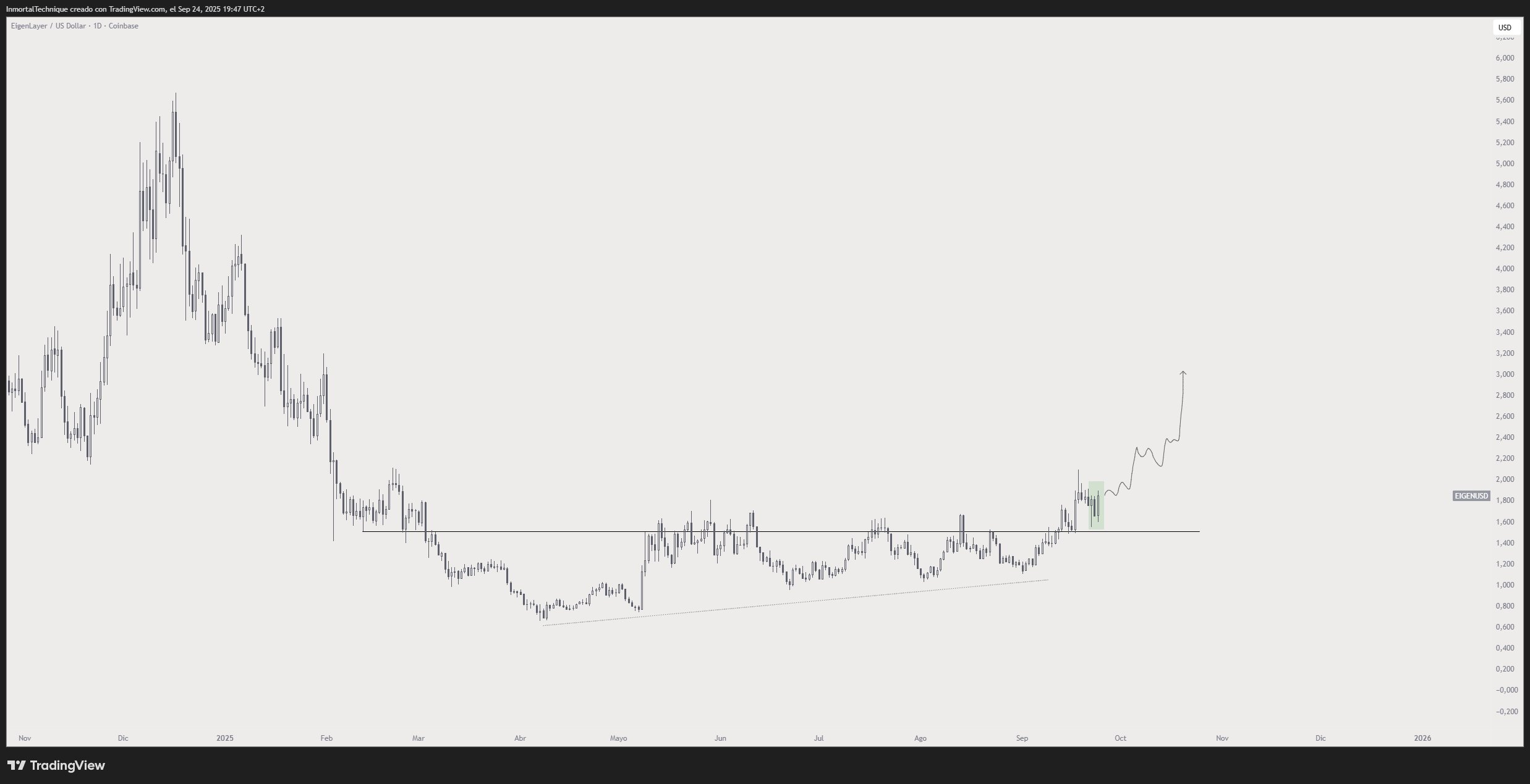

The trader is also bullish on EigenCloud (EIGEN), a platform that aims to bring “verifiability as a service” to both on-chain and off-chain applications. Inmortal appears to be targeting $3 for EIGEN based on its technical and fundamental setups.

“1. Institutions like the verifiable cloud.

2. Web3 arm of Japan’s largest telecom is joining Eigen.

3. EIGEN price action says it all.

Today’s daily candle engulfing the previous one is very telling.”

At time of writing, EIGEN is worth $1.89, up over 7% on the day.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Update: Energy Industry and Cryptocurrency Align on Strategic Approaches and Technical Drivers

- National Fuel Gas finalized a $2.62B acquisition of CenterPoint Energy's Ohio utility, doubling its gas rate base to $3.2B and expanding to 1.1M customers by Q4 2026. - TD Sequential indicators triggered bullish signals for Chainlink (LINK) and XRP after nine red candles, with XRP up 9% in seven days and LINK near key support levels. - Energy sector consolidation and crypto technical catalysts both highlight strategic growth themes, with National Fuel leveraging regulatory alignment while traders monitor

Compliance as a Priority Fuels Polymarket’s U.S. Comeback and Token Strategy

- Polymarket plans to relaunch in the U.S. via QCX acquisition, aiming for October 2025 compliance-based operations. - Native token and airdrop will follow U.S. market stabilization, prioritizing long-term utility over short-term hype. - $9B valuation boost from ICE's $2B investment highlights growing institutional interest in prediction markets for gauging global events. - Platform's $2B weekly trading volume with Kalshi underscores prediction markets' rising role in financial sentiment analysis.

Ethereum News Update: Ethereum Eyes $5,000 as Whales Accumulate Amid Bitcoin Withdrawals and Broader Economic Challenges

- Ethereum (ETH) trades at $3,957, with technical indicators suggesting potential for a $5,000 rally if $3,750–$3,800 "triple bottom" support holds and $4,000 resistance breaks. - Whale accumulation and on-chain data hint at institutional buying, contrasting with $127M ETH ETF outflows versus Bitcoin's $20M inflows amid macroeconomic uncertainty. - Key risks include $3,700 support breakdown triggering $3,600 losses, while rising U.S. Treasury yields and Bitcoin dominance complicate ETH's short-term recover

"Time-Based Tokenomics Ignite 500% RIVER Rally, Transforming the Airdrop Landscape"

- RIVER token surged 500% to $10 after Binance listing and a time-encoded dynamic airdrop conversion model. - The 180-day conversion mechanism incentivizes long-term holding, with River Pts rising 40x and creating arbitrage opportunities. - Perpetual futures on major exchanges generated $100M+ daily volume, while 120,000+ addresses engaged in ecosystem campaigns. - Critics question sustainability as short-term incentives wane, though the model redefines tokenomics by encoding time into value formation. - R